Daily Market Report — July 15, 2025

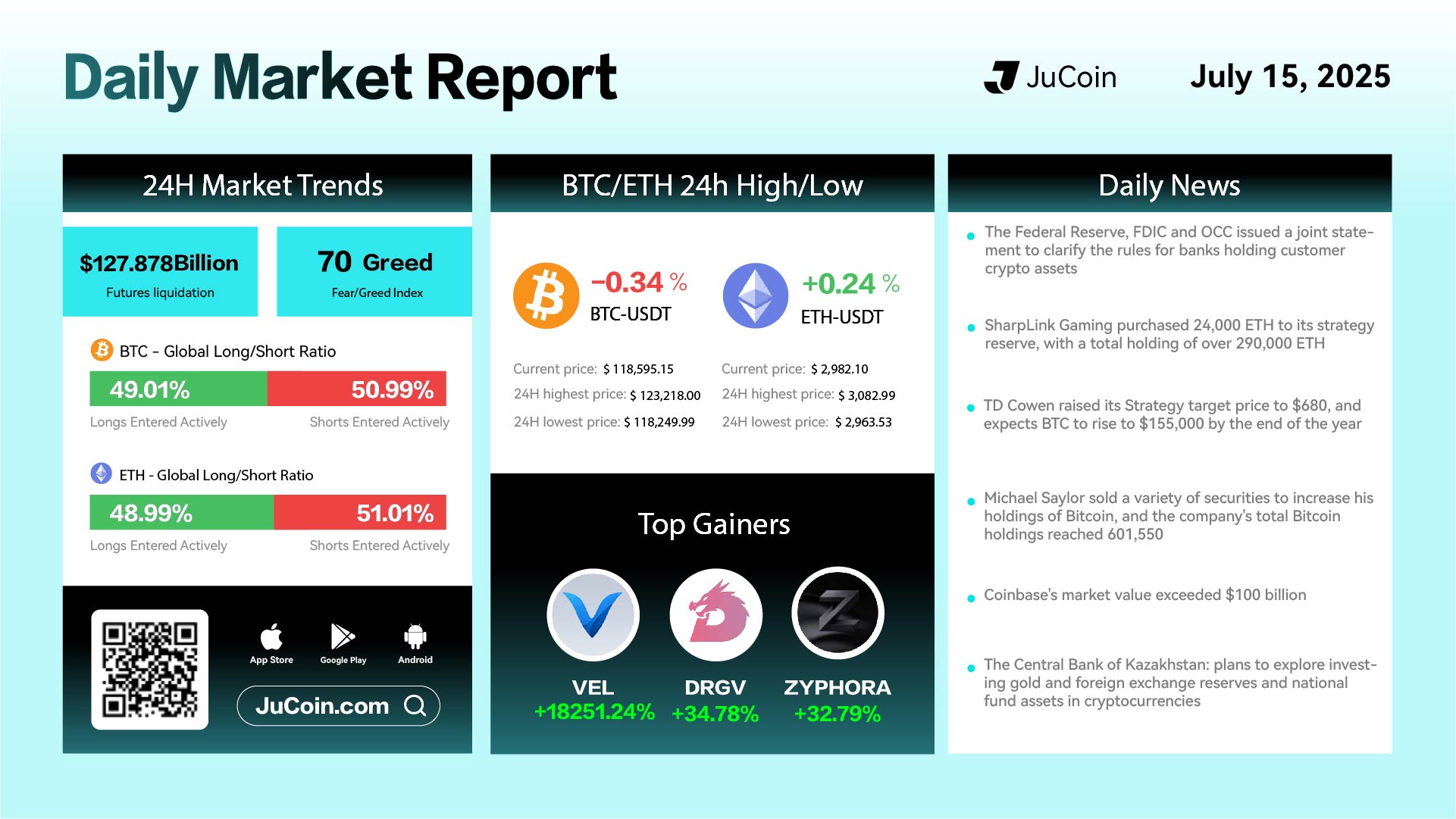

Bitcoin (BTC) slightly retraced by 0.34%, closing at $118,595.15 after briefly touching $123,218.00 earlier in the day. Ethereum (ETH) held its ground, gaining a modest 0.24% to end at $2,982.10, continuing its slow climb near the $3K level. The Fear & Greed Index remained firmly in the “Greed” zone at 70, while futures liquidation volume rose to $127.88 billion, indicating heightened trading volatility. Notably, both BTC and ETH saw short positions slightly outpacing longs, reflecting increased caution among traders.

The day’s top gainers were VEL (+18,251.24%), DRGV (+34.78%), and ZYPHORA (+32.79%).

VEL’s meteoric surge raised eyebrows across the market, signaling either a highly speculative rally or a low-liquidity breakout event.

In major institutional and regulatory news, the Federal Reserve, FDIC, and OCC jointly issued a statement to clarify rules for banks holding customer crypto assets, potentially opening new pathways for mainstream adoption through traditional banking channels.

SharpLink Gaming added another 24,000 ETH to its treasury, bringing its total holdings to over 290,000 ETH, continuing its aggressive accumulation strategy.

Wall Street firm TD Cowen raised its year-end BTC price target to $155,000, citing continued macro tailwinds and increasing institutional exposure as catalysts. The firm also bumped its own stock target price to $680.

Michael Saylor reportedly sold various securities to further boost MicroStrategy’s BTC reserves, which now stand at 601,550 BTC, solidifying its position as the largest corporate holder of Bitcoin.

Coinbase’s market valuation exceeded $100 billion, reaffirming investor confidence in crypto infrastructure amid global regulatory developments.

Finally, the Central Bank of Kazakhstan is exploring new strategies to allocate gold and foreign exchange reserves into crypto assets, another signal of growing sovereign-level interest in digital currencies.