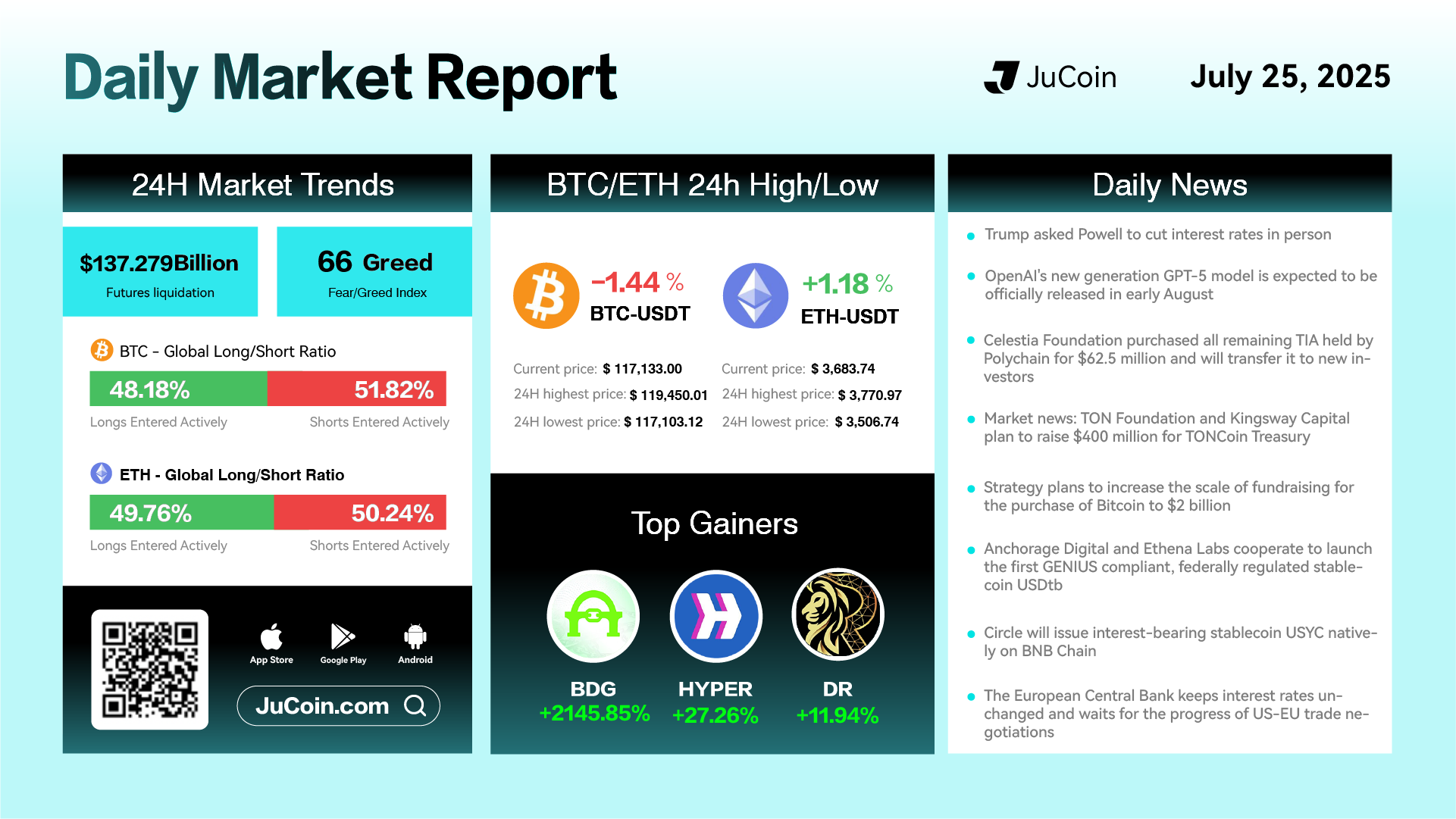

Daily Market Report — July 25, 2025

Bitcoin (BTC) retreated 1.44% over the past 24 hours to $117,133.00, trading between $119,450.01 and $117,103.12. Ethereum (ETH)

rose 1.18% to $3,683.74, with an intraday high of $3,770.97 and a low of $3,506.74. The Fear & Greed Index slipped to 66, signaling cautious sentiment. Futures liquidation volume totaled $137.28 billion, and shorts held a slight edge on BTC (51.82%), while ETH positioning remained nearly balanced.

Top gainers included BDG (+2145.85%), HYPER (+27.26%), and DR (+11.94%), showing renewed speculative energy in smaller-cap tokens despite overall mixed market conditions.

In macro and policy news, former President Donald Trump reportedly urged Federal Reserve Chair Jerome Powell to cut interest rates, a move that could influence broader financial markets and risk sentiment. Meanwhile, OpenAI confirmed plans to release its next-generation GPT‑5 model in early August, highlighting accelerating AI development and its intersection with crypto innovation.

On the institutional side, the Celestia Foundation purchased all remaining TIA tokens held by Polychain for $62.5 million, with plans to redistribute the assets to new investors. The TON Foundation and Kingsway Capital announced a plan to raise $400 million for the TONCoin Treasury, signaling growing support for Telegram-linked ecosystem growth.

Strategy revealed an increase in its fundraising target for Bitcoin purchases to $2 billion, emphasizing sustained institutional accumulation of BTC. Additionally, Anchorage Digital and Ethena Labs unveiled the first GENIUS-compliant, federally regulated stablecoin USDtb, while Circle announced it will issue the interest-bearing stablecoin USYC natively on BNB Chain.

In Europe, the European Central Bank opted to keep interest rates unchanged, awaiting clarity on the progress of U.S.–EU trade negotiations, which could have spillover effects on global financial markets.