Kima Network is a decentralized settlement layer for funds movement. Its goal is to connect bank accounts, public/private chains, and applications to enable cross-ecosystem payments and clearing that are “non-custodial, smart-contract-free, and without wrapped assets.” This Innovation and Tech article explains its working principles, security model, real-world scenarios, and developer onboarding path to help assess its technology and risks.

Summary: Kima Network uses a self-developed settlement layer and multi-party security modules to release/receive value directly across systems rather than “lock-and-mint,” reducing common bridge attack surfaces and covering payments and settlement from crypto wallets to bank accounts.

How does Kima Network enable cross-ecosystem settlement “without smart contracts”?

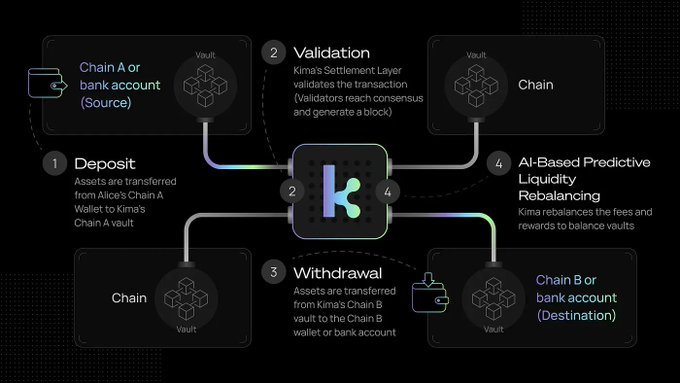

The core idea is to abstract “cross-system transfers” as settlement events synchronized off-chain/on-chain. The network maintains native asset pools on each integrated chain. A “Warden” committee completes threshold signatures within a Trusted Execution Environment (TEE) and authorizes outflows based on corresponding inflow records. This avoids reliance on smart contracts, oracles, or external relays, and does not mint wrapped assets. Official documentation states its architecture is based on the Cosmos SDK and supports direct transfers/payments among public chains, private chains, and bank accounts.

Where exactly are its security advantages versus traditional bridges?

Typical bridge risks come from “lock-and-mint” and contract/oracle trust assumptions. Kima circumvents this path entirely: no target-chain contract calls, no wrapped assets, direct management of multi-chain native asset pools with TEE + TSS authorization—removing common attack surfaces by design. Both the whitepaper and website emphasize a “no smart contracts, no oracles, no bridge” zero-exposure approach, and introduce game-theoretic incentives for liquidity rebalancing.

Is Kima a bridge?

The team explicitly says “it is not a bridge,” but an interoperability settlement protocol that transfers value directly between multi-chain asset pools.

Which real-world scenarios benefit first?

Top-ups from stablecoins to cards: Kima integrates with the Mastercard sandbox, enabling self-custody wallets to top up prepaid cards with USDC/USDT—showing a compliant “crypto → payment card” path.

Cross-chain checkout for e-commerce: When buyer and merchant assets reside on different chains, merchants can still receive funds directly to their target-chain address, avoiding page jumps and complexity to reduce churn.

Native cross-chain transfers inside wallets: Multi-chain wallets can embed Kima’s transfer capability so users complete inter-chain moves without leaving the interface.

RWA atomic settlement: Supports Delivery-versus-Payment (DvP)-style synchronized exchange of assets and funds, reducing reliance on third-party custody.

How should developers integrate and go live quickly?

- Read the docs and architecture; confirm supported chains/assets and compliance needs;

- Use the SDK/widgets to integrate transfers, payments, and status queries;

- Co-test across 10 chains in the Light/Advanced Demo environment;

- Configure risk controls and limits;

- Roll out in grayscale.

The official demos provide end-to-end flows on networks from Ethereum and Bitcoin to Solana/BNB, etc.

How is the token economy designed—can it support security and liquidity?

According to CoinMarketCap, $KIMA has a max/total supply of 210,000,000, with about 58,369,000 circulating, primarily deployed on Arbitrum. Contracts and circulating data can be verified on block explorers and major data sites.

What scenarios does the token actually cover?

$KIMA is used to pay network fees, stake to participate in network security and ecosystem incentives, and is said to have governance voting properties; however, its public Terms and Conditions state that $KIMA grants no governance rights. The two statements are inconsistent for now—defer to future official clarification.

How are issuance, vesting, and unlocks arranged?

Public information shows the IDO round unlocked 15% at TGE, followed by a 1-month cliff and 9-month linear release; multiple early/eco allocations unlock through 2024–2027. Timelines and percentages vary slightly across sources—use official announcements as primary and cross-check third-party trackers.

Are value capture and fee flows clear?

The protocol focuses on cross-ecosystem settlement and payments, with fees settled on-chain. $KIMA serves as the billing and incentive vehicle for the network/security layer. Ecosystem expansion (payment gateways, in-wallet cross-chain, merchant checkout) should directly drive fees and staking demand.

FAQ

What is Kima Network’s core positioning?

An infrastructure-agnostic settlement layer that completes non-custodial transfers and payments across public chains, private chains, and bank accounts.

Why emphasize “no smart contracts”?

To remove major bridge attack surfaces: contract vulnerabilities, oracle and wrapped-asset dependencies; authorization/outflows use TEE + TSS with multi-layer security controls.

Does it support stablecoins and fiat directions?

It has demonstrated stablecoin top-ups to payment cards; the docs also list supported fiat/payment methods. Actual capability depends on integration scope.

How long does developer integration take?

SDKs, widgets, demo environments, and faucets support quick PoC builds; production timing depends on compliance and risk processes.

KIMA use cases and incentives?

Pay network fees, incentivize settlement participants, and governance; become a validator/delegator or provide cross-chain liquidity to earn fees.

Is it a replacement for cross-chain bridges?

More precisely, it is a “settlement layer,” not a bridge—transferring value directly between multi-chain asset pools without minting wrapped assets.

Key Takeaways

Replace traditional bridges with a “settlement layer,” removing lock-and-mint, contract, and oracle risks by design.

Security model uses TEE + TSS with multi-party authorization, directly managing native multi-chain asset pools to reduce attack surface and custody risk.

Clear pilots: stablecoin → payment card top-ups, B2B cross-chain receivables, e-commerce cross-chain checkout, native in-wallet cross-chain transfers.

Clear integration path: SDK/Widget + multi-chain demo environment supports PoC → grayscale → full launch.

Configurable compliance and risk: when enabling bank/fiat flows, pair with KYC, limits, and anomaly alerts.

Economics and governance to watch: network fees and incentives plus governance voting; mid-term focus on liquidity rebalancing and progressive decentralization.