Pump.fun’s $4 Billion ICO: A Turning Point for Meme Launch Platforms

On July 9, 2025, leading Solana-based meme token launch platform Pump.fun revealed its native token PUMP’s tokenomics and announced a $4 billion ICO starting July 12, aiming to raise $1.32 billion (including $720M private sale + $600M public sale). This event marks the largest fundraising case in the Solana ecosystem this year but has sparked intense controversy due to a team/investor-heavy distribution, full unlock at launch, and a backdrop of collapsing revenues.

This market insight article dissects the PUMP token distribution model, surrounding controversies, and the competitive threat, as well as the broader implications for Solana’s ecosystem and regulatory environment.

Background: From Peak to Pivot

Rise and Decline

Launched in January 2024 on Solana, Pump.fun quickly rose with its one-click token launch model:

-

Revenue boom: Total revenue exceeded $700M, with a daily peak of $7M in January 2025, briefly surpassing Uniswap as the fourth-highest earning protocol.

-

Market share slump: By July 2025, daily revenue plunged 92% to $500K, with TVL and token launch count overtaken by competitor LetsBonkFun (market share: 55.2% vs. 34.9%).

Tokenization as Strategic Shift

In response to competitive pressure, Pump.fun is pivoting to become a “decentralized social platform” akin to TikTok or Twitch, with plans to reward content creators. However, this narrative clashes with its high-valuation fundraising effort.

Tokenomics: Breakdown of Key Controversies

Imbalanced Allocation

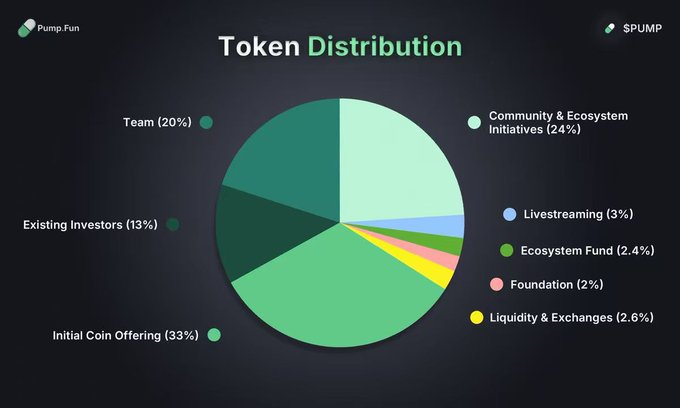

The distribution of PUMP’s 1 trillion total supply has drawn backlash:

-

Team/Investor Control: 20% to team + 13% to existing investors + 2% to foundation + 2.4% to ecosystem fund = 37.4% internal allocation.

-

Vague Community Incentives: 24% labeled “Coming Soon” for community use with no clear plan.

-

ICO Arbitrage Risk: 33% (18% private + 15% public) fully unlocked at listing, all priced at $0.004.

Public Sale Terms

-

Participation: Via Pump.fun and 6 CEXs (Gate, Bitget, Bybit, etc.)

-

Geofencing: US and UK residents excluded; EU users must sign voluntary declarations.

-

Unlock Structure: 48–72 hours of non-transfer period post-launch, then full liquidity.

Market Response: Polarized Opinions and Competitive Pressures

Supporters’ Valuation Argument

-

PS Ratio Justification: With $750M in historical revenue, the $4B valuation yields a PS ratio of 10.8, below Lido’s 15.

-

Social Platform Narrative: Claims to disrupt live-streaming by rewarding early supporters of content creators.

Critics’ Core Accusations

-

Exploitative Distribution: Researcher Rex notes 75% of revenue came from retail users, yet tokens primarily serve insiders.

-

Historical Hypocrisy: Founder previously declared “presales are scams,” making this ICO a self-contradiction.

-

Competitor Advantage: LetsBonkFun, with its “50% revenue burn to BONK” model, earned $1.04M in one day—more than 2x Pump.fun.

Exchange Positions Diverge

-

Proactive: Bybit set a $500K individual cap; Bitget allowed $1M max allocation.

-

Cautious: Some exchanges temporarily delisted the offering link over liquidity concerns.

Risks: Regulation and Ecosystem Disruption

Short-Term Hazards

-

Dump Pressure: 330B tokens unlocked day one; private investor dumping could trigger 40% price drop.

-

Liquidity Drain: $1.32B raised may siphon funds from other Solana projects.

Governance Weaknesses

-

Centralized Control: Team indirectly controls 9% via the foundation, likely holding over 46% voting power.

-

No Revenue Rights: Whitepaper states PUMP holders have no platform profit share, contradicting earlier “50% rev-share” promises.

Rising Regulatory Risk

-

SEC Scrutiny: Despite excluding US/UK users, may be deemed unregistered securities.

-

EU Compliance Gaps: Voluntary waivers may fall short of MiCA investor protection standards.

Industry Impact: Meme Platform Paradigm Clash

Contrasting Models

Pump.fun vs. LetsBonkFun highlights key shifts in the space:

-

Value Distribution: Pump.fun profits favor insiders; LetsBonkFun returns 50% via BONK burns.

-

User Cost: Pump.fun’s total fee is 3% (2% + 0.05 SOL gas); LetsBonkFun’s is 1% + 0.01 SOL.

-

Long-Term Vision: LetsBonkFun funds ecosystem growth (e.g. $15K USDC for $USELESS), Pump.fun has no sustainable plans.

The Need for Regulatory Clarity

-

Legal Entity Ambiguity: As a protocol, Pump.fun may evade conventional rules.

-

Dev Accountability: Needs clearer boundaries akin to “safe harbor” rules in IP law.

More on Solana ecosystem compliance in JuCoin’s Developer Guide.

Outlook: A Crucial Test for Trust

Short-Term Flashpoints

-

Launch Outcome: If price drops over 30% on July 17, capital may quickly shift to competitors.

-

Team Transparency: Whether lock-up details and community fund plans are disclosed.

-

Regulatory Response: US and EU reactions to “100% unlocked on day one” sales.

Industry Cautionary Tale

PUMP’s ICO is ultimately a liquidity redistribution experiment.

When platforms grow via community only to consolidate value internally—when low technical barriers make trust the true scarcity—meme launch platforms must evolve from mere tools to equitable ecosystems. If this high-valuation ICO fails, it may force the entire industry to reimagine token distribution—moving toward a “user-as-shareholder” model.

Technology lowers the cost of issuance, but only fairness builds lasting consensus.