The following content is published by JuCoin Labs Research Institute:

1. Project Overview

WalletConnect is an open-source Web3 communication protocol dedicated to connecting users’ wallets with decentralized applications (dApps), providing a unified, encrypted, and secure communication layer for the Web3 world. Currently, WalletConnect is evolving from a “connection protocol” to “Web3 communication infrastructure,” offering services including push notifications, message relays, session management, and becoming the default intermediary layer between wallets and applications.

WalletConnect is poised to address the industry’s long-standing pain point of “fragmented user access” in Web3. By providing a unified connection layer, it reduces the multi-chain adaptation cost for developers. DApps only need to integrate the WalletConnect SDK to access over 600 different wallets, covering major blockchains like Ethereum, Solana, and Cosmos, enabling a “one-time integration, universal access” model.

2. Technological Innovations

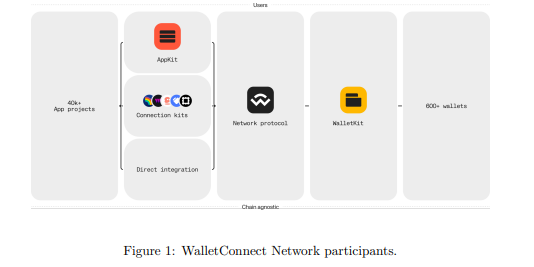

WalletConnect has built a decentralized, secure, and efficient Web3 communication infrastructure through the collaboration of users, wallet developers, dApp developers, node operators, and protocol governance participants. Users seamlessly connect wallets and dApps; wallet and dApp developers achieve rapid integration and interaction through the protocol; node operators maintain network stability; governance participants engage in decision-making through $WCT tokens, promoting protocol upgrades and ecosystem development, as shown in the following diagram:

In addition, WalletConnect’s technological innovations include:

-

Unified Communication Layer Protocol: WalletConnect has evolved from an early-stage connection protocol to a full communication stack, supporting encrypted messaging, on-chain signatures, push notifications, aiming to build the “encrypted WhatsApp” of Web3.

-

Modular SDK and Enhanced Developer Experience: Providing developers with componentized SDKs, including wallet connection, authorization management, push services, message relay, supporting quick integration and personalized customization.

-

Multi-Chain Compatibility and Platform Support: The protocol is compatible with major chains such as Ethereum, Polygon, Optimism, BSC, and Arbitrum, and supports integration with browser plugins, mobile apps, and desktop applications.

-

Native Support for Account Abstraction: WalletConnect is designed with compatibility for Account Abstraction, allowing for future evolution of dApp UX.

3. Team and Fundraising

Team Background

-

Founder Pedro Gomes is from Portugal and previously worked at leading mobile payment company TrueLayer and fintech startups. Since 2018, he has been dedicated to building Web3 communication protocols with rich development experience and strong community reputation.

-

Core Team Members: The CTO was a blockchain architect at ConsenSys, focused on Ethereum client and SDK development; the product lead comes from the Coinbase Wallet team, with extensive experience in wallet products; most of the operations team has backgrounds in projects like ConsenSys, Status, and Parity, emphasizing “protocol neutrality” and “developer-first” product philosophy.

Fundraising Background According to RootData, WalletConnect has completed four fundraising rounds, totaling $46.5 million:

-

March 8, 2022: $11 million raised from investors including USV, 1kx, Coinbase Ventures, Zerion, Semantic Ventures, and A.Capital.

-

November 3, 2022: $12.5 million raised from investors including Shopify, Coinbase Ventures, HashKey Capital, Foresight Ventures, P2 Ventures, and ConsenSys.

-

January 15, 2025: $13 million raised from investors including USV, 1kx, and BitGo.

-

February 14, 2025: $10 million raised through a public sale.

4. Tokenomics

The native token $WCT has a total supply of 1 billion, with no additional inflation. Team and investor unlocks follow a linear release mechanism to ensure mid-to-long-term interest alignment:

-

Foundation (27%): For partnerships, ecosystem incentives, ecosystem development, and daily operations;

-

Airdrop (18.5%): For periodic airdrops to users, applications, wallets, nodes, etc.;

-

Team (18.5%): Allocated to project team members;

-

Rewards (17.5%): For staking rewards and performance incentives;

-

Early Supporters (11.5%): Allocated to supporters providing resources in the early stages;

-

Core Development (7%): For further development of the protocol and related modules.

$WCT token functions mainly include network fees, staking, ecosystem rewards, and community governance. However, it is important to note the significant lag in utility activation. Currently, only staking and exchange trading are active. Key functions like fee payments await community voting for implementation, and the 17.5% allocated for rewards will be gradually released over the coming years. Community governance functionalities are also delayed, making $WCT primarily a “pre-launch token with delayed utility,” causing a short-term lack of effective value capture scenarios.

5. Business Status

-

Monthly Active Wallets: Over 5.2 million wallets connected via WalletConnect in March 2025, a 95% increase compared to 2.6 million in March 2024.

