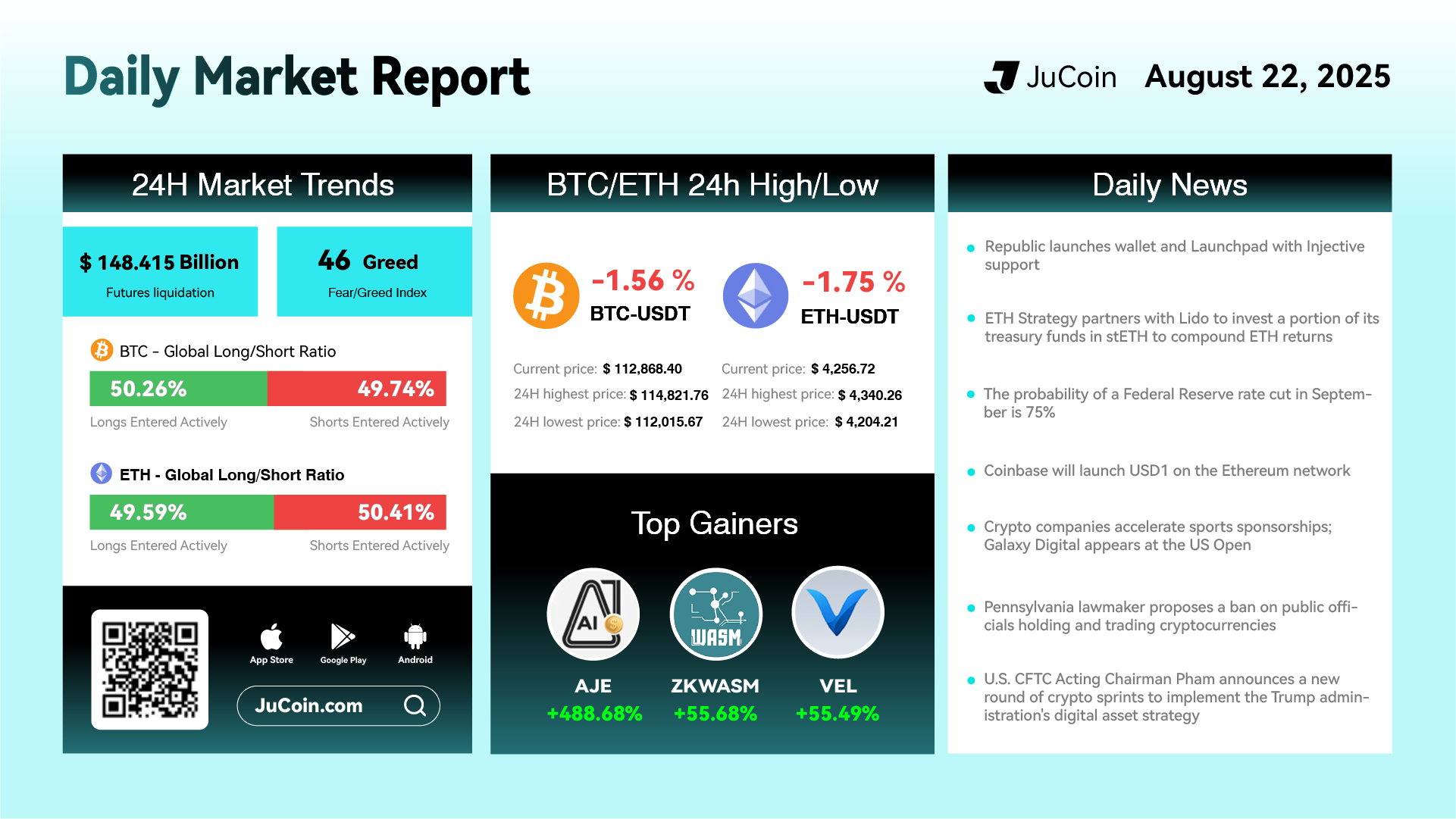

Daily Market Report — August 22, 2025

Crypto markets saw continued volatility over the past 24 hours. Bitcoin (BTC) slipped 1.56% to close at $112,868.40, after trading between $112,015.67 and $114,821.76. Ethereum (ETH) followed a similar downward trajectory, falling 1.75% to $4,256.72, with a high of $4,340.26 and a low of $4,204.21. Futures liquidation volume stood at $148.415 billion, reflecting the heightened leverage in the system. The Fear & Greed Index came in at 46 (Greed), indicating sentiment is still cautiously optimistic despite recent price dips. Long/short positioning was balanced, with BTC leaning slightly toward shorts (51.50% vs 48.50%) and ETH similarly skewed (50.77% vs 49.23%).

Altcoins once again provided bright spots in an otherwise muted session. AJE skyrocketed by +488.68%, leading the day’s rally on a surge of speculative flows. ZKWASM added +55.68%, highlighting ongoing interest in infrastructure-related tokens. Meanwhile, VEL gained +55.49%, extending its recent momentum and underscoring the appetite for mid-cap assets even as majors faltered.

On the corporate front, Republic launched a wallet and launchpad product with Injective support, expanding its ecosystem reach. At the same time, ETH Strategy partnered with Lido to invest part of its treasury in stETH, leveraging liquid staking to compound ETH returns.

Monetary policy remains in focus. The probability of a Federal Reserve rate cut in September is now estimated at 75%, setting expectations for fresh liquidity injections that could bolster risk assets.

In product expansion news, Coinbase announced it will launch USD1 stablecoin on the Ethereum network, reinforcing its role in stablecoin adoption. Separately, crypto firms continue to deepen mainstream visibility, with Galaxy Digital sponsoring the US Open, marking another milestone in sports partnerships.

From the policy arena, a Pennsylvania lawmaker introduced a proposal to ban public officials from holding or trading cryptocurrencies, stirring debate on potential conflicts of interest. Meanwhile, the US CFTC Acting Chairman Pham unveiled a new series of “crypto sprints” designed to accelerate the Trump administration’s digital asset strategy, signaling increased regulatory momentum.