Key Takeaways

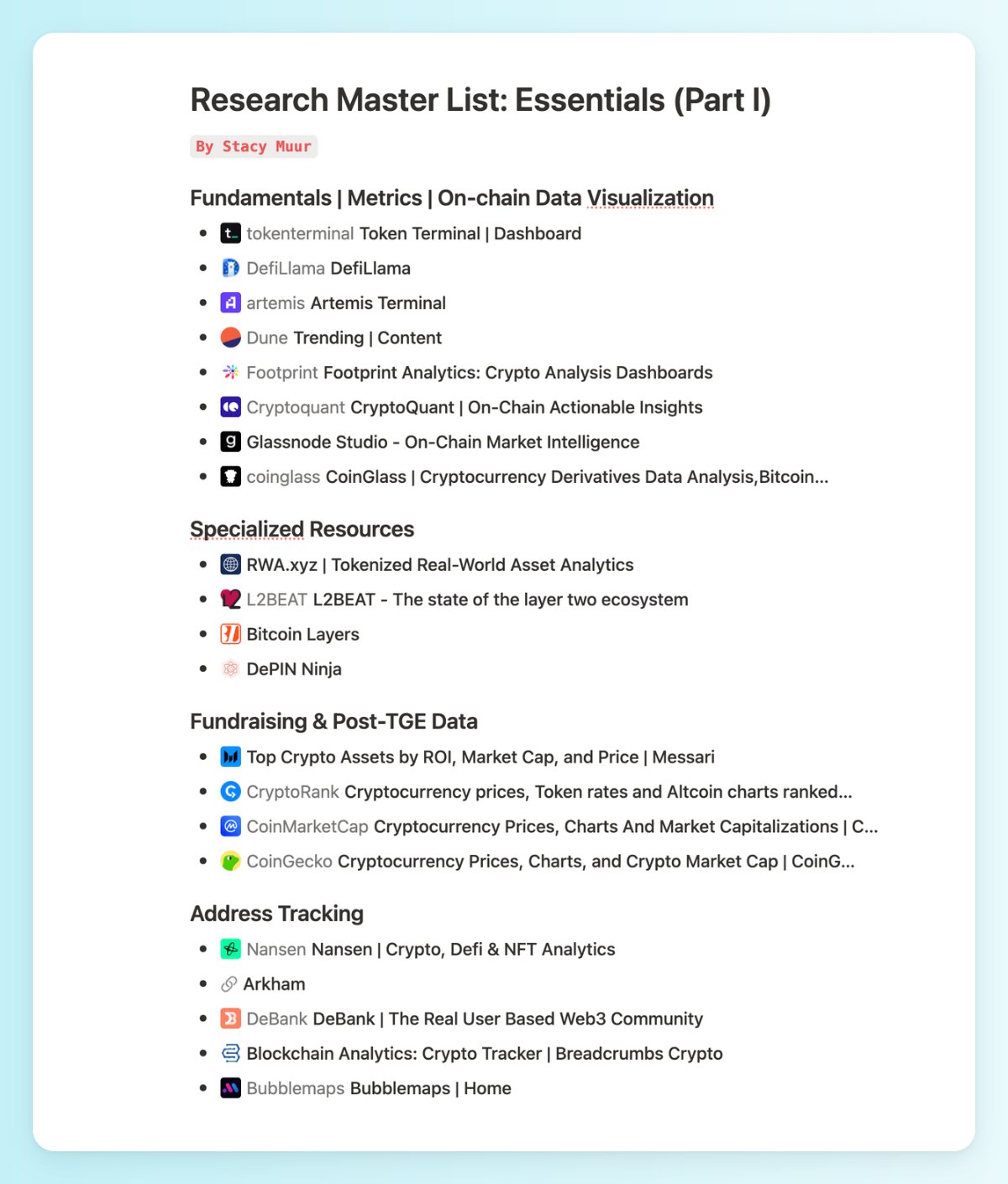

- Diverse Tool Ecosystem: The crypto research tool landscape in 2025 offers a wide range of solutions, from market data aggregators like CoinMarketCap to advanced on-chain analytics platforms like Glassnode, catering to various investor needs.

- Specialized Analytics Growth: Tools like DefiLlama and Dune Analytics highlight the rise of specialized platforms for DeFi, NFTs, and cross-chain analysis, reflecting the market’s increasing complexity.

- AI and Predictive Analytics: AI-driven tools such as Token Metrics and CryptoHawk are transforming crypto research by providing predictive insights and automating complex analyses.

- Regulatory and Compliance Focus: Security and compliance tools like Blockstash Intelligence and Koinly are gaining importance as regulatory scrutiny increases, especially for institutional investors.

- Investor-Specific Solutions: The optimal toolset varies by investor profile, with beginners favoring user-friendly platforms like CoinStats, while active traders and institutions rely on advanced tools like TradingView and Santiment.

