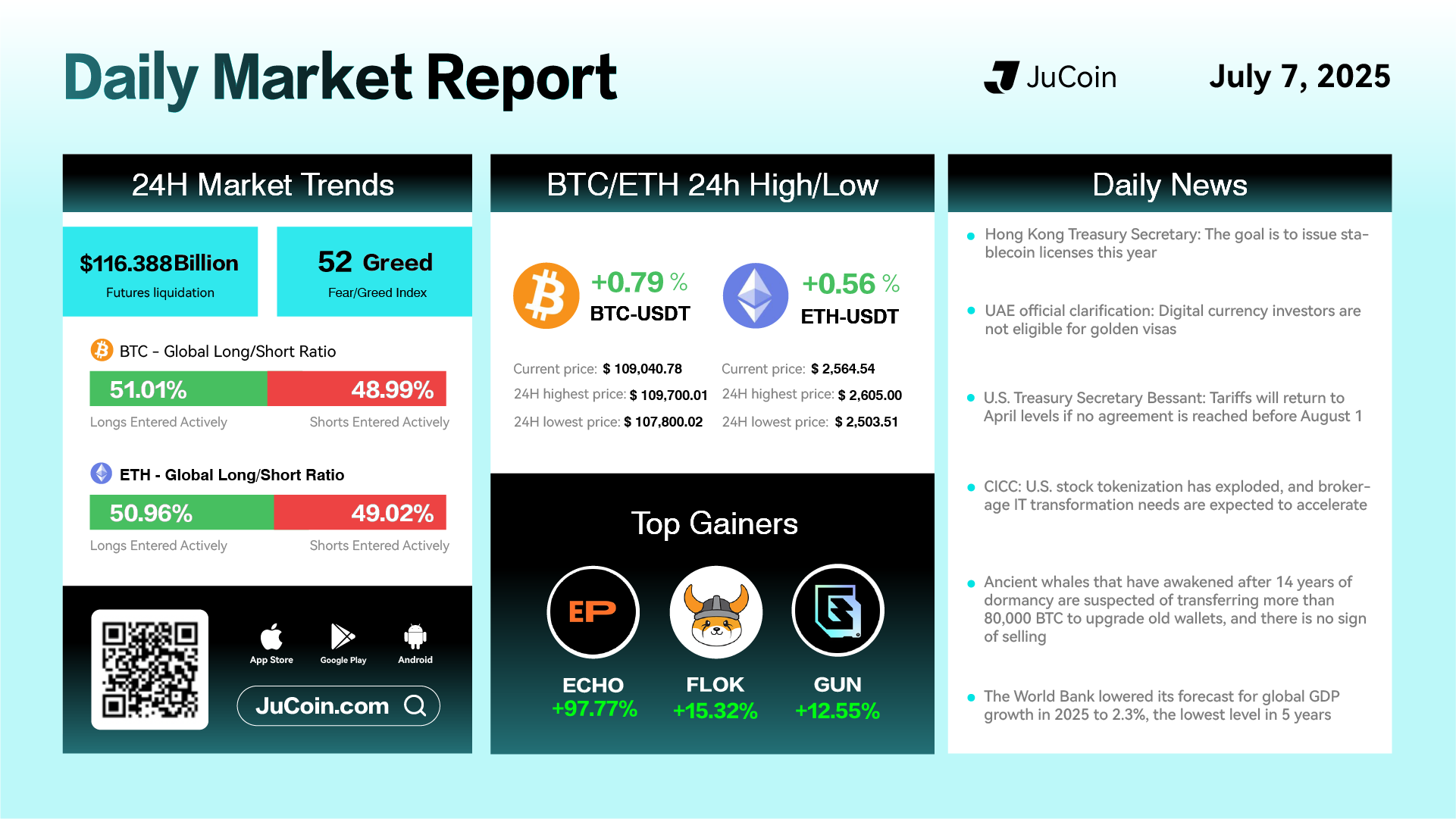

Daily Market Report — July 7, 2025

Bitcoin (BTC) rose 0.79% over the past 24 hours to close at $109,040.78, trading within a range of $107,800.02 to $109,700.01. Ethereum (ETH) also posted a modest 0.56% gain to $2,564.54. The Fear & Greed Index sits at 52, maintaining a balanced yet optimistic investor sentiment. Futures liquidation volume came in at $116.4 billion, and both BTC and ETH saw slightly more long positions than shorts.

Top gainers included ECHO (+97.77%), FLOK (+15.32%), and GUN (+12.55%), showing renewed interest in meme tokens and high-volatility small caps.

On the regulatory front, Hong Kong’s Treasury Secretary reiterated that the city aims to issue official stablecoin licenses by the end of 2025, boosting Asia’s role in digital asset compliance. In contrast, UAE officials clarified that digital asset investors will not qualify for golden visas, reinforcing regional regulatory divergence.

U.S. Treasury Secretary Bessant warned that unless a trade deal is reached before August 1, tariffs will revert to April levels, adding macro uncertainty. Meanwhile, CICC reported a surge in U.S. stock tokenization, predicting rapid IT infrastructure upgrades among brokerages to meet demand.

From an on-chain intelligence angle, analysts flagged movement of over 80,000 BTC from ancient whale wallets that had been dormant for 14 years. However, there’s no sign of market selling, with most transfers attributed to wallet upgrades.

Finally, the World Bank revised its forecast for global GDP growth in 2025 down to 2.3%, marking the lowest level in five years, a signal that macroeconomic headwinds continue to weigh on markets globally.