-

Total Connections: Over 256 million connections processed as of March 2025.

-

Unique Wallets: Over 40.7 million unique wallets connected by March 2025.

-

Applications: 58,900 applications integrated with WalletConnect.

-

On-Chain Data: $WCT currently has 123,917 on-chain holders, with holdings relatively concentrated — the top three addresses hold 16.32%, 11.26%, and 10%, respectively.

6. Ecosystem

WalletConnect has integrated over 58,000 dApps and mainstream wallets, creating a communication network across asset trading, social, and governance scenarios. Major sectors and representative projects include:

1. Wallet Applications

-

MetaMask: Major Ethereum wallet integrated with WalletConnect for mobile wallet connections; exploring WalletConnect Push integration.

-

Trust Wallet: Binance-backed multi-chain wallet, fully integrated with WalletConnect, participating in v2 protocol upgrade.

-

Rainbow Wallet: UX-focused wallet app, actively testing WalletConnect Chat to expand social functionalities.

2. DeFi Protocols

-

Uniswap: Mainstream DEX supporting WalletConnect multi-wallet access and developing chat and notification modules.

-

Zapper: DeFi investment aggregator, deeply integrated WalletConnect for asset tracking and investment strategies.

-

Zerion: Web3 financial platform participating in WalletConnect Chat testing to optimize full-chain interactions.

3. NFT and Content Platforms

-

OpenSea: Leading NFT marketplace supporting mobile wallet connections via WalletConnect.

-

Foundation: Creator-friendly NFT marketplace integrating WalletConnect for signing and login.

-

Showtime: NFT social platform utilizing WalletConnect for NFT display and identity binding.

4. On-Chain Social and Communication Protocols

-

Push Protocol: On-chain messaging protocol collaborating with WalletConnect to standardize push notifications.

-

Lenster: Web3 social platform planning to integrate WalletConnect Chat for on-chain conversations and identity verification.

-

Convo Space: Decentralized commenting and chat system supporting WalletConnect login and exploring push services.

7. Risk Analysis

WalletConnect has recently been listed on major centralized exchanges like Binance, Upbit, OKX, and Coinbase (offering perpetual contracts), but still faces several key risks:

-

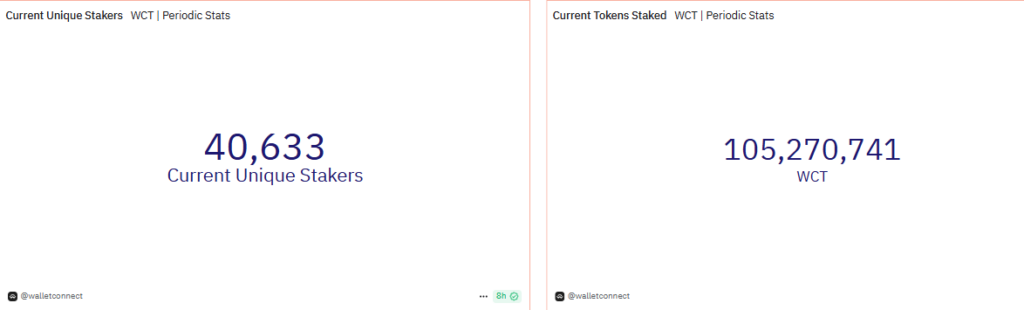

Staking Rewards Highly Dependent on Inflation, leading to incentive loop risk. Current $WCT staking yields 85% APY, with over 50% coming from inflation. According to Dune, there are 40,633 stakers with over 100 million $WCT staked. While attracting users to lock tokens, it risks a “mine-dump-sell” cycle that may worsen token liquidity and trigger a death spiral.

-

Lack of Governance Utility, making token value support weak. Governance proposals mainly focus on protocol upgrades and parameters, lacking mechanisms like token buybacks or burns.

-

Airdrop Release Imbalance, creating market sell-off signals. Only 8% of the first 185 million airdrop tokens were claimed, while the rest returned to the reward pool, perceived as potential sell pressure.

8. Valuation Analysis

Since WalletConnect mainly operates in the wallet sector, we compare it with TrustWallet and SafePal:

-

TrustWallet: Market cap $317M, FDV $760M.

-

SafePal: Market cap $232M, FDV $232M, focused on hardware wallets with less ecosystem expansion and protocol influence than WalletConnect.

Overall, $WCT seems undervalued. Based on its market position, protocol growth, and pending token utility activation, a reasonable market cap range would be $200M–$300M, implying 3–5x upside potential if key issues are addressed.

9. Conclusion

WalletConnect has evolved into a key role in Web3 communication infrastructure, leading in users, protocol maturity, and ecosystem coverage. $WCT has built multiple value channels across governance, incentives, and functionality and gained strong attention after listings on Binance and OKX.

However, inflation-based incentives and delayed token utility present investment risks. Until a clear revenue model and token buyback mechanisms emerge, $WCT’s value is still largely expectation-driven.

Overall, $WCT is a strong protocol and early token model, making it suitable for mid-term positioning.