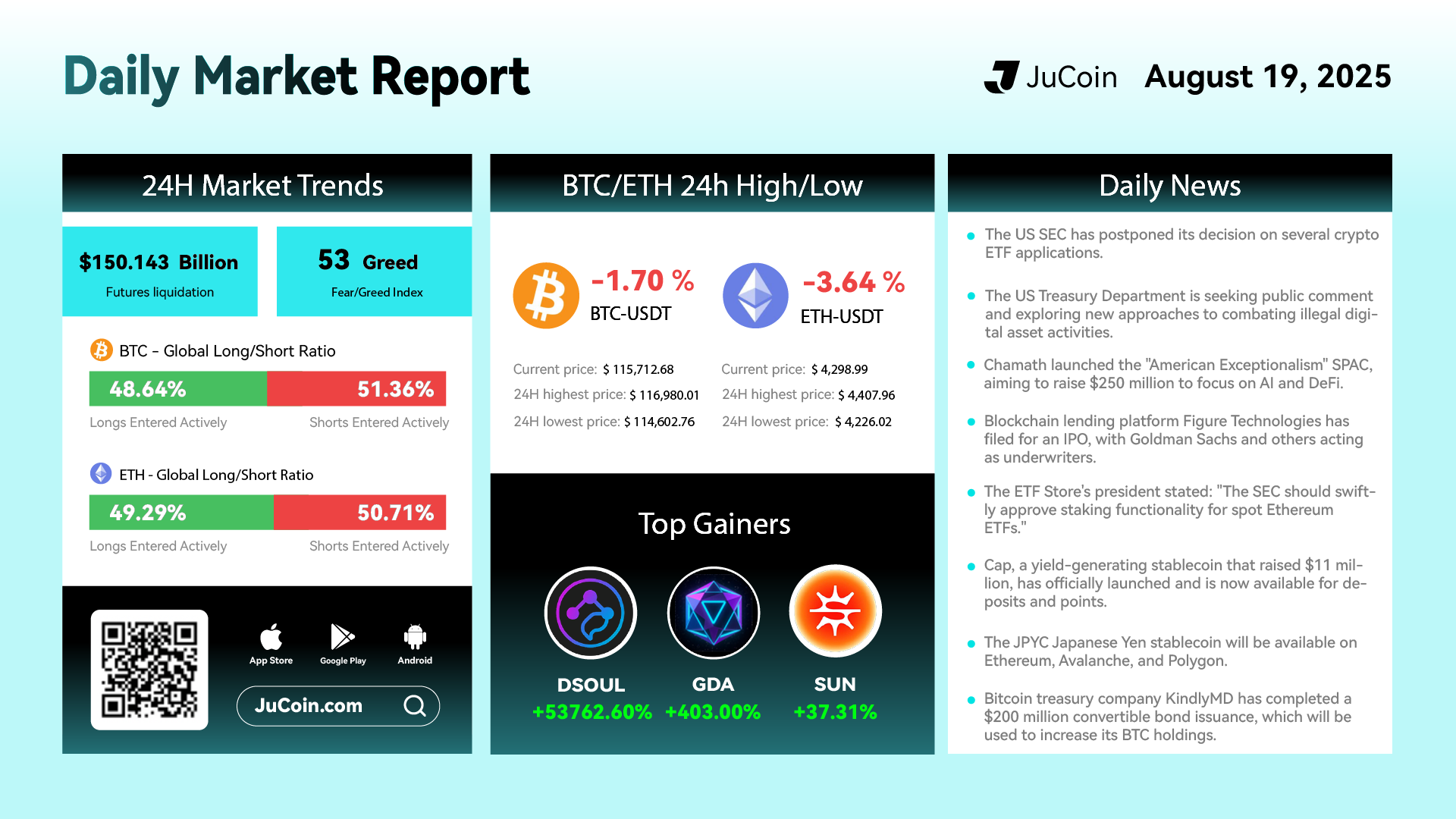

Daily Market Report — August 19, 2025

The cryptocurrency market experienced another wave of volatility on August 19, 2025. Futures liquidations over the past 24 hours reached $150.143 billion, reflecting heightened activity as traders positioned themselves around shifting sentiment. The Fear and Greed Index registered at 53, indicating a moderately cautious but still optimistic outlook among investors.

Bitcoin (BTC) continued to show weakness, sliding 1.70% over the past 24 hours. The price traded between a high of $116,980.01 and a low of $114,602.76, settling at $115,712.68. Market positioning leaned slightly bearish, with 51.36% of traders shorting BTC compared to 48.64% long positions. Ethereum (ETH) faced even steeper losses, falling 3.64% within the same period. ETH’s price dropped to $4,298.99, with intraday movements spanning from a high of $4,407.96 to a low of $4,226.02. Short activity was slightly dominant, making up 50.71% of positions, versus 49.29% longs.

Despite broader market pullbacks, several tokens surged dramatically. DSOUL/USDT skyrocketed by an astonishing +53,762.60%, capturing significant trader attention. GDA/USDT also posted strong gains at +403.00%, while SUN/USDT rose by +37.31%, standing out as one of the day’s most resilient performers.

Regulatory developments remained in focus as the US SEC once again delayed its decision on multiple crypto ETF applications. Meanwhile, the US Treasury Department invited public feedback on new frameworks to counter illicit digital asset activities.

Investor interest in AI and blockchain innovation was evident as Chamath Palihapitiya launched the “American Exceptionalism” SPAC, targeting $250 million in funding for AI and DeFi projects.

Traditional finance continued deepening its ties with blockchain. Figure Technologies, a leading lending platform, filed for an IPO with Goldman Sachs among its underwriters. In parallel, industry voices such as The ETF Store’s president pushed the SEC to approve staking functionality for spot Ethereum ETFs.

In stablecoin developments, Cap officially launched its yield-generating stablecoin after raising $11 million, offering users both deposits and reward points. Similarly, JPYC’s Japanese Yen stablecoin expanded across Ethereum, Avalanche, and Polygon networks.

Finally, Bitcoin treasury firm KindlyMD announced the completion of a $200 million convertible bond issuance, with proceeds earmarked for expanding its BTC reserves—yet another signal of institutional appetite for digital assets.