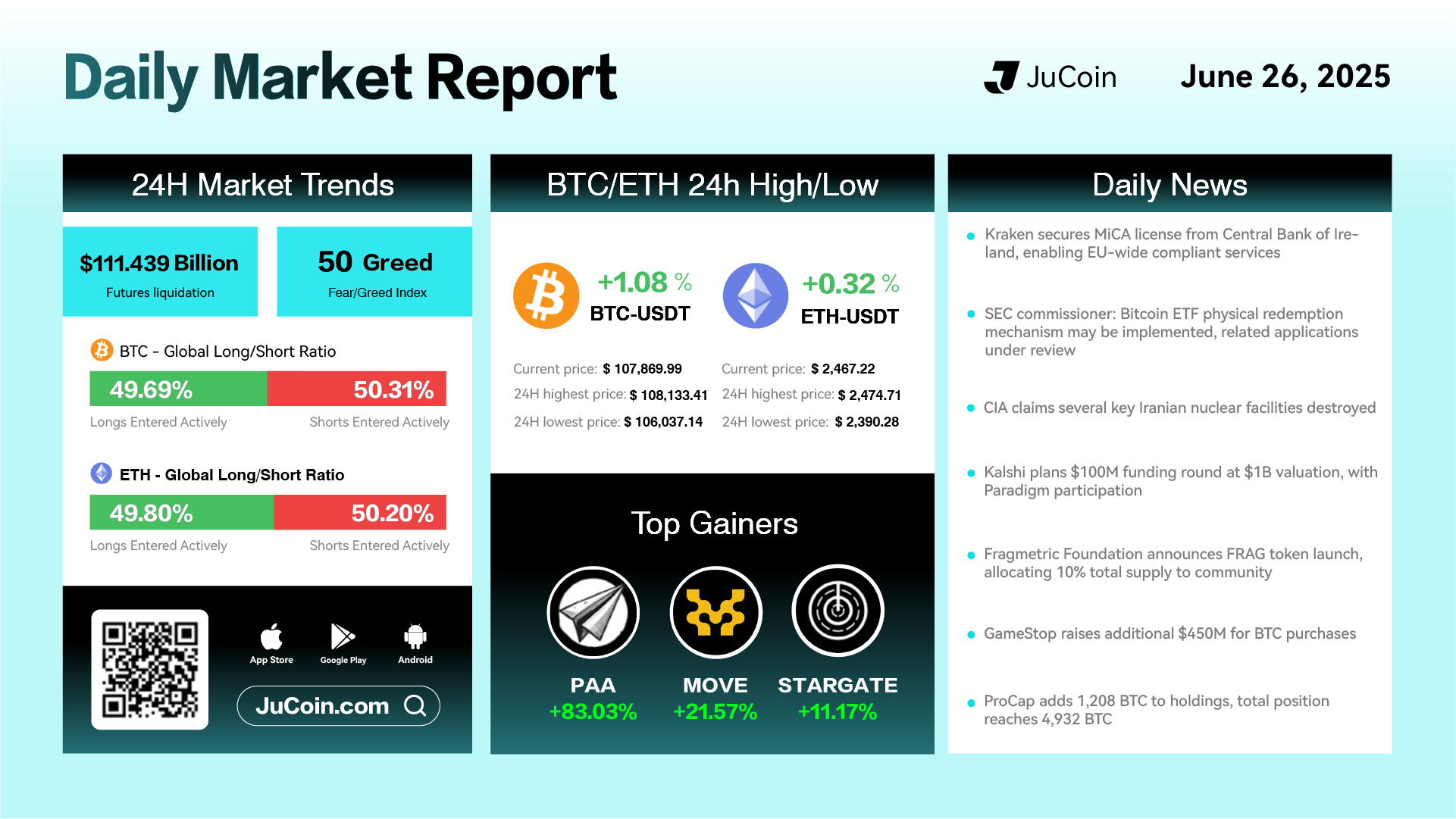

Daily Market Report — June 26, 2025

Bitcoin (BTC) limbed 1.08% over the past 24 hours to $107,869.99, trading between $106,037.14 and $108,133.41. Ethereum (ETH) posted a smaller gain of 0.32%, closing at $2,467.22. The Fear & Greed Index remained neutral at 50, while futures liquidations totaled $111.4 billion, showing strong activity in derivatives markets. Long/short ratios for BTC and ETH stayed almost evenly split, reflecting market indecision.

Top altcoin performers included PAA with an 83.03% surge, MOVE up 21.57%, and STARGATE gaining 11.17%, continuing the trend of selective altcoin breakouts during periods of major coin consolidation.

In regulatory news, Kraken secured a MiCA license from the Central Bank of Ireland, enabling it to offer compliant crypto services across the EU. Meanwhile, the SEC revealed that a Bitcoin ETF physical redemption mechanism is under review—potentially opening the door for more flexible institutional BTC products.

On the institutional front, ProCap added 1,208 BTC to its holdings, now totaling 4,932 BTC, while GameStop raised an additional $450 million for further BTC purchases. Kalshi is reportedly raising $100 million in a new round at a $1 billion valuation, with Paradigm among the investors.

Elsewhere, the Fragmentic Foundation announced the launch of the FRAG token, allocating 10% of the supply to community incentives. Separately, geopolitical headlines resurfaced as the CIA claimed several Iranian nuclear facilities were destroyed, potentially adding volatility to global markets.