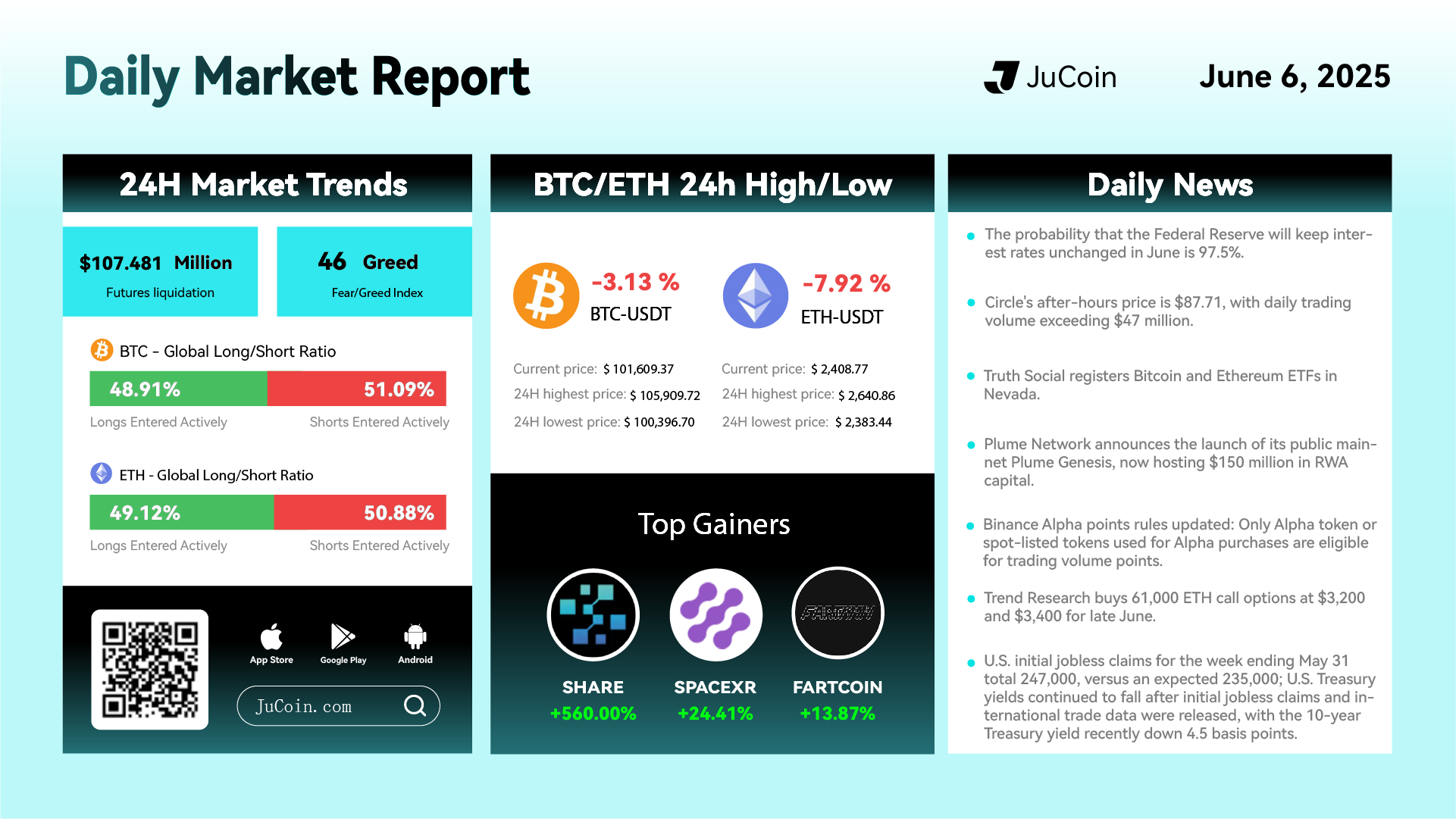

Daily Market Report – June 6, 2025

Bitcoin (BTC) declined 3.13% over the past 24 hours to $101,609.37, while Ethereum (ETH) plunged 7.92% to $2,408.77. BTC traded between $100,396.70 and $105,909.72, and ETH ranged from $2,383.44 to $2,640.86. Futures liquidations surged to $107.48 million, reflecting elevated volatility as sentiment turned more cautious. The Fear & Greed Index dropped to 46, marking a shift into “Neutral” from recent bullish levels. The global long/short ratio remained nearly even, with BTC longs at 48.91% and shorts at 51.09%, while ETH showed 49.12% long and 50.88% short positions.

Despite broader market weakness, several altcoins outperformed. SHARE led the day with a 560% spike, followed by SPACEXR rising 24.41% and FARTCOIN up 13.87%. The total value locked (TVL) across all blockchains was steady, with no major net inflows or outflows noted.

In institutional news, the Federal Reserve is now expected to keep interest rates unchanged at the June FOMC meeting, with a 97.5% probability priced in by markets. U.S. initial jobless claims rose to 247,000 — higher than the 235,000 estimate — reflecting softening labor market conditions. The 10-year Treasury yield fell 4.5 basis points in response to the data.

Circle’s after-hours stock trading volume surpassed $47 million, with shares peaking at $87.71. Meanwhile, Truth Social filed registration paperwork in Nevada for both Bitcoin and Ethereum ETFs. Plume Network officially launched its public mainnet, securing over $150 million in tokenized real-world assets (RWAs) within its ecosystem.

Additional developments included Binance Alpha updating its points calculation policy, now only counting volumes from Alpha or spot-listed tokens. Trend Research executed a large bet on Ethereum upside, purchasing 61,000 call options targeting $3,200 and $3,400 strikes expiring in late June. ETF inflows remained steady as traditional finance deepens its footprint in digital asset markets.