Daily Market Report — June 18, 2025

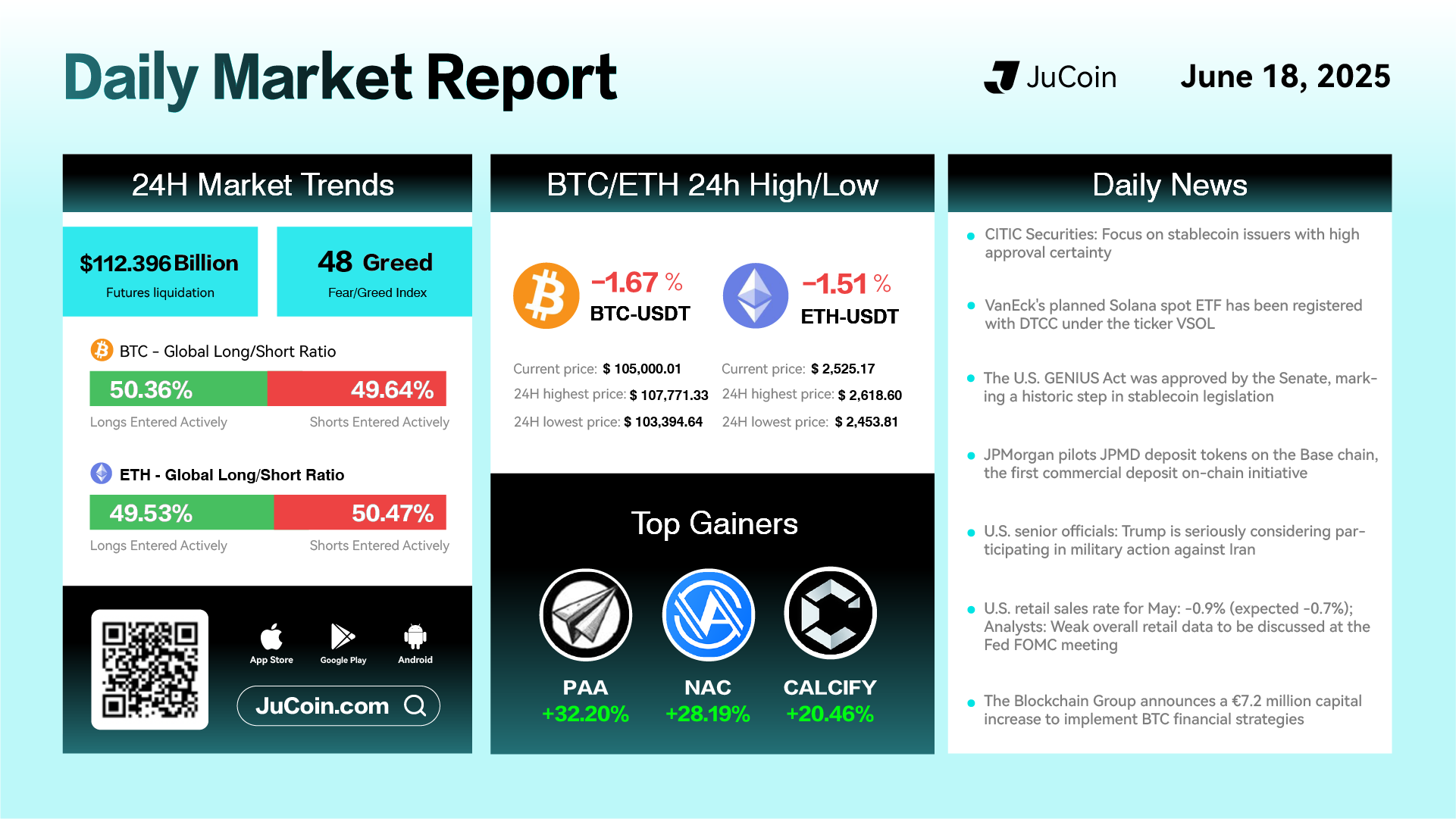

Bitcoin (BTC) price dropped 1.67% over the past 24 hours to $105,000.01, with a trading range between $103,394.64 and $107,771.33. Ethereum (ETH) also slipped 1.51% to $2,525.17. The market showed $112.4 billion in futures liquidations, while the Fear & Greed Index dipped to 48, indicating softening sentiment. Long/short ratios were mostly balanced, with BTC at 50.36% long and ETH slightly favoring shorts at 50.47%.

Top altcoin gainers included PAA with a 32.20% rise, NAC climbing 28.19%, and CALCIFY gaining 20.46%, showing selective upside in a largely red market.

On the policy front, stablecoin developments took center stage. The U.S. Senate passed the GENIUS Act, a landmark bill focused on stablecoin regulation, while CITIC Securities emphasized confidence in high-certainty stablecoin issuers. JPMorgan’s pilot of JPMD deposit tokens on the Base chain marked the first commercial on-chain deposit initiative by a major bank.

Meanwhile, VanEck’s Solana spot ETF was officially registered with DTCC under the ticker VSOL, expanding institutional access to the Solana ecosystem. On the macro front, U.S. retail sales fell 0.9% in May, worse than expected, which could weigh on the Fed’s tone in the upcoming FOMC meeting. In Europe, the Blockchain Group announced a €7.2 million capital increase to support BTC financial strategies.

Geopolitically, U.S. officials reported that former President Trump is seriously considering involvement in military operations against Iran, adding to market uncertainty.