1. Project Overview

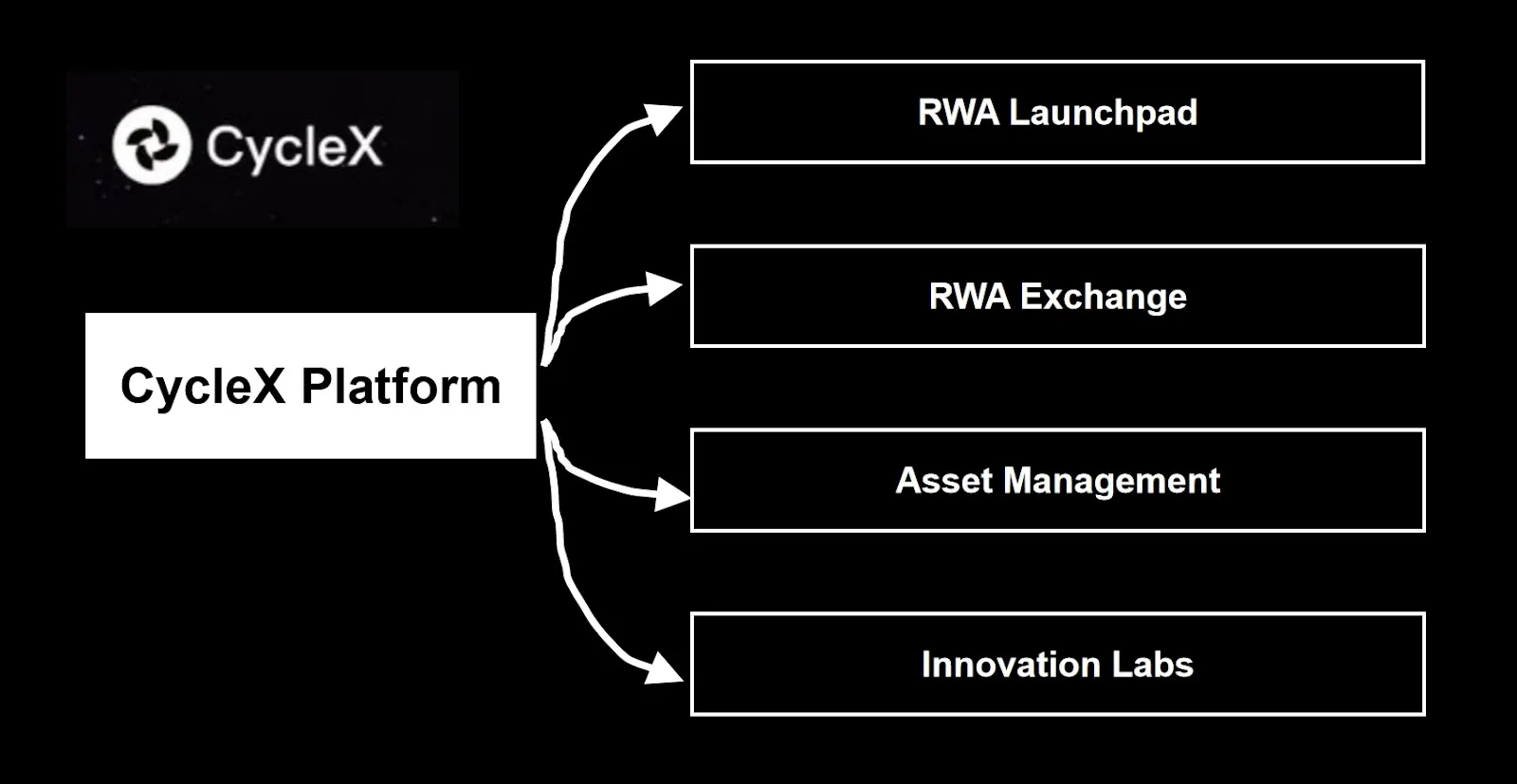

CycleX is an asset tokenization and trading platform focused on the RWA (Real World Assets) sector, aiming to realize the on-chain issuance and circulation of traditional financial assets. The project is committed to building a bridge connecting global financial assets with investors, reducing the barriers and costs of trading financial products across regions and jurisdictions. CycleX offers diversified product services including asset tokenization, fund issuance, and trade matching, promoting the digital circulation of real-world assets!

