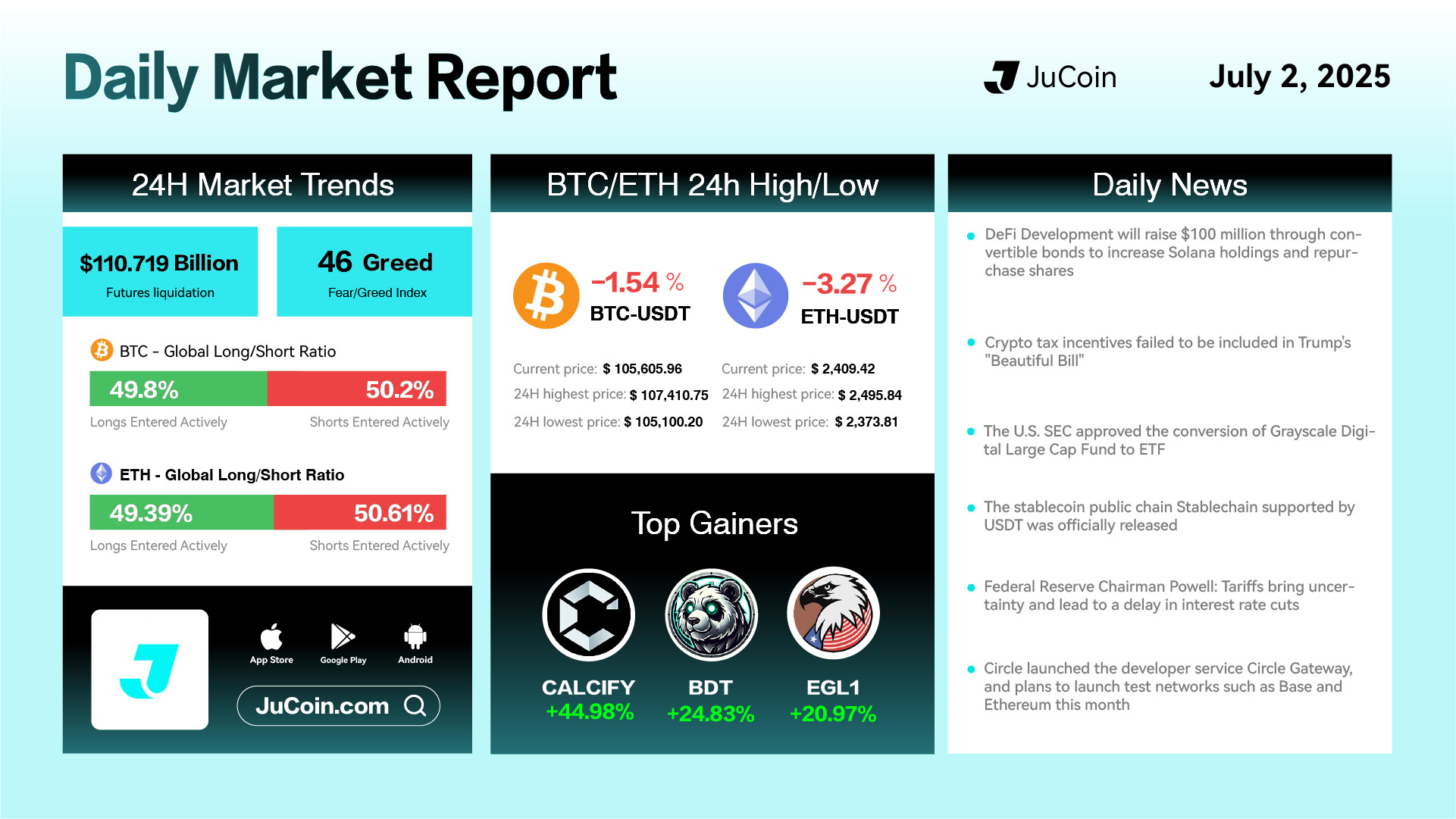

Daily Market Report — July 2, 2025

Bitcoin (BTC) price dropped 1.54% over the past 24 hours to $105,605.96, trading between $105,100.20 and $107,410.75. Ethereum (ETH) saw a sharper correction, falling 3.27% to $2,409.42. The Fear & Greed Index dropped to 46, reflecting a cooling of investor sentiment. Futures liquidation volume stood at $110.7 billion, and short positions slightly outweighed longs on both BTC and ETH.

Top gainers for the day were CALCIFY (+44.98%), BDT (+24.83%), and EGL1 (+20.97%), indicating a temporary capital rotation into lower-cap altcoins amid overall market weakness.

In regulatory and macro updates, the U.S. SEC approved the conversion of the Grayscale Digital Large Cap Fund into an ETF, a milestone for broader crypto ETF adoption. Meanwhile, the much-anticipated “Beautiful Bill” from the Trump administration failed to include crypto tax incentives, a disappointment for the digital asset industry.

On the infrastructure front, the stablecoin-focused blockchain Stablechain, backed by USDT, officially launched, adding momentum to the stablecoin ecosystem. Circle also unveiled Circle Gateway for developers, with plans to roll out Ethereum and Base testnets later this month.

In corporate strategy, DeFi Development announced a $100 million raise through convertible bonds aimed at increasing its Solana holdings and executing share buybacks.

Fed Chair Jerome Powell commented that ongoing trade tariffs could delay interest rate cuts, adding macroeconomic uncertainty to crypto market dynamics.