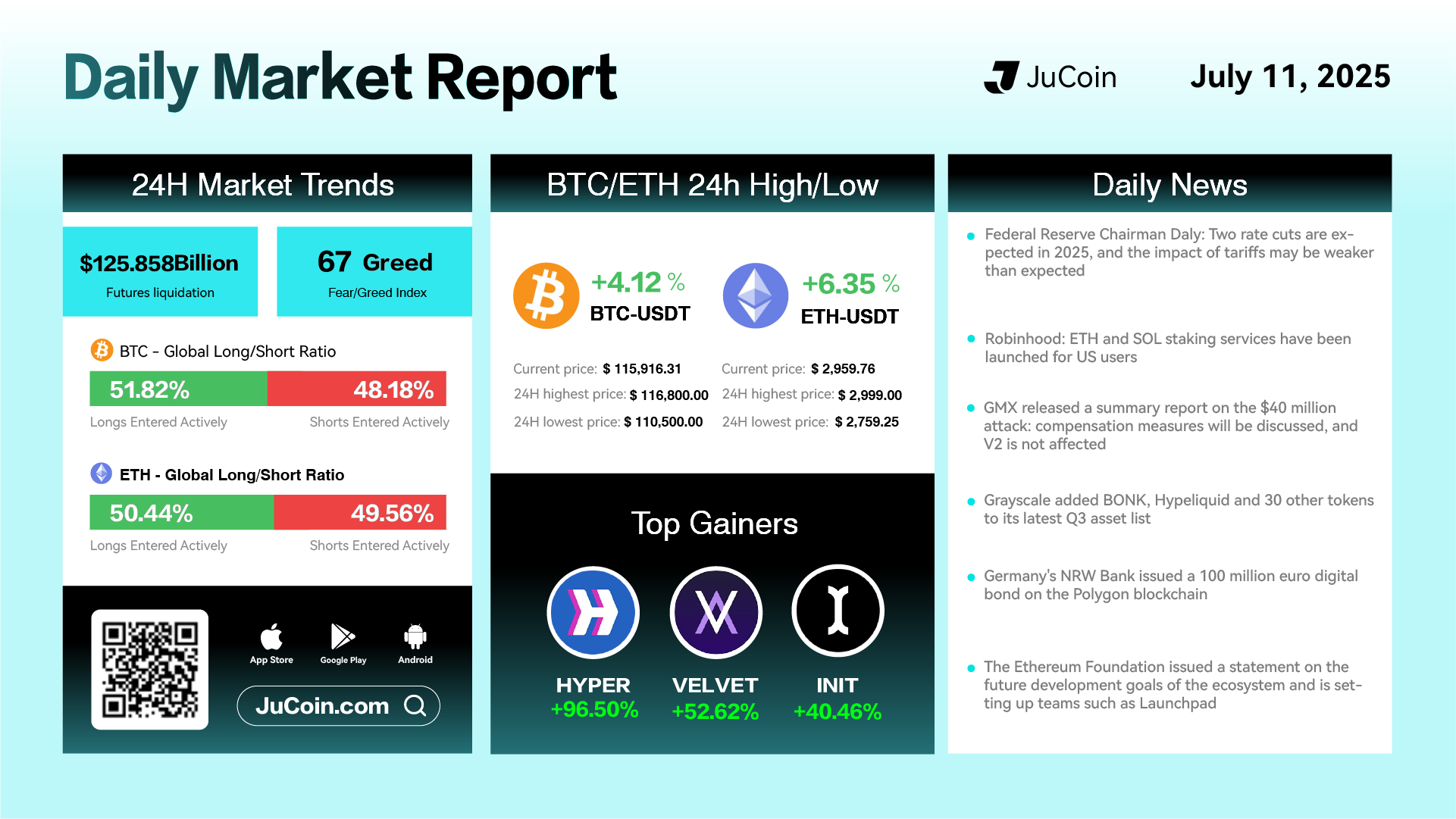

Daily Market Report — July 11, 2025

Bitcoin (BTC) extended its rally with a 4.12% gain in the past 24 hours, pushing the price to $115,916.31, while Ethereum (ETH) surged 6.35% to $2,959.76, riding the momentum of staking demand and broader altcoin strength. The Fear & Greed Index rose to 67, marking a clear “Greed” signal for the first time in weeks. Futures liquidation volume hit $125.9 billion, signaling aggressive repositioning as bulls took over.

Top gainers were HYPER (+96.50%), VELVET (+52.62%), and INIT (+40.46%), reflecting strong capital rotation into trending tokens across various narratives, including staking, L2 ecosystems, and governance assets.

In policy and regulation, Federal Reserve Chairman Daly announced that two rate cuts are still expected in 2025, while downplaying the inflationary impact of tariffs. Markets responded positively to the continued dovish outlook.

Robinhood officially launched ETH and SOL staking for U.S. users, a long-awaited move that could significantly increase retail participation in on-chain yield generation.

On the security front, GMX released a post-mortem summary of the recent $40 million V1 attack, assuring users that V2 was unaffected and that a compensation mechanism is under discussion.

Meanwhile, Grayscale added BONK, Hypeliquid, and 30 other tokens to its Q3 asset list, offering investors broader exposure to trending mid-caps and meme assets.

In Europe, Germany’s NRW Bank issued a €100 million digital bond on Polygon, reinforcing institutional interest in public chain issuance.

Finally, the Ethereum Foundation released a strategic statement, outlining long-term goals such as increased support for developer teams and new initiatives under the Launchpad program, hinting at Ethereum’s commitment to ecosystem growth beyond core protocol development.