CycleX is a subsidiary of its parent company WhaleFlow Labs and has formed a strategic partnership with Hong Kong-listed Star Group (8297HK). It is registered in the United States and primarily provides financial services to the global market. CycleX has attracted attention and support from institutions including Chainlink, Plume Network, KuCoin Labs, and JuCoin.

2. Key Highlights

-

Diverse Asset Coverage: CycleX 2.0 supports various asset classes including stocks, bonds, real estate, artwork, and media assets, covering both on-chain and off-chain institutions to meet diversified investment needs. These include cash assets, credit assets, over-collateralized assets, cryptocurrencies, and alternative investments.

-

Innovative Fund Structure: Utilizing a diversified fund architecture compliant with the ERC1400 standard, combined with SPE and SPV to build RWApool, enabling multi-asset integration and risk classification management. Fund shares circulate on-chain as NFTs or ERC-20 tokens, enhancing liquidity and transparency.

-

On-Chain Native Asset Management: Through dedicated SPV pools integrated with Chainlink real-time data, combined with Cobo custody and independent audits, CycleX achieves high security and transparency in asset management, ensuring user fund safety and operational compliance.

-

Secondary Market Liquidity Release: Leveraging pricing mechanisms such as DEXs, CycleX 2.0 supports seamless secondary market trading of fund shares, enhancing token liquidity and investment flexibility, creating an efficient on-chain trading experience.

-

Compliance and Institution-Friendly Design: Providing multiple entry points for institutions and retail investors, combined with regulatory compliance frameworks and necessary licenses, ensuring fund safety and legality, empowering institutions to easily enter the on-chain financial market.

3. Team Background and Tokenomics

3.1 Team Background:

CycleX is launched by WhaleFlow Labs. The core founding team has a strong background in traditional finance and internet finance industries, with members having worked at global top 100 financial institutions and leading fintech companies, possessing professional experience in investment banking, securities, and auditing. The three co-founders are responsible for different business areas:

-

Rain: Co-founder, responsible for product innovation and ecosystem expansion, focusing on platform application scenarios and external partnerships.

-

Andy: Co-founder, responsible for asset management, asset tokenization, and institutional client services, focusing on fund management and financial product design.

-

Peper: Co-founder, responsible for SME marketing, retail expansion, and data growth services, focusing on retail users and growth strategies.

3.2 Tokenomics:

The native token issued by the CycleX platform is Whaleflow Coin (WFC), which has not yet been launched. WFC mainly serves the following functions:

-

Platform utility token: WFC can be used to pay for platform service fees, asset staking, and participate in DAO governance, granting users project governance rights and operational participation rights.

-

Token-equity linkage mechanism: WFC holders can not only profit through circulation in the crypto market but also gain revenue linkage with underlying real-world assets (such as Nasdaq market assets), bridging traditional financial markets and crypto markets, with potential value akin to “Token + Equity”.

-

Four business empowerment: WFC will support the collaborative development of CycleX’s four major business units — CycleX asset issuance, FlowX asset trading, asset management, and innovative business platforms — serving as the core value carrier of the platform ecosystem growth.

4. Partnerships and Compliance Progress

4.1 Partnership Progress:

The parent company behind CycleX, WhaleFlow Labs, collaborates with Hong Kong-listed Star Group, serving as an important bridge for traditional financial resource channels. This synergy of on-chain and off-chain, crypto and traditional finance is a prominent advantage in the current RWA platform development. CycleX has gained attention and support from multiple key ecosystem players, including Chainlink providing oracle services to ensure transparency and reliability of tokenized asset prices or statuses; Plume Network, a Layer 1 blockchain focused on RWA compliance, offering underlying infrastructure support for asset tokenization; KuCoin Labs, which has included CycleX in its accelerator program to provide resource matching, potential financing guidance, and exchange relationship building.

Meanwhile, on July 16th, CycleX announced a strategic partnership with xStocks, a global leading securities asset tokenization platform. xStocks has strong industry recognition and credibility in the RWA sector due to its diversified traditional financial assets coverage and strict compliance standards. Following that, on July 17th, CycleX further announced cooperation with leading trading platform JuCoin, planning to leverage JuCoin’s ecosystem resources and technical network to promote more traditional asset on-chain integration and liquidity expansion.

