Taker Protocol: Yield Infrastructure Redefining Bitcoin Asset Efficiency

In Q4 2024, Taker Protocol completed a $3 million seed round led by Electric Capital, Dragonfly, and DCG, aiming to solve a core pain point for Bitcoin holders: long-term idle assets (with annual yields under 1%) and centralized staking risks (e.g., WBTC requires custody). The project pioneered the NPOL (Native Proof of Liquidity) consensus mechanism, enabling users to stake BTC directly from native Bitcoin addresses to mint yield-bearing assets (tBTC), without cross-chain bridges or surrendering private key control. As of July 2025, the protocol sees over 12,000 daily active on-chain addresses, with 80% accessed via OKX Wallet—demonstrating its user-friendly design.

This Token Insights article explores how Taker Protocol leverages NPOL consensus to unlock Bitcoin liquidity, detailing its technical architecture, token economy, and ecosystem progress.

Technical Architecture: Three-Layer Innovation of NPOL Consensus

Taker Protocol’s core breakthrough lies in building a non-custodial yield extension layer with a three-tiered architecture:

-

Staking Layer: Utilizes Discreet Log Contracts (DLC) to enable secure on-chain Bitcoin staking. Users lock BTC in multi-signature script addresses and automatically receive 1:1 pegged tBTC certificates—all without third-party custody. This design inherits the security of the Bitcoin mainnet, eliminating asset misappropriation risk.

-

Liquidation Layer: Overseen by a Distributed Collateral Agent (DCA) network, which monitors collateral ratios. If BTC price fluctuations cause undercollateralization, the system automatically initiates discounted auctions to recover bad debts in a decentralized manner, preventing cascading liquidations.

-

Yield Layer: Aggregates lending and derivatives protocols (e.g., BTC options on Merlin Chain), distributing 100% of yields to tBTC holders. Testnet results show base APYs of 4.5%-8%, with incentives pushing returns up to 15%.

The architecture is compatible with both EVM and native Bitcoin addresses. Developers can deploy DApps in Solidity, while users interact via Taproot signatures, with transaction costs under $0.001.

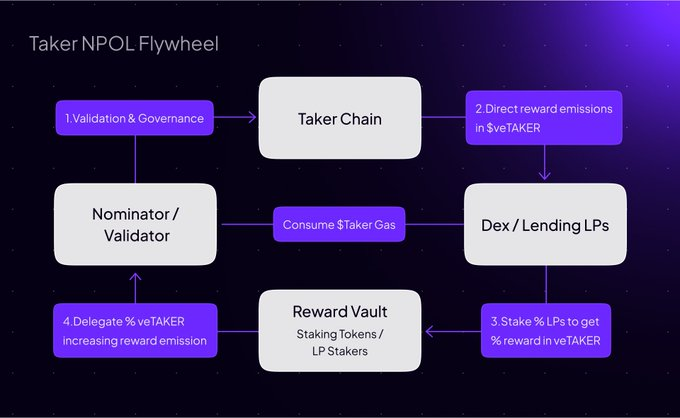

Tokenomics: Dual Empowerment of $TAKER

The $TAKER token serves as both a governance and utility hub for the ecosystem. It has a fixed total supply of 1 billion tokens, allocated to balance community incentives with long-term sustainability:

-

30% Community Airdrop: Redeemable via “mining points,” requiring on-chain actions (e.g., staking BTC to mint tBTC);

-

25% Ecosystem Fund: Supports liquidity mining and node subsidies;

-

20% Investors: Subject to a 12-month lock-up;

-

Remaining Allocation: Team (15%) and liquidity incentives (10%).

$TAKER enables three core functions:

-

Governance Voting: Determines parameters like yield pool distribution and asset listings;

-

Fee Discounts: Provides up to 50% discount on on-chain transaction fees;

-

Node Incentives: Validators staking $TAKER receive additional BTC yield shares.

Binance Alpha’s exclusive channel (launching July 18) allows users to claim airdrops. Those not participating can continue earning tokens by staking BTC.

Ecosystem Progress & Strategic Partnerships

Taker Protocol is driving Bitcoin’s transition from a “store of value” to a “productive asset,” with key milestones including:

-

Developer Tools: Open-source SDK supporting BRC-20 assets and Runes protocol integration, with GitHub stars exceeding 1,200;

-

Institutional Partnerships: Joint Bitcoin derivatives library with Merlin Chain, enabling structured products like options and futures;

-

Exchange Listings: Following Binance Alpha’s debut, spot listings on MEXC and Gate.io are planned for Q3;

-

Cross-Chain Expansion: Solana integration planned for Q4 2025 to enable BTC-SOL seamless swaps.

Users can refer to JuCoin’s Bitcoin Staking Guide to learn how to mint tBTC.

Risk Balancing & Future Challenges

Despite its potential, the project faces three major challenges:

-

Technical Validation: DLC liquidations depend on oracle pricing (e.g., Chainlink); manipulation could trigger faulty liquidations. Testnets simulated stability under 20% price deviations, but mainnet stress remains untested.

-

Regulatory Compliance: The SEC may classify tBTC as an unregistered security; Hong Kong SFC mandates adherence to its “Virtual Asset Trading Platform Guidelines.”

-

Competitive Pressure: BounceBit emphasizes institutional compliance but suffers from centralization risks, while Babylon builds a security layer without direct yield generation.

Key development milestones will shape the protocol’s trajectory:

-

Q3 2025: Mainnet V2 to support Ordinals-backed lending and launch BTC yield index funds tied to MicroStrategy (MSTR) stock performance.

-

Long-Term Vision: Must prove that NPOL can host billions in BTC assets and overcome the trust bottleneck of sidechain models.

When Bitcoin holders shift from passive hoarding to active yield generation, and BTC liquidity transforms from dormant cost into productive capital, blockchain’s value storage paradigm reaches full maturity. Taker Protocol’s mission is not merely a technical experiment—it’s a fundamental inquiry into whether the Bitcoin ecosystem can sustain a self-reinforcing capital loop. Its outcome will define the feasibility boundaries of crypto as a productive asset class.