Daily Market Report – May 26, 2025

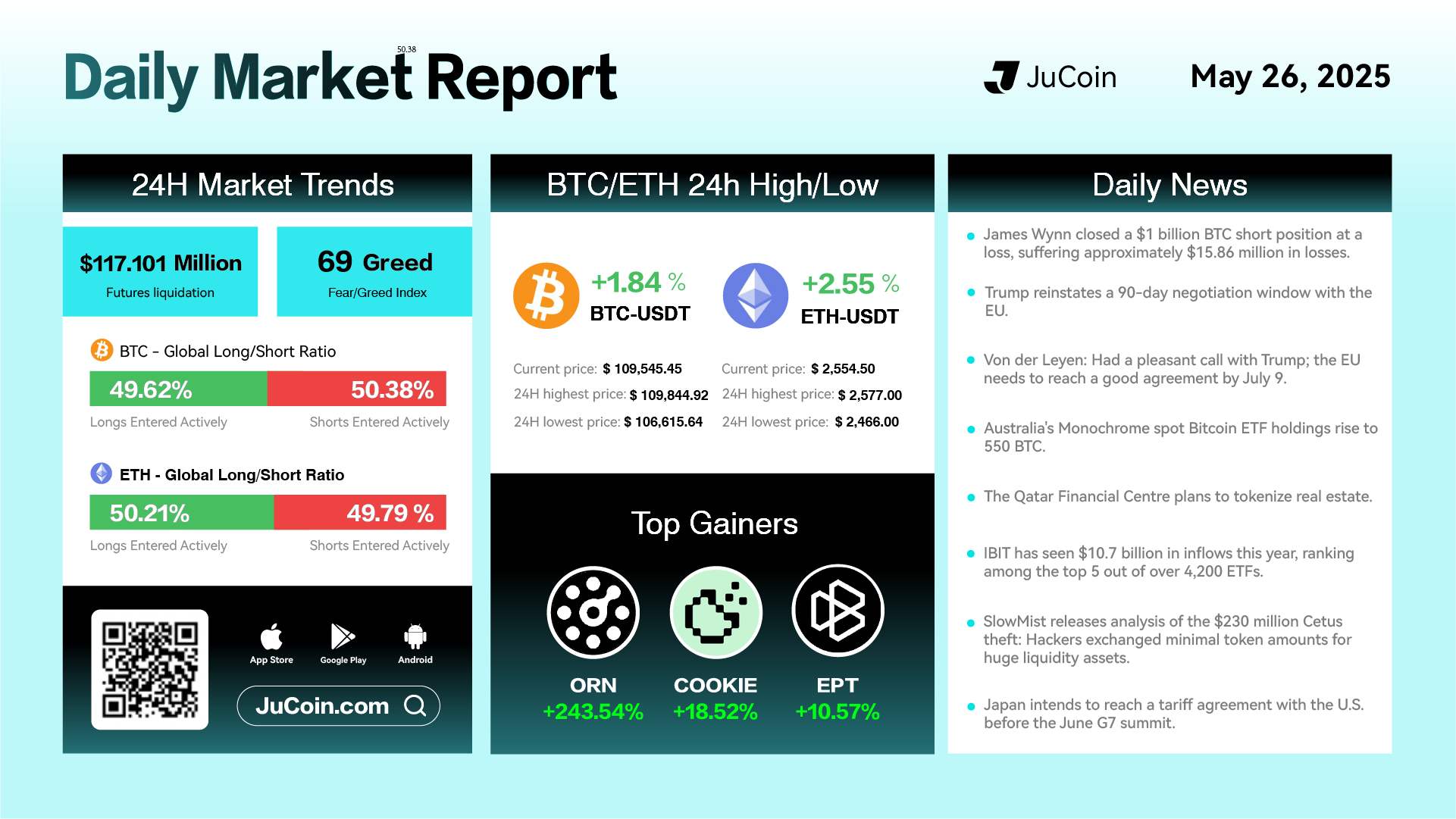

Crypto markets opened the final week of May in the green, with both Bitcoin and Ethereum posting solid gains. Bitcoin (BTC) rose 1.84% to $109,545.45, briefly hitting a high of $109,844.92, while Ethereum (ETH) climbed 2.55% to $2,554.50, following a range between $2,466.00 and $2,577.00. Market sentiment held firm in “Greed” territory, with the Fear & Greed Index at 69, and futures liquidations reached $117.10 million as leveraged shorts were gradually cleared out. Long/short ratios remained nearly balanced for both BTC and ETH, reflecting measured positioning from traders.

Leading altcoin gainers included ORN/USDT with a massive +243.54% spike, COOKIE/USDT up +18.52%, and EPT/USDT gaining +10.57%, suggesting renewed attention to lower-cap and meme-style assets.

On the news front, a headline-grabbing loss came from trader James Wynn, who reportedly closed a $1 billion BTC short position with a staggering $15.86 million in realized losses. Meanwhile, U.S. President Donald Trump reinstated a 90-day negotiation window with the EU, signaling a pause in escalating trade tensions. European Commission President Ursula von der Leyen confirmed a “pleasant call” and stated that a formal agreement may be reached by July 9.

From the institutional front, Bitcoin ETF inflows continue as Australia’s Monochrome Bitcoin ETF has expanded its holdings to 550 BTC, reinforcing continued mainstream adoption and robust Bitcoin ETF inflows. Additionally, IBIT was revealed to be among the top 5 most popular ETFs of the year, with inflows totaling $10.7 billion—a major signal of retail and institutional alignment around BTC.

Elsewhere, Qatar’s Financial Centre announced plans to tokenize real estate, building on a broader wave of RWA (real-world asset) tokenization initiatives. And in security news, SlowMist published a breakdown of the $230 million Cetus exploit, revealing that the attackers exchanged only minimal token amounts to access high-liquidity pools, highlighting new vectors for exploit strategies.

Finally, Japan announced its intent to reach a tariff agreement with the U.S. ahead of the G7 summit in June, hinting at improved macro cooperation just as global crypto adoption continues to accelerate.