4.2 Compliance Progress:

CycleX’s compliance system is primarily constructed through its parent company WhaleFlow Labs and its subsidiaries, covering multiple jurisdictions including the United States and the British Virgin Islands, specifically including:

-

WhaleFlow Group Usltd: Registered in the United States, holding a Money Services Business (MSB) license (Registration No.: 31000243370255) and a U.S. Securities and Exchange Commission (SEC) investment advisor license. This entity is responsible for overall operation and management of the CycleX platform, legally providing asset tokenization and investment advisory services.

-

WhaleFlow Group Ltd: Registered in the British Virgin Islands (BVI), regulated by the Financial Services Commission (FSC) of BVI (Registration No.: 2161278), mainly responsible for tokenized fund issuance and asset management on the platform. All investors are required to pass KYC and AML (anti-money laundering) checks and are limited to qualified investors.

Additionally, CycleX establishes special purpose entities or vehicles to build asset pools for isolating and managing cash, credit assets (bonds, securities), crypto assets, and alternative investments (such as real estate, artwork), with regulated custodians overseeing fund custody to further safeguard investor funds.

5. Business Data

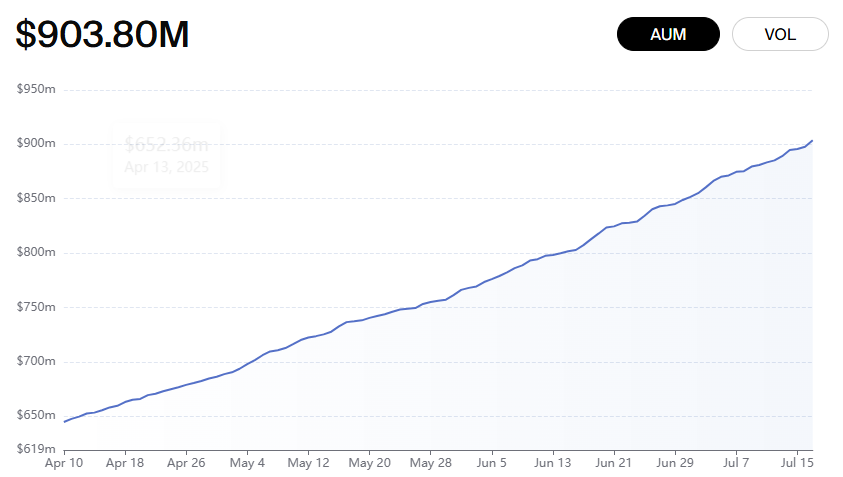

CycleX currently demonstrates a relatively steady growth trend in business data. The platform’s cumulative trading volume (VOL) reaches approximately $283 million, daily active users (DAU) exceed 50,000, and total assets under management (AUM) are around $904 million. In terms of user scale and capital size, CycleX has ranked among the upper-middle tier of emerging RWA tokenization platforms.

In terms of product structure, CycleX has launched various tokenized products linked to real-world assets, mainly covering money market funds, alternative investments, corporate bonds, and repurchase agreements. All assets adopt over-collateralization design and have been audit-verified. Among them, money market funds manage $50 million, alternative investments and corporate bonds manage $14 million and $10 million respectively, and repurchase agreements stand at $2 million, reflecting a diversified overall asset structure.

