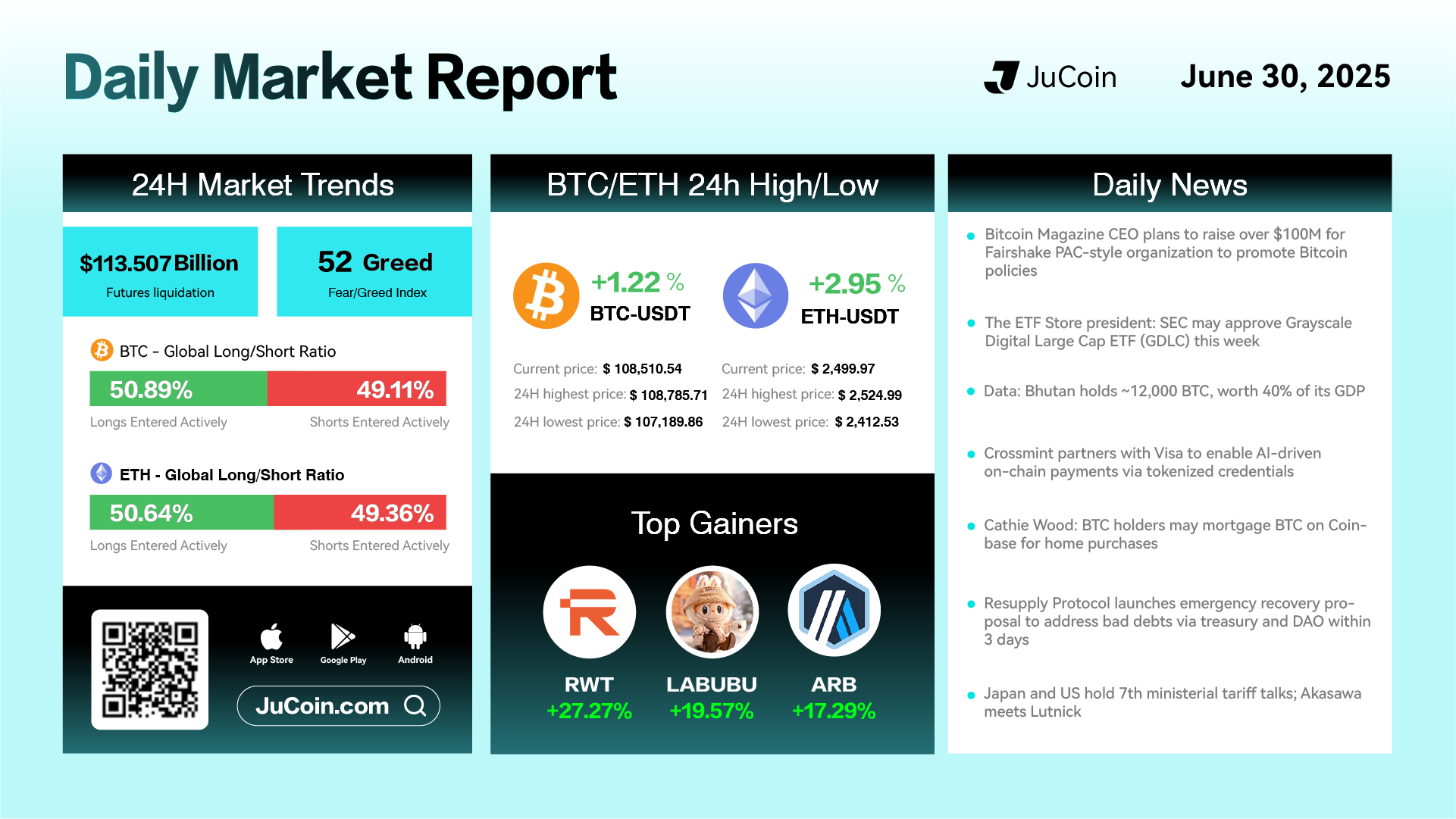

Daily Market Report — June 30, 2025

Bitcoin (BTC) price rose 1.22% over the past 24 hours to $108,510.54, trading between $107,189.86 and $108,785.71. Ethereum (ETH) outpaced BTC with a 2.95% rally, closing at $2,499.97. The Fear & Greed Index rose to 52, indicating a shift toward moderate bullish sentiment. Futures liquidation volume reached $113.5 billion, while long positions dominated slightly across both BTC and ETH.

Top gainers included RWT, jumping 27.27%, LABUBU gaining 19.57%, and ARB climbing 17.29%, showing strong interest in mid-cap tokens alongside the broader market recovery.

In policy and macro news, the CEO of Bitcoin Magazine announced plans to raise over $100M for a PAC-style organization to promote Bitcoin-friendly political initiatives. Meanwhile, the president of The ETF Store stated the SEC may approve the Grayscale Digital Large Cap ETF (GDLC) this week, potentially boosting institutional interest.

Geopolitically, Bhutan revealed it holds approximately 12,000 BTC, representing 40% of its GDP, a rare instance of sovereign-level BTC backing. In the payments infrastructure, Crossmint announced a partnership with Visa to enable AI-powered on-chain transactions using tokenized credentials.

On the DeFi-fintech frontier, Cathie Wood noted that BTC holders may soon be able to mortgage Bitcoin on Coinbase to fund home purchases. Additionally, Resupply Protocol proposed a DAO-backed recovery plan to address protocol-level bad debts within three days.