Asseto is committed to building a compliant bridge that brings traditional financial assets into the decentralized world through smart contracts and multi-stage approval processes, achieving both high security and high liquidity. This Innovation and Tech article explores Asseto’s architectural design, compliance mechanisms, on-chain asset workflows, and the multiple values it offers to investors.

Summary: Asseto employs KYC/AML verification, multi-sig custody, and on-chain compliance contracts to support the tokenization of stocks, bonds, and other traditional assets, empowering DeFi use cases. The native ASO token serves as collateral, governance, and protocol stability, ensuring robust system operations.

What are the core components of Asseto’s platform architecture?

Asseto’s platform comprises three layers: the off-chain compliance layer, the on-chain smart contract layer, and the cross-chain bridging layer. The off-chain compliance layer handles investor identity verification (KYC/AML), fiat settlement, and custodial compliance; multi-sig custody ensures asset security. The on-chain smart contract layer manages token issuance, transfers, and settlement workflows, and fetches real-time price feeds via oracles. The cross-chain bridging layer enables interoperability across multiple public chains, allowing assets to move freely between Ethereum, BSC, and other networks.

All transactions undergo off-chain approval before triggering on-chain contract execution, significantly reducing smart contract risks. Additionally, the protocol uses a modular governance framework—token holders can vote to adjust compliance parameters and fee structures, enabling sustainable platform evolution.

How does Asseto ensure data privacy and security?

In the off-chain compliance layer, Asseto deploys dedicated audit nodes; all user data is encrypted and stored within Trusted Execution Environments (TEEs), and KYC results are verified via zero-knowledge proofs (ZKPs) without exposing sensitive information on-chain. On-chain contracts only store hash commitments to prevent privacy leaks.

Meanwhile, Asseto’s cross-chain bridge uses multi-signature and timelock mechanisms, with multi-party audits ensuring assets remain controlled throughout transfers. The platform also engages third-party security firms for regular smart contract audits and penetration testing to identify and patch vulnerabilities quickly.

How does Asseto tokenize traditional assets?

On Asseto, compliant institutions first custody fiat assets (e.g., stocks, bonds) off-chain, then mint corresponding tokenized assets (aStock, aBond, etc.) via on-chain contracts at a 1:1 peg to the underlying asset. Once users hold these asset tokens, they can leverage them in DeFi for lending, staking, and trading.

The tokenization workflow includes:

-

Asset Custody: A regulated custodian receives and safeguards traditional assets.

-

Contract Minting: An on-chain mint transaction generates the matching token.

-

Cross-Chain Distribution: The token is bridged to target networks via the cross-chain bridge.

-

Redemption & Settlement: Users burn tokens to request asset redemption, and the off-chain custodian releases the underlying asset.

This design preserves the asset’s compliance attributes while granting investors DeFi’s high yields and instant liquidity.

What are the main incentive mechanisms of the ASO token?

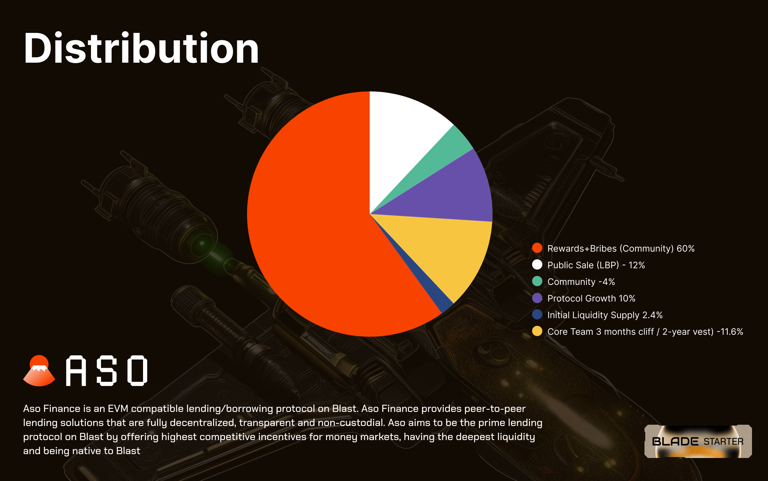

According to the official GitBook “Distribution,” ASO’s total supply is 100,000,000 tokens, allocated and incentivized as follows:

-

Public Sale (LBP) 12,000,000 ASO (12%): Foundation for initial liquidity and community engagement.

