Avantis launched the AVNT airdrop checker on September 7, initially covering more than 65,000 wallets, with the claim window opening at 22:00 on September 9. The total token supply is 1 billion, aligning with expansion following its $8M Series A co-led by Founders Fund and Pantera. This Market Insights article outlines the rules, allocations, participation checklist, and key risks.

Summary: The airdrop is usage- and contribution-driven. AVNT total supply is 1B; community ~51%; airdrop 12.5%. Claims open at 22:00 on September 9. Use the checker first to confirm eligibility and amounts.

Project Snapshot

Avantis is a decentralized derivatives venue and “universal leverage layer” in the Base ecosystem, aiming to bring crypto, FX, commodities, and indices under one market-making and clearing architecture. The AVNT verification tool released on September 7 is central to its tokenization and community expansion. The team later confirmed claim timing and coverage via social channels. As mainnet trading and user metrics accelerate, activity and contributions need to be reflected at the token layer. With Series A closed, phased distribution is being used to broaden awareness beyond existing users and deepen market-making.

Platform & Ecosystem Background

According to The Block reports, Avantis raised $8M in a Series A in June 2025 co-led by Founders Fund and Pantera Capital, with Symbolic Capital, SALT Fund, Flowdesk and others participating. Funds are earmarked for expanding product surface (multi-asset support, clearing, oracles) and compliance infrastructure. On PANews, Avantis is framed as a leading perpetuals DEX on Base, supporting crypto, FX, commodities, and index exposures with flexible leverage/collateral, emphasizing cross-asset extension on a single leverage layer.

Synergy with the Base Ecosystem

Same-chain loops let distribution, trading, and market-making happen in one environment, reducing bridge and asset-fragmentation friction and security risks. Wallets, data, and clearing tooling integrations shorten the path from newcomer to active trader. Public information indicates this airdrop covers 65,000+ wallets, with claims opening at 22:00 on September 9 and the checker live since September 7. Timeline and figures have been cross-validated across multiple sources and official channels.

Am I Eligible?

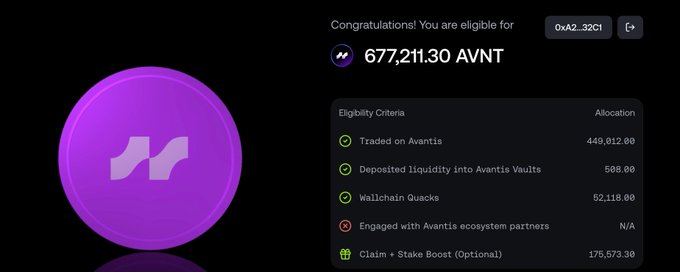

The checker emphasizes historical interaction quality over “pure acquisition”:

- Trading activity and retention curves

- LP/market-making contribution

- Developer/integration building

- Official campaigns (including Quacker) and other modular metrics

Final determinations use on-chain snapshots plus anti-sybil rules. If there’s network congestion or parameter tweaks, the team may roll open in waves or add a make-up window; rely on the official page and announcements to avoid “fake windows” created by reposts.

Tokenomics: Supply, Allocation & Utility

Total Supply & Community Share

AVNT total supply is 1 billion. Disclosed figures indicate ~51% community, with ~12.5% for airdrops; the rest spans team, foundation/treasury, and investors. Precise schedules will follow the whitepaper and governance updates. Multiple outlets report consistent allocation frameworks.

Utility & Value

- Ecosystem incentives: long-term budgets for trading, MM, integrations, and governance participation.

- Governance: parameters for fees, incentive curves, and risk controls are expected to be token-governed.

- Coordination: may couple with points/XP, staking, or MM programs (per subsequent announcements).

Network effects in derivatives come from depth and counterparty quality. A higher community share with staged airdrops binds “usage—MM—governance” on one growth curve and softens volatility from single-point market-making. This aligns with the “long-term incentives” narrative seen across reports.

Vesting & Sell-Pressure Management

Common practices include staged unlocks and extended vesting curves, deweighting high-frequency wash activity via deductions/reviews, and dynamic LP/treasury management—to reduce early listing distortions and price noise. Final arrangements depend on on-chain contracts and governance posts.

How to Participate

-

Access the AVNT Airdrop Checker only via Avantis’ official channels.

-

Connect your usual address to view eligibility and provisional amounts.

-

After 22:00 on September 9, follow the page flow to sign and claim (ensure sufficient gas during peak times).

-

Track subsequent waves and any “review/make-up” notices so you don’t miss windows.

-

If you’re an LP/MM or builder, watch for ecosystem incentives and governance proposals.

Core Impact: Traders, Market Makers & the Protocol

- For traders: a single primary settlement asset and clear incentive curves help control slippage and funding costs. Airdrop-driven supply and traffic peaks may amplify short-term volatility, but greater depth can make spreads and fees more predictable.

- For MMs & LPs: clearer allocations/unlocks improve the planning of MM budgets and expected returns; with governance, MM parameters (e.g., funding, tiered incentives) can align with liquidity cycles.

- For the protocol & builders: token-based long-term budgets and governance seats support a “build—share—govern” flywheel, attracting external front-ends, strategies, and derivatives integrations.

As more trading and clearing consolidate under one protocol, risk, oracle, and liquidation parameters can be optimized around a single asset matrix, reducing cross-protocol mismatches and liquidation cascades.

FAQ

Who is the airdrop for?

Primarily historical users and contributors, including traders, LPs, integrators/builders, and specific campaign participants; the checker result is final.

When and how do I claim?

From 22:00 on September 9 via the official entry—follow the signature flow. Avoid third-party “claim-for-you” services. If there are rolling waves, defer to official notices.

What are AVNT total supply and community share?

Total supply 1B; community ~51%, of which ~12.5% is airdropped. Remaining allocations/vesting follow the whitepaper and governance updates.

What about Avantis funding and positioning?

Series A $8M, co-led by Founders Fund and Pantera; product positioning is a “universal leverage layer” on Base.

What if I’m not in the initial list?

Watch for later waves/reviews/make-ups. Keep contributing via trading, MM, and building to qualify for future incentives.

Any early pitfalls to avoid?

Phishing and mis-signing: verify token and claim contracts; avoid oversized positions in shallow pools—start small and average in.

Key Takeaways

Checker live 9/7; 65k+ addresses covered; claims start 9/9 22:00.

AVNT supply 1B; community ~51%, airdrop 12.5%, focusing on “usage + contribution” distribution.

Avantis closed an $8M Series A (Founders Fund, Pantera lead); airdrop supports expansion and deeper MM.

Before participating, follow the “security trio”: official entry, minimal approvals, staged execution; track unlocks and treasury disclosure transparency.