Crypto research tools are indispensable for investors navigating the volatile and complex digital asset market. These platforms deliver critical data, actionable insights, and advanced analytical capabilities to support informed decision-making. Recent market analyses indicate that traders employing multiple specialized tools often outperform those relying on limited data sources. From basic price trackers in the market’s early days, the ecosystem has evolved to include sophisticated on-chain analytics, behavioral analysis platforms, and AI-driven prediction tools, reflecting the growing maturity of the cryptocurrency market and the rising demands of retail and institutional investors for robust data and analysis.

As cryptocurrency markets continue to evolve and mature, the crypto research tools available for research, analysis, and trading have grown increasingly sophisticated. This Crypto Deep Dives report examines the current landscape of crypto research tools as of April 2025, exploring the various categories, leading platforms, emerging trends, and best practices for selection based on investor needs.

Categories Of Crypto Research Tools

Market Data & Price Tracking Tools

Market data aggregators remain the bedrock of cryptocurrency research tools, providing vital information on prices, market capitalization, trading volumes, and historical trends. Platforms like CoinMarketCap are widely trusted for their comprehensive coverage of thousands of cryptocurrencies, offering a reliable starting point for investors. CoinGecko enhances this foundation with deeper insights into developer activity, community engagement, and growth metrics, appealing to those seeking more nuanced data. CryptoCompare, rated 4.3/5 by users, delivers real-time updates, portfolio tracking, and a variety of chart types, catering to both novice and experienced users. These platforms balance accessibility with depth, offering free basic services alongside premium features for those requiring advanced functionality, making them essential for building a solid research framework.

Technical Analysis & Trading Platforms

Technical analysis platforms empower traders to identify market trends, support and resistance levels, and optimal entry and exit points. TradingView leads the market with extensive chart types, customizable indicators, and social trading features, achieving a user rating of 4.8/5 for its advanced candlestick charting and annotation capabilities. Coinigy integrates with multiple exchanges to provide robust charting and portfolio management, rated at 4.5/5 by users. For decentralized exchange data, DEX Screener delivers real-time price analysis across various DEXs and blockchains.

These platforms have evolved to include social features, enabling traders to share strategies and adapt traditional methods like Gann angles for cryptocurrency markets.

Portfolio Management Tools

Portfolio trackers have become critical for investors managing diverse holdings across multiple exchanges, wallets, and blockchains, offering streamlined views of performance and asset allocation. DeBank, promoted as “The Web3 Messenger & Best Web3 Portfolio Tracker,” excels at monitoring investments on decentralized platforms, integrating seamlessly with Web3 ecosystems. CoinStats and Delta simplify performance tracking by consolidating data from various exchanges, while Merlin provides institutional-grade reporting tailored for decentralized finance portfolios.

These crypto research tools go beyond basic tracking, incorporating features like performance analytics, tax reporting integration, and real-time alerts for significant market movements. As investors increasingly diversify across chains, such platforms ensure clarity and control, enabling better strategic decisions in a complex market environment.

On-Chain Analytics Platforms

On-chain analytics platforms leverage blockchain data to uncover insights into network activity, transaction patterns, and wallet behaviors. Santiment, a market intelligence leader, provides behavioral analytics for over 2,500 cryptocurrencies, boasting 1,100+ metrics and millions of labeled addresses. Glassnode specializes in network health and user behavior insights, while Nansen focuses on wallet profiling for crypto, DeFi, and NFT analysis. Dune Analytics enables custom data extraction and visualization from multiple blockchains. These tools reveal underlying dynamics, such as whale movements and network growth, often signaling major market shifts not visible through price data alone.

DeFi-Specific Analytics

The rapid expansion of decentralized finance has driven demand for specialized analytics tools to monitor and evaluate DeFi protocols and opportunities. DefiLlama stands out as the premier platform, tracking Total Value Locked across over 800 protocols on more than 80 blockchains, offering investors a clear view of market trends. DeFi Pulse complements this with detailed rankings and analytics based on key performance metrics, while L2BEAT focuses on the growing ecosystem of Ethereum layer 2 scaling solutions.

APY Vision supports DeFi investors by monitoring liquidity pool performance and calculating impermanent loss, helping to mitigate risks. These platforms empower users to compare yields, assess protocol health, and uncover emerging opportunities, addressing the unique challenges of navigating the dynamic and intricate DeFi landscape.

Security & Compliance Tools

As regulatory oversight intensifies, crypto research tools focused on security, compliance, and forensic analysis have become essential for ensuring trust and accountability in cryptocurrency markets. Blockstash Intelligence offers real-time crime investigation and forensic capabilities across multiple blockchains, with features like transaction monitoring and wallet assessments to enhance security. MetaSleuth supports independent research, stolen funds recovery, and compliance-driven forensic analysis, catering to users prioritizing due diligence.