-

Community Incentives 4,000,000 ASO (4%): Airdrops and rewards for early adopters to grow the user base.

-

Protocol Growth 10,000,000 ASO (10%): Ecosystem incubation, partner incentives, and R&D grants.

-

Core Team 11,600,000 ASO (11.6%): 3-month lockup, then 2-year linear vesting to align long-term incentives.

-

Initial Liquidity 2,400,000 ASO (2.4%): Depth provision for key trading pairs to minimize slippage.

-

Rewards & Bribes (Community) 60,000,000 ASO (60%): Distributed via liquidity mining, governance rewards, and “bribe” mechanisms (users can offer extra incentives for proposals they support).

Unsold tokens and equivalent liquidity tokens are permanently burned; burn transactions are verifiable via the multi-sig contract and official X account announcements.

In operational terms, ASO token incentives include:

Staking & Yield Distribution:

Users stake ASO to support network security and off-chain compliance checks, earning base APY based on stake amount and duration.

A portion of protocol revenues (trading fees, redemption fees, etc.) is used to buy back ASO and distribute to stakers, forming a “buyback–burn–dividend” loop.

Liquidity Mining:

Users provide ASO in designated trading pools to earn additional farming rewards, incentivizing liquidity depth and activity.

Governance & Bribes:

ASO holders vote on protocol proposals; to boost participation, users can “bribe” proposals with extra ASO, increasing their voting power.

Transparency & Audits:

All token emissions and incentive distributions occur on-chain and are publicly auditable. Quarterly reports are published, and the community can review funds via the multi-sig contract.

Through these layered, multi-scenario incentives, the ASO token secures platform safety and compliance while driving community engagement and ecosystem growth.

What benefits and protections do Asseto investors receive?

Asseto employs a dual-yield mechanism: tokenized assets earn DeFi interest and farming rewards, while the underlying traditional assets distribute dividends or coupon payments, delivering a “fiat + crypto” composite yield. The compliance fund and multi-sig custody model safeguard principal; in the event of force majeure, an emergency compensation mechanism can activate insured payouts.

Additionally, ASO holders participate in governance—voting on new asset types, fee adjustments, or onboarding custodians—enhancing shared governance and security.

FAQ

Which traditional assets does Asseto support?

Stocks, corporate bonds, government bonds, and money-market instruments; plans to expand to fund shares and commodities.

How do I participate in asset tokenization?

Complete KYC/AML, deposit funds to the custodian, then mint asset tokens on-chain.

What are ASO token use cases?

Staking for validation, liquidity mining, governance voting, and compliance fund coverage.

How long is the redemption process?

Standard redemption: 3–5 business days; expedited: 1–2 days with extra fees.

How does the platform mitigate counterparty risk?

Multi-entity custody, regular audits, off-chain redundancy, and emergency compliance fund safeguards.

What are future plans?

Support more asset classes, integrate additional chains, and launch insurance pools to reduce user risk exposure.

Key Takeaways

Three-Layer Architecture: Off-chain compliance, on-chain contracts, cross-chain bridging ensure asset security and liquidity.

Compliance-First: KYC/AML, multi-sig custody, TEE & ZKP dual privacy protections.

Tokenization Workflow: 1:1 peg, cross-chain distribution, and on-chain redemption end-to-end.

Dual Yield: DeFi yields plus traditional dividends/coupons for enhanced returns.

Community Governance: ASO holders vote on fees and asset expansions.