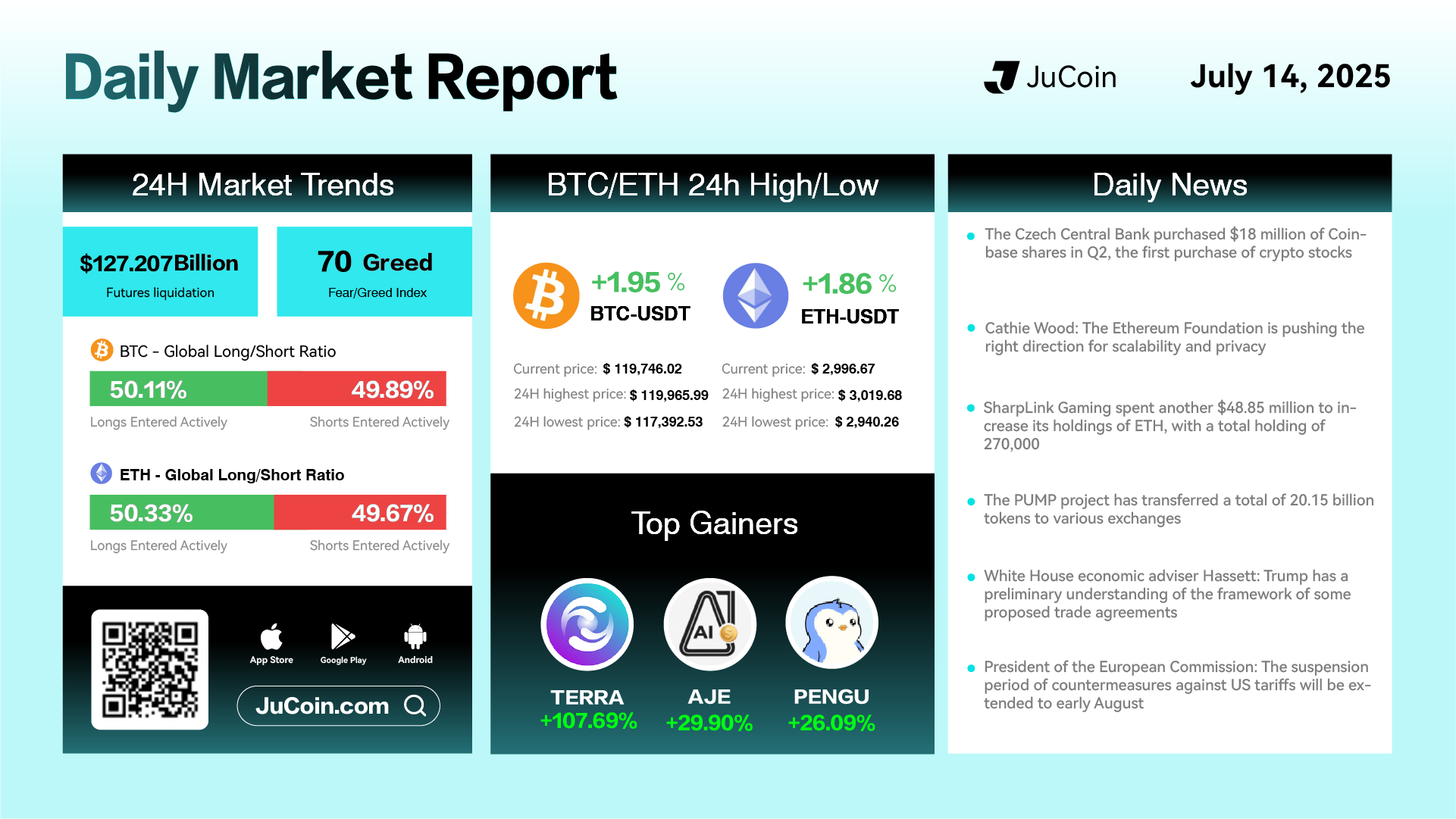

Daily Market Report — July 14, 2025

Bitcoin (BTC) rose 1.95% in the past 24 hours to close at $119,746.02, with an intraday range of $117,392.53 – $119,965.99. Ethereum (ETH) followed with a 1.86% gain, ending at $2,996.67, just shy of reclaiming the $3,000 mark. The Fear & Greed Index jumped to 70, indicating heightened investor optimism. Meanwhile, futures liquidation volume remained high at $127.2 billion, and both BTC and ETH saw slightly more long positions than shorts.

Top gainers were TERRA (+107.69%), AJE (+29.90%), and PENGU (+26.09%). These performances suggest renewed interest in ecosystem tokens and AI narratives.

On the institutional front, the Czech Central Bank disclosed an $18 million purchase of Coinbase shares in Q2, marking its first move into crypto stocks—an encouraging sign for traditional finance entering digital asset markets.

Cathie Wood praised the Ethereum Foundation for its strategic direction on scalability and privacy, reinforcing confidence in ETH’s long-term infrastructure vision.

Gaming firm SharpLink continued its ETH accumulation, adding $48.85 million to its holdings for a total of 270,000 ETH—underscoring rising institutional exposure to Ethereum.

Meanwhile, the PUMP project moved 20.15 billion tokens to exchanges, raising speculation around upcoming liquidity events or market activity.

In macro news, White House economic adviser Hassett stated that Trump has a preliminary understanding of trade deal frameworks, while the European Commission confirmed that the suspension of counter-tariffs will extend into early August, easing geopolitical market tension for now.