Koinly and CoinTracker address the tax compliance needs of approximately 60% of crypto investors who face reporting challenges, providing automated tax calculations to simplify regulatory adherence. These platforms reflect the industry’s adaptation to a maturing regulatory environment, particularly for institutional investors who prioritize robust security and compliance measures to safeguard their operations.

Leading Crypto Research Tools In The Market (2025)

In 2025, several platforms stand out for their innovation and reliability. Santiment, a behavioral analytics pioneer since 2017, delivers over 1,100 metrics across 2,500+ assets, covering on-chain, social, and development data. TradingView dominates technical analysis with a 4.8/5 user rating, offering unmatched customization and social trading features.

DefiLlama provides comprehensive DeFi TVL tracking across numerous blockchains, while Dune Analytics excels in custom blockchain data queries and visualization. CoinMarketCap and CoinGecko remain foundational for market data, and Glassnode serves as a premium on-chain intelligence solution for professional traders and institutions. These crypto research tools have earned trust through consistent performance and broad data coverage.

Crypto Research Tools: Emerging Trends & Innovations

The crypto research tool landscape continues to evolve rapidly, with several notable trends emerging:

AI-Driven Analytics

Artificial intelligence is increasingly being incorporated into crypto analytics platforms to provide predictive insights and automate analysis. Token Metrics transforms data into actionable investment insights, while Crypto Prophets employs machine learning techniques like Linear Regression and XGBoost for price forecasting. CryptoHawk enhances market movement predictions, leveraging AI to identify patterns and correlations beyond traditional methods.

Cross-Chain Analytics

As the cryptocurrency ecosystem becomes increasingly multi-chain, tools offering cross-chain visibility are gaining traction. Chainbase provides an all-in-one infrastructure for indexing and transforming on-chain data across blockchains. Footprint Analytics visualizes data from NFTs and GameFi, and Dappradar ranks decentralized applications across multiple chains, helping investors maintain a holistic market perspective.

Specialized Niche Tools

Highly specialized tools are emerging for specific market niches. DePIN.Ninja and DePINscan focus on Decentralized Physical Infrastructure Networks, while NFTrai supports professional NFT minting and trading. Artemis tracks developer activity both on- and off-chain, reflecting the market’s growing complexity and diversification into distinct sectors with unique analytical needs.

Regulatory Technology Integration

With heightened regulatory scrutiny, RegTech integration is a growing trend. KYC/AML tools incorporate verification technologies like face recognition, while blockchain analytics platforms monitor transactions for suspicious activity. Compliance dashboards streamline reporting and management, aligning with institutional demands for regulatory adherence in crypto markets.

Selecting the Right Crypto Research Tools For Different Investor Profiles

Choosing the right crypto research tools depends heavily on an investor’s experience, strategy, and objectives, as each profile demands tailored solutions to navigate the dynamic digital asset market effectively. For beginners, user-friendly platforms with educational resources are ideal to build foundational knowledge without overwhelming complexity; CoinMarketCap and CoinGecko offer accessible market data, while Coinbase integrates simple analytics within its exchange interface, and CoinStats provides straightforward portfolio monitoring to track investments with ease.

Active traders, however, require more sophisticated tools to capitalize on market volatility, relying on TradingView for advanced charting and technical insights, DEX Screener and DEXTools for real-time decentralized exchange data, and Coinalyze for in-depth analytics to inform rapid trading decisions.

Investors focused on decentralized finance (DeFi) and institutional players have distinct needs that demand specialized and enterprise-grade platforms. DeFi investors benefit from tools like DefiLlama and DeFi Pulse, which track Total Value Locked and protocol performance, alongside APY Vision for monitoring liquidity pool gains and impermanent loss, and DappLooker for no-code multi-chain analytics to navigate the complex DeFi landscape of yields and risks.

Institutional investors, managing large-scale portfolios, prioritize comprehensive and compliant solutions such as Glassnode and Coin Metrics for robust on-chain analytics, Santiment for behavioral market intelligence, and Blockstash Intelligence and MetaSleuth for security and regulatory compliance, ensuring their operations meet stringent requirements. By aligning tool selection with specific goals, investors can optimize their research and decision-making processes in the evolving crypto ecosystem.

Why Crypto Research Tools Are Key To 2025 Success?

The cryptocurrency research tool landscape in 2025 reflects the digital asset market’s growing sophistication. From foundational market data platforms to AI-driven predictive analytics and niche-specific tools, the ecosystem addresses the diverse needs of every investor type. As the market evolves, innovations in cross-chain analytics, regulatory technology, and artificial intelligence are poised to drive further advancements. Crypto research tools that balance simplicity with comprehensive insights will likely gain prominence. For investors, selecting the right tools—aligned with their strategies, experience, and data needs—remains critical to enhancing decision-making and achieving success in this dynamic market.