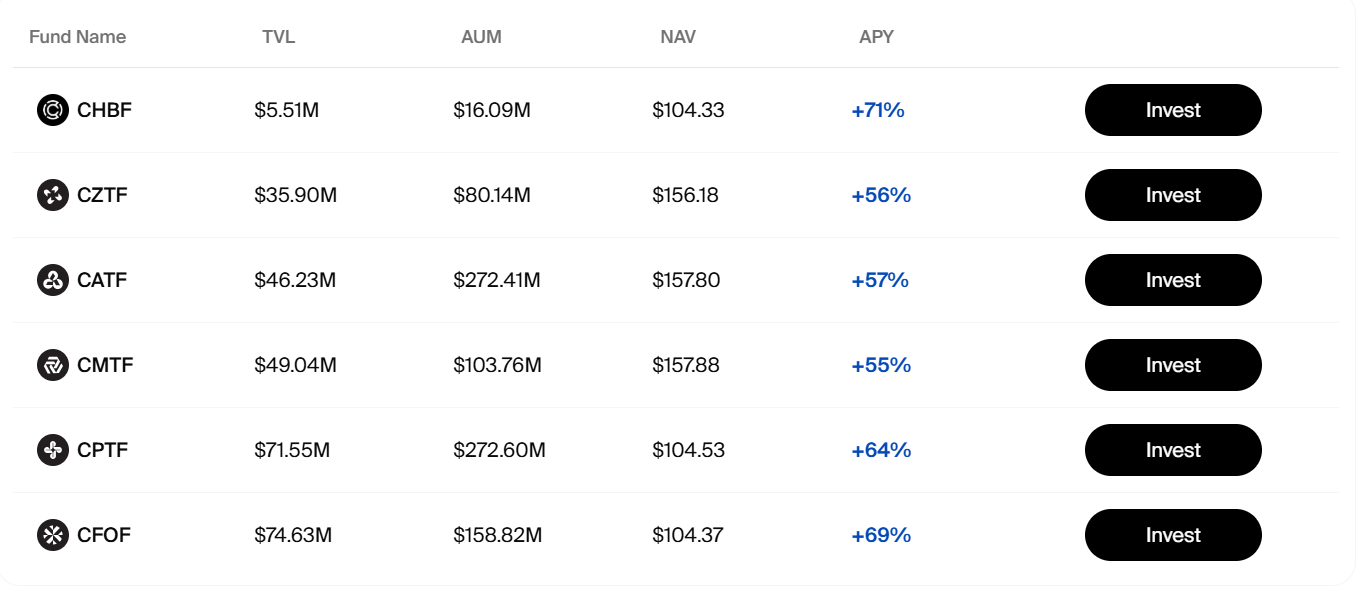

Currently, the platform’s six core tokenized fund products manage sizeable AUMs ranging from tens of millions to hundreds of millions of dollars. Among these, the CATF and CPTF funds have both surpassed $270 million in AUM, becoming the platform’s main capital-bearing products. Other funds like CFOF and CZTF have AUMs between $80 million and $150 million. The annualized returns of these funds remain strong, ranging from 55% to 71%, exhibiting strong yield appeal.

6. Investment Logic

6.1 Sector Logic: RWA Asset Tokenization Possesses Medium- to Long-Term Growth Certainty

The RWA sector has entered a phase of substantive application and scale expansion. It is expected that over the next 3-5 years, a large volume of traditional financial assets will realize on-chain issuance and trading. As a key infrastructure connecting on-chain and off-chain markets, RWA platforms are gradually becoming the preferred gateway for institutions entering the crypto market. CycleX focuses on fund-type RWA products and secondary market trading system construction, combining compliance and asset-side deployment, covering the full process from asset issuance to circulation, and has the potential to rapidly scale in line with industry growth.

6.2 Project Advantages: Product Implementation and Institutional Endorsement Build Competitive Moats

CycleX leverages traditional financial resources from WhaleFlow Labs and Star Group, combined with crypto ecosystem partners such as Chainlink, Plume Network, and JuCoin, forming industry synergies bridging on-chain and off-chain, crypto and traditional finance. The project’s multiple launched RWA fund products cover cash, bonds, and alternative assets, validating the commercial viability of asset tokenization and secondary market trading. With innovative advantages in fund structure design, asset transparency, and liquidity support, CycleX is expected to establish a standardized RWA product matrix, forming a long-term competitive moat.

6.3 Investment Expectations: A Potential Quality Early-Stage Target, Token Issuance Worth Close Attention

To date, CycleX has not yet launched its platform token and remains in an early stage without token value released. Coupling the project’s fund product dividend mechanism with its trading platform nature, future issuance of platform tokens or fund-related asset tokens is expected to grant holders core rights such as fee discounts, governance participation, and profit dividends, unlocking value increments driven by platform scale growth!

7. Conclusion

As an emerging RWA infrastructure platform, CycleX leverages strong traditional financial cooperative resources and crypto industry institutional support, achieving initial implementation in asset tokenization fund issuance and on-chain trading system construction. With its unique model and multi-asset compliance management system, CycleX is gradually building product and technical barriers in the RWA sector, with a clear growth path!

From a data perspective, CycleX manages total assets exceeding $900 million, and core fund products maintain annualized yields between 55% and 70%, demonstrating stability and attractiveness in product design and asset operations. Considering the sustained trend toward RWA asset tokenization and CycleX’s early stage in tokenomics value realization, the project holds certain medium- to long-term allocation value. It is recommended to focus closely on upcoming token issuance milestones and asset scale expansion progress, viewing CycleX as a high-potential early-stage quality target in the RWA sector, suitable for medium- to long-term positioning!