Daily Market Report – May 19, 2025

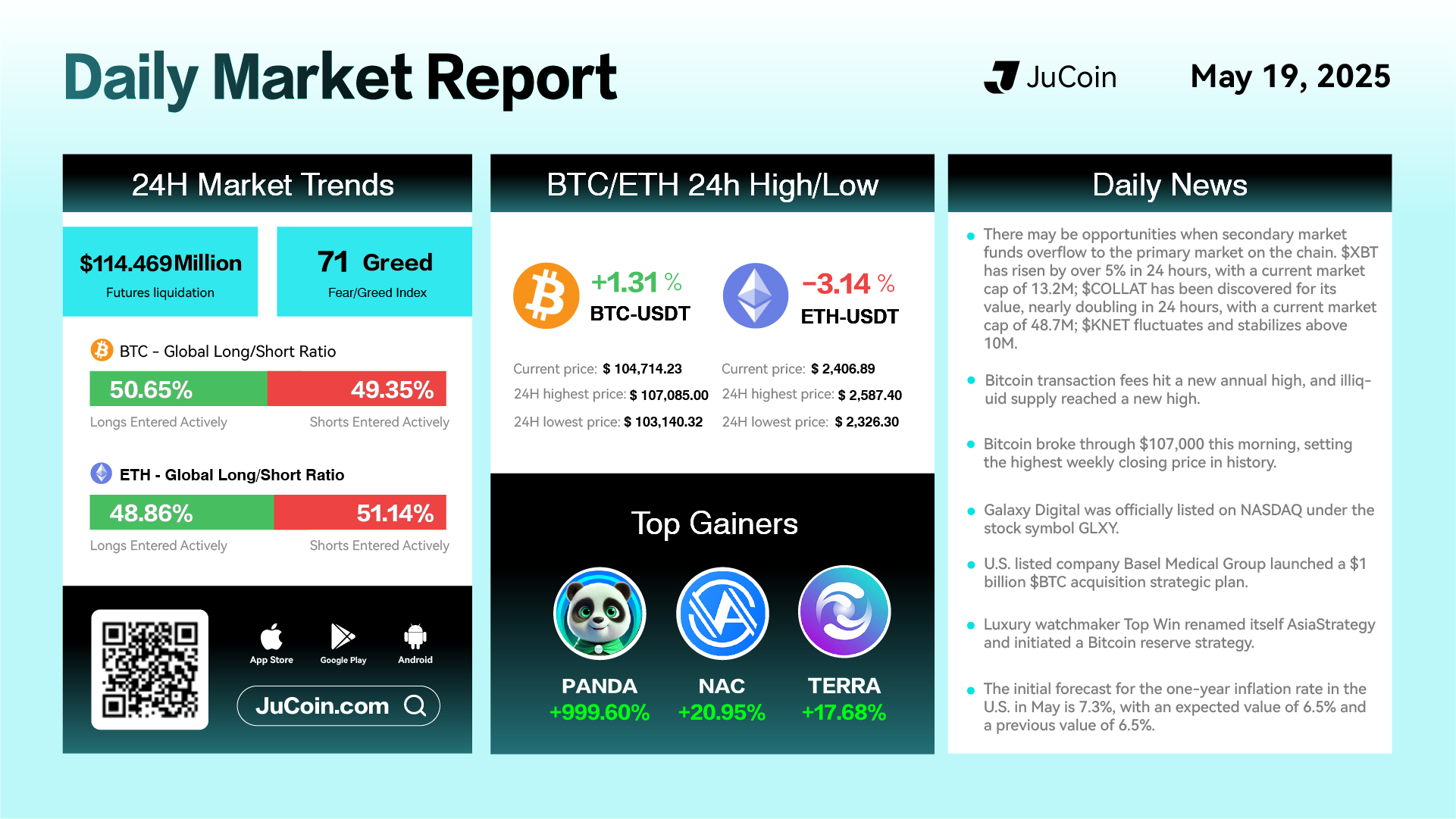

Bitcoin led today’s action with a 1.31% gain to $104,714.23, briefly crossing $107,000 and setting the highest weekly closing price in its history. BTC traded between $103,140.32 and $107,085.00, even as network congestion and liquidity constraints pushed transaction fees to new annual highs. Ethereum (ETH), by contrast, dropped 3.14% to $2,406.89, retreating from a daily high of $2,587.40. Futures liquidations totaled $114.47 million, reflecting increased leverage rotation, while sentiment stayed elevated with the Fear & Greed Index holding steady at 71. The BTC long/short ratio favored longs at 50.65%, while ETH traders leaned slightly bearish, with only 48.86% of positions long.

Top gainers were once again dominated by high-risk tokens. PANDA exploded +999.60%, NAC climbed 20.95%, and TERRA rose 17.68%, continuing the surge in meme and high-beta altcoins. Despite that, the market’s underlying volatility remains. On-chain token flows show capital rotation from secondary to primary market contracts, with XBT rising over 5%, COLLAT nearly doubling to a $48.7M market cap, and KNET holding above $10M.

Major headlines included Galaxy Digital’s official listing on NASDAQ under the ticker GLXY, signaling a continued institutionalization of crypto-native firms. Meanwhile, Basel Medical Group launched a $1 billion Bitcoin acquisition strategy, and luxury watchmaker Top Win rebranded as AsiaStrategy, disclosing plans for its own BTC reserve. These developments reflect growing corporate treasury adoption across diverse sectors.

In macroeconomic news, early forecasts for May’s one-year U.S. inflation rate came in at 7.3%, above the expected 6.5%, raising potential concerns about monetary tightening ahead. Nonetheless, crypto markets appeared to shrug off the inflation beat, buoyed by strong price action and bullish narratives.