Daily Market Report — July 22, 2025

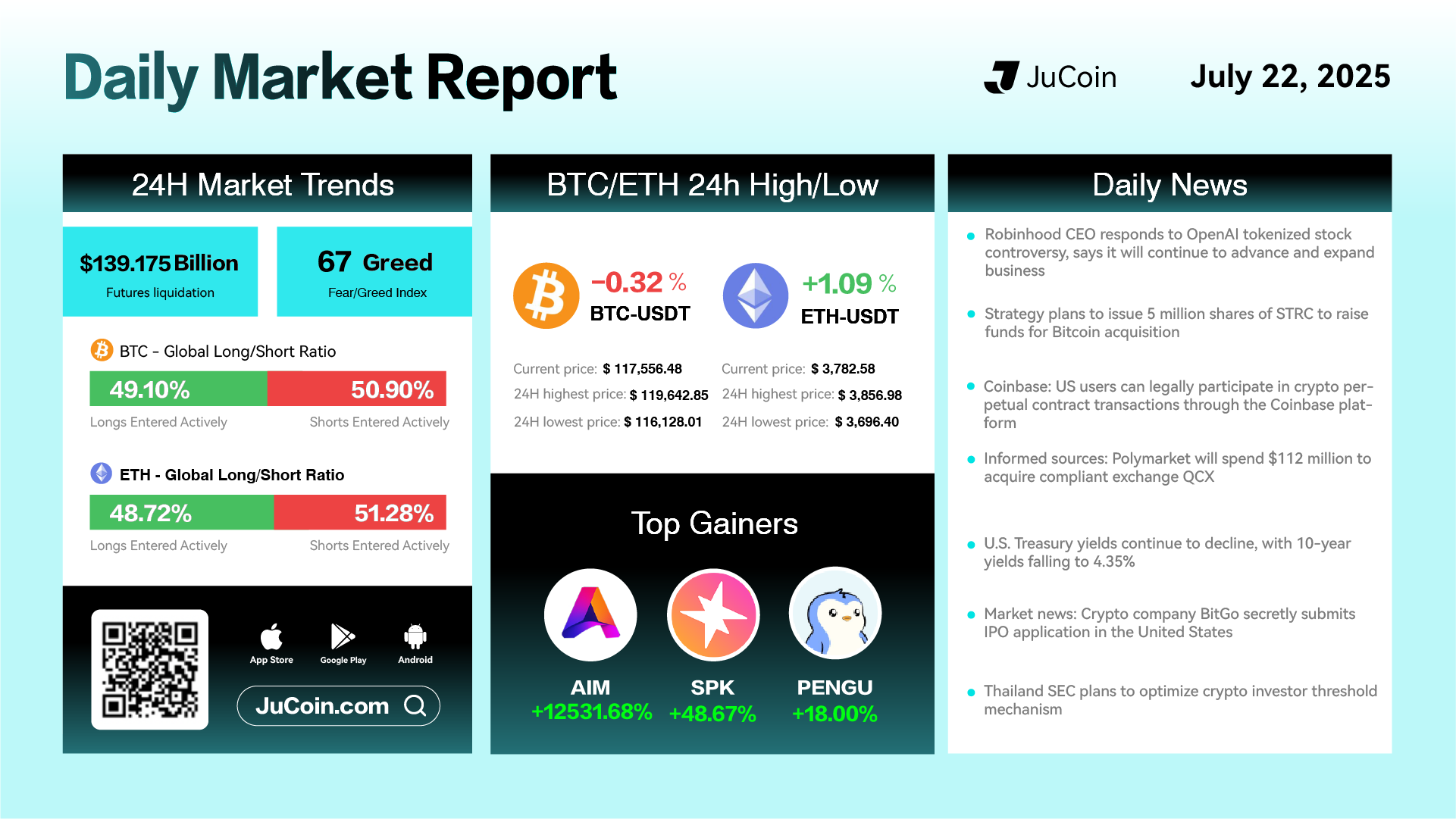

Bitcoin (BTC) edged down 0.32% over the past 24 hours to $117,556.48, trading between a high of $119,642.85 and a low of $116,128.01. Ethereum (ETH) rose 1.09% to $3,782.58, showing relative strength despite market uncertainty. The Fear & Greed Index remained at 67, indicating consistent investor confidence in the mid-greed zone. Futures liquidation volume reached $139.175 billion. Short positioning continued to dominate slightly, with BTC and ETH short ratios at 50.90% and 51.28%, respectively.

Top gainers were SKP (+47.18%), LABUBU (+24.45%), and PENGU (+20.93%), reflecting renewed activity in mid-cap and meme-adjacent tokens as traders sought short-term momentum plays.

In regulatory and institutional developments, Robinhood’s CEO responded to the recent OpenAI tokenized stock controversy, emphasizing the company’s commitment to innovation and market expansion. Meanwhile, Strategy announced plans to issue 5 million shares of STRC to fund further Bitcoin acquisitions.

Coinbase revealed that U.S. users can now legally access perpetual contract trading via its platform—an important milestone for derivatives accessibility. Separately, sources disclosed that Polymarket intends to acquire compliant exchange QCX in a $112 million deal, signaling growing interest in regulated prediction market infrastructure.

On the macro front, U.S. Treasury yields continued to drop, with the 10-year yield falling to 4.35%, potentially supporting risk assets like crypto. Reports also emerged that BitGo has quietly filed for an IPO in the United States, indicating sustained confidence in the crypto custody sector.

Finally, Thailand’s SEC is preparing to optimize its crypto investor threshold mechanism, a move expected to improve retail investor participation while enhancing regulatory clarity.