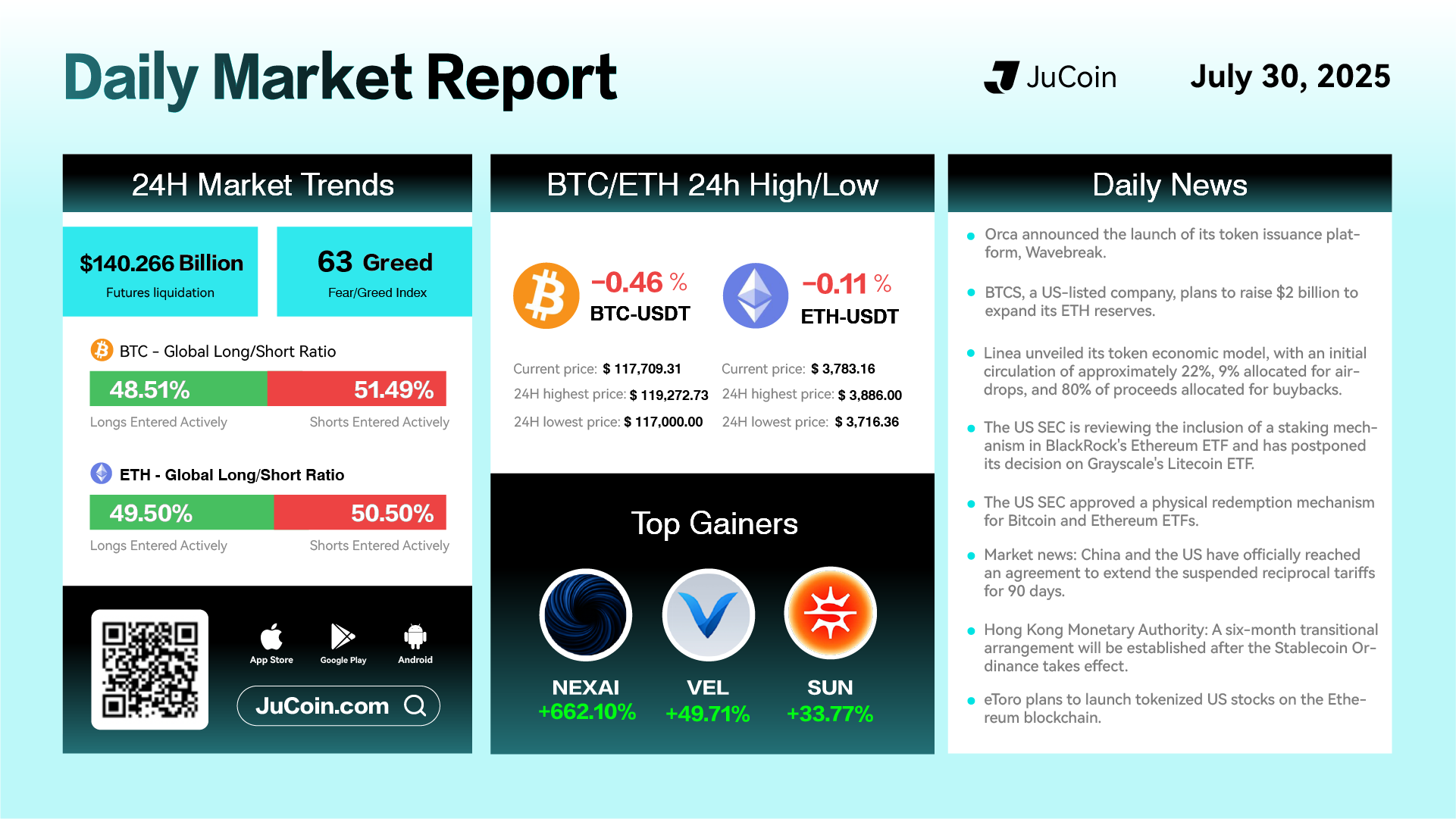

Daily Market Report — July 30, 2025

Bitcoin (BTC) declined 0.46% over the past 24 hours, closing at $117,709.31, after trading between $117,000.00 and $119,272.73. Ethereum (ETH) also edged down 0.11% to $3,783.16, with an intraday high of $3,886.00 and a low of $3,716.36. The Fear & Greed Index held steady at 63, signaling moderated market sentiment. Futures liquidation volumes reached $140.27 billion, with BTC short positions slightly dominating (51.49%) and ETH showing a similar slight short bias (50.50%).

Top gainers included NEXAI (+662.10%), VEL (+49.71%), and SUN (+33.77%), underscoring strong speculative momentum in AI- and infrastructure-related tokens.

On the DeFi and infrastructure front, Orca announced the launch of Wavebreak, its new token issuance platform, aimed at supporting next-generation projects. In corporate news, BTCS, a U.S.-listed company, revealed plans to raise $2 billion to expand its ETH reserves, signaling growing institutional interest in Ethereum.

Linea introduced its tokenomics, with an initial circulation of approximately 22%, 9% allocated for airdrops, and 80% of proceeds earmarked for buybacks, reflecting a highly structured approach to supply and demand management.

From a regulatory perspective, the U.S. SEC is reviewing the inclusion of a staking mechanism in BlackRock’s Ethereum ETF and postponed its decision on Grayscale’s Litecoin ETF. However, it did approve physical redemption mechanisms for both Bitcoin and Ethereum ETFs, potentially increasing institutional product flexibility.

On the macro side, China and the U.S. reached an agreement to extend suspended reciprocal tariffs for 90 days, easing near-term trade tensions. The Hong Kong Monetary Authority also confirmed a six-month transitional arrangement following the implementation of the Stablecoin Ordinance, giving issuers time to meet compliance requirements.

In digital assets innovation, eToro announced plans to launch tokenized U.S. stocks on Ethereum, highlighting a growing convergence of traditional equity markets and blockchain-based tokenization.