ALPACA Token’s Frenzied Week: A Review of Data and Market Sentiment

Over the past seven days, the token ALPACA from the DeFi project Alpaca Finance experienced a stunning rally, with its price soaring from $0.04 to a peak of $0.34 — a 750% increase — before retreating and stabilizing around $0.23. This volatility far outpaced Bitcoin (+3.2%) and Ethereum (+5.7%) during the same period, sparking speculation of an “altcoin season” return.

On-chain data shows that ALPACA’s trading volume on Binance Smart Chain (BEP-20) exceeded $120 million in a single day on April 25, accounting for 37% of its total supply, indicating that short-term speculative capital dominated the market.

The immediate catalyst behind the surge was the project team’s announcement of a partnership with cross-chain protocol Stargate, allowing users to stake ALPACA for multi-chain yield farming. Additionally, Alpaca Finance’s Total Value Locked (TVL) surged from $180 million to $430 million in just one week, with some top liquidity pools offering annualized returns (APY) exceeding 180%, attracting a flood of leveraged farming capital.

Technical Analysis: The Battle Between Support and Resistance

From a technical perspective, ALPACA is currently at a critical juncture:

-

Support Level $0.18: Corresponds to the 38.2% Fibonacci retracement on the 4-hour chart, resonating with the 20-day moving average ($0.175), and aligns with the high-volume trading zone from April 22–24.

-

Resistance Level $0.47: If it breaks above the previous high at $0.34, the next target would be the 50% retracement level of the historical high ($0.97 in May 2021).

It’s worth noting that ALPACA’s 4-hour RSI has fallen from the overbought zone (92) to 62, but the Bollinger Band width remains at a high 45%, suggesting that volatility has not been fully released.

For short-term traders, grid trading between $0.18 and $0.34 could automatically capture volatility profits while avoiding manual monitoring risks.

Fundamental Analysis: Sustainable Growth or a Liquidity Trap?

Despite the price surge, investors need to rationally assess Alpaca Finance’s long-term value:

-

Product Iteration: The newly launched “Leveraged Farming Insurance Pools” hedge liquidation risks through partial revenue, but this mechanism relies heavily on ALPACA staking, potentially increasing selling pressure.

-

Tokenomics: Currently, 89% of the total supply is circulating, but 11% reserved for the team will unlock in 2025, posing a potential sell-off risk.

-

Competitor Comparison: Competing DeFi protocol Alpha Homora’s TVL-to-market cap ratio is 5.3, while Alpaca Finance’s is only 1.9, indicating a relatively high valuation.

On-chain behavior shows that whale addresses (holding over $1 million) collectively sold about 12 million ALPACA above $0.30, while retail investors continued to chase in. This chip distribution could trigger “pump and dump” risks, especially if market liquidity tightens.

Risk Management Strategies: Tailored for Three Types of Investors

Short-Term Traders

Monitor the $0.18 support level’s retest and strength. If the daily close falls below, a trend reversal may occur. Near $0.34, consider partial profit-taking while retaining 30% of the position for breakout opportunities. On the other hand, Binance announced that it will soon delist the token, and investors need to be cautious of the downside risks caused by liquidity contraction.

Long-Term Holders

Focus on TVL growth sustainability. If the weekly average TVL stabilizes above $300 million, it can be seen as a sign of fundamental improvement. Also monitor team token unlock events, with real-time whale alerts available through JuCoin’s portfolio analysis tools.

New Entrants

Avoid FOMO. Adopt a “10% position trial + 90% staggered entry” strategy, prioritizing participation in low-leverage stablecoin farming to mitigate ALPACA price volatility’s impact on returns.

Key Indicators to Watch Going Forward

-

Cross-Chain Collaboration Launch: If asset bridging with Stargate goes live before May, it could drive new TVL inflows.

-

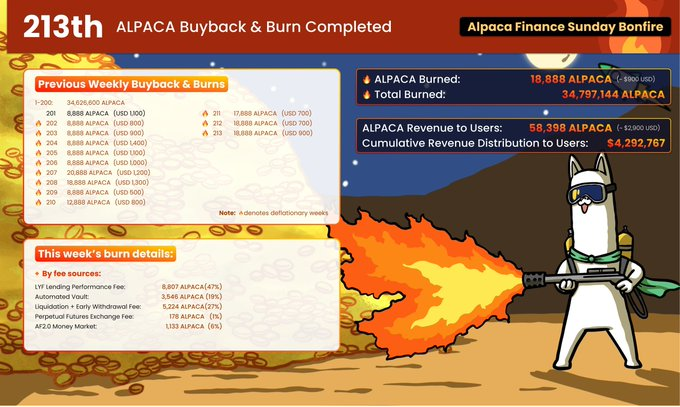

Burn Mechanism Upgrade: The current 0.05% per transaction burn rate is too low. Raising it above 0.3% would significantly enhance deflation expectations.

-

BTC Market Trend: If Bitcoin falls below $90,000, ALPACA could follow due to liquidity outflows, necessitating caution regarding correlation risks.

ALPACA’s recent rally has detached from traditional valuation frameworks. Investors must remain sober: High returns inherently come with high risks, especially in DeFi, where protocol bugs and regulatory crackdowns are ever-present black swans. Only through a combination of profit-taking, position management, and hedging tools can one protect profits amid volatility.