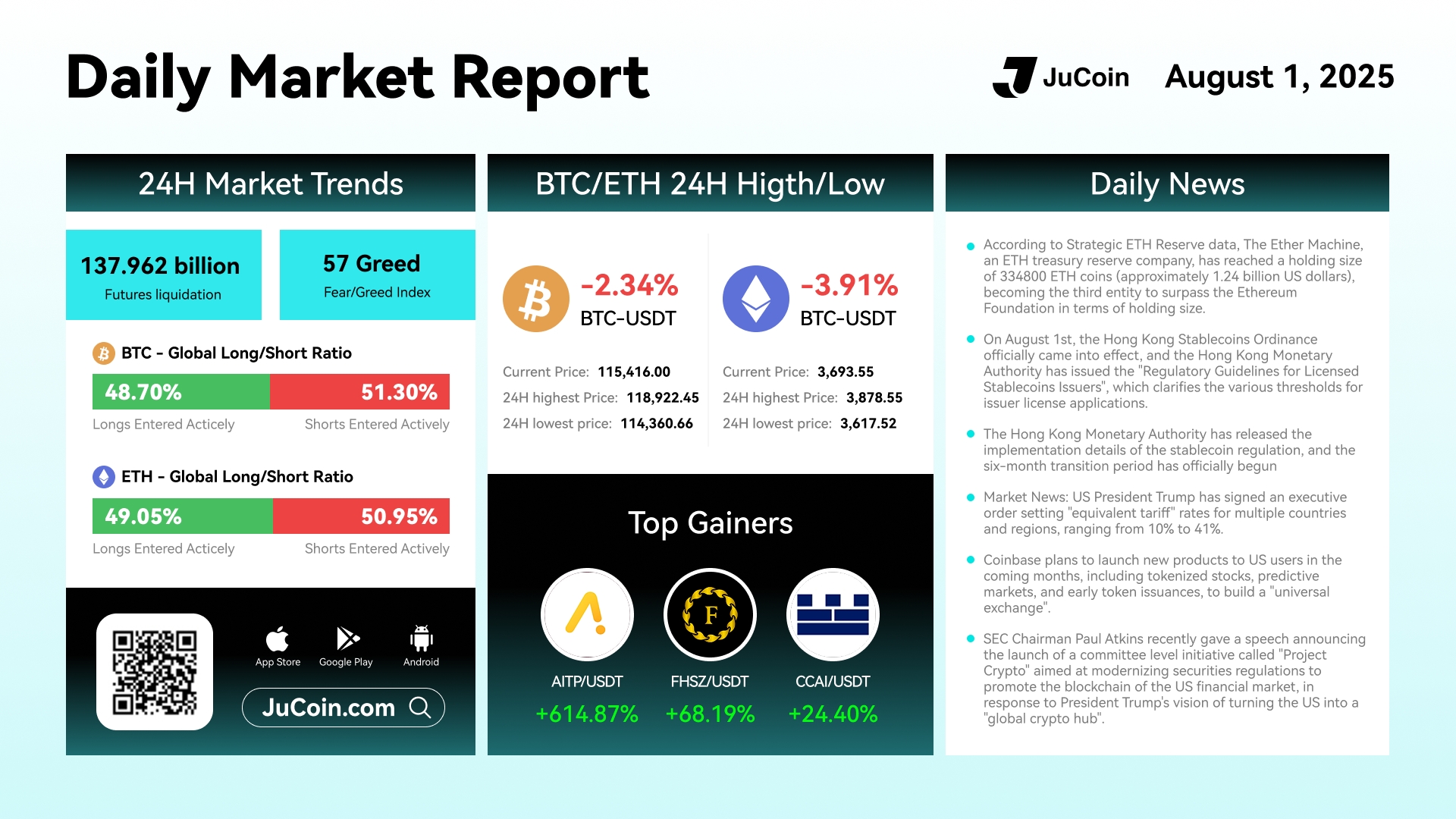

Daily Market Report — August 1, 2025

Bitcoin (BTC) fell 2.34% in the past 24 hours to close at $115,416.00, trading between $114,360.66 and $118,922.45. Ethereum (ETH) rdeclined 3.91% to $3,693.55, moving within a range of $3,617.52 to $3,878.55. The Fear & Greed Index dropped to 57, signaling weakening investor confidence. Futures liquidation volume reached $137.96 billion, with shorts dominating slightly for both BTC and ETH.

Top gainers were AITP (+614.87%), FHSZ (+68.19%), and CCAI (+24.40%), reflecting strong speculation in niche and AI-related assets.

From a regulatory and macro perspective, The Ether Machine, an ETH treasury reserve company, reached a holding size of 334,800 ETH (~$1.24 billion), surpassing the Ethereum Foundation’s holdings and becoming the third-largest entity globally.

On the regulatory front, the Hong Kong Stablecoins Ordinance officially came into effect on August 1, alongside the release of Regulatory Guidelines for Licensed Stablecoin Issuers by the Hong Kong Monetary Authority. This marks the start of a six-month transitional period for compliance under the new framework.

In the US, President Trump signed an executive order introducing “equivalent tariffs” on multiple countries and regions, ranging from 10% to 41%, further shaping global trade dynamics. Meanwhile, Coinbase announced plans to roll out new products for US users, including tokenized stocks, prediction markets, and early token issuance, aiming to evolve into a “universal exchange.”

Additionally, SEC Chairman Paul Atkins unveiled “Project Crypto”, a committee-level initiative designed to modernize securities regulation, align blockchain innovations with financial markets, and support the President’s vision of transforming the US into a global crypto hub.