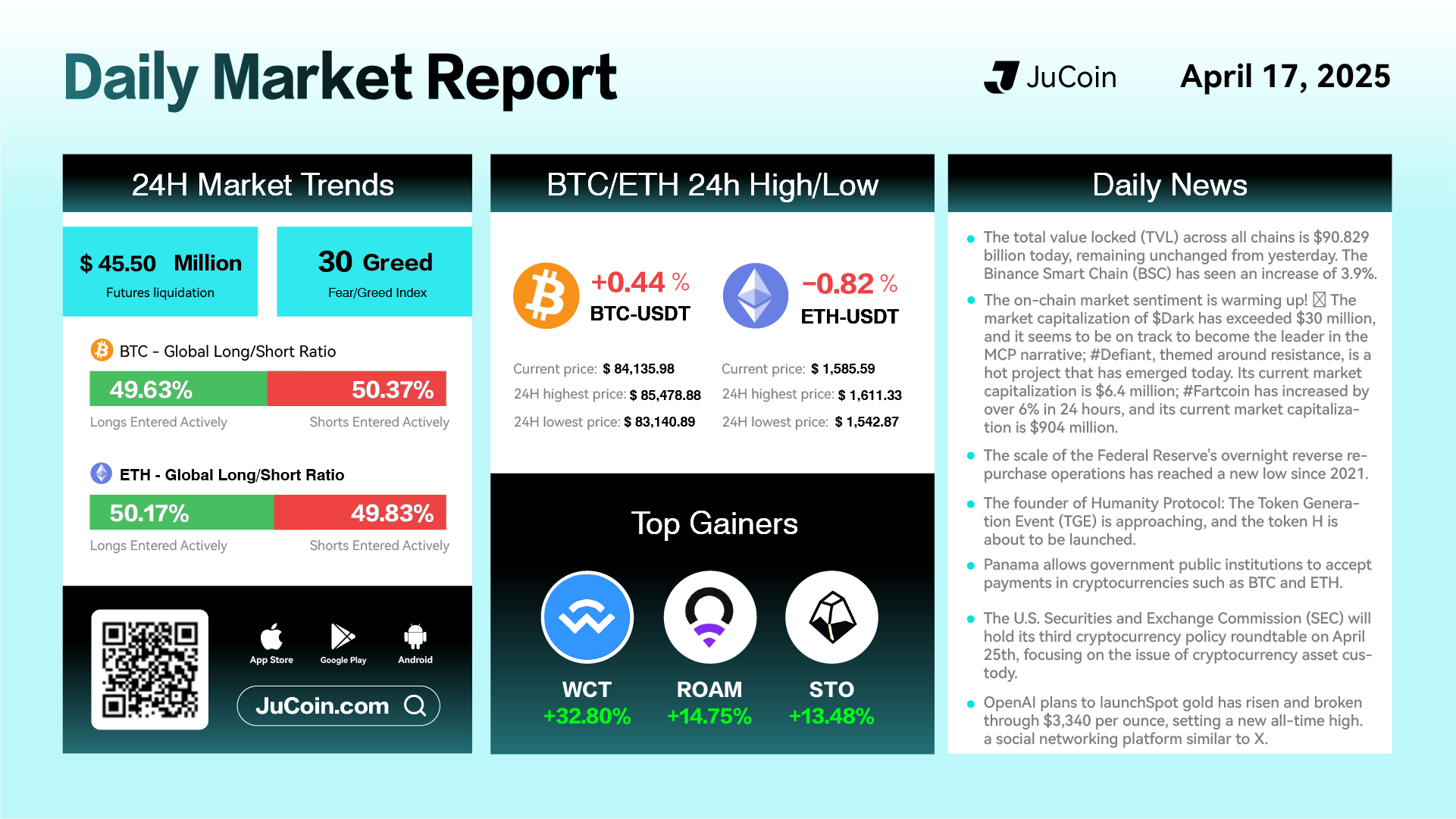

Daily Market Report – April 17, 2025

The cryptocurrency market showed slight movements over the past 24 hours, with Bitcoin (BTC) rising 0.44% to $84,135.98, while Ethereum (ETH) decreased by 0.82% to $1,585.59. BTC reached a high of $85,478.88 and a low of $83,140.89, while ETH peaked at $1,611.33 and bottomed out at $1,542.87. Despite the slight pullback in Ethereum, the overall market sentiment remains cautious, with the Fear & Greed Index at 30, indicating a sentiment of “Fear.” Futures liquidations increased to $45.50 million, suggesting increased volatility during the day.

The global long/short ratio shows a nearly even split, with 49.63% of Bitcoin trades being longs and 50.37% shorts, and Ethereum showing a similar trend with 50.17% long and 49.83% short positions, indicating a balanced market stance.

On the altcoin front, WCT led the top gainers with a 32.80% increase, followed by ROAM at 14.75%, and STO at 13.48%, showcasing strong performance in selected tokens despite the broader pullback in Bitcoin and Ethereum prices.

In terms of market activity, the total value locked (TVL) across all chains remained steady at $90.829 billion, with a notable 3.9% increase in the Binance Smart Chain (BSC). The on-chain market sentiment remains bullish, with DARK exceeding a market cap of $30 million, while other tokens like Defiant and Fartcoin also saw significant growth in the last 24 hours.

In news, the U.S. Federal Reserve’s overnight reverse repurchase operations reached a new low, while gold set a new record, rising above $3,340 per ounce. Additionally, Panama has taken a forward-looking step by allowing government entities to accept cryptocurrency payments, including Bitcoin and Ethereum. The SEC’s upcoming cryptocurrency policy roundtable on April 25th will focus on asset custody issues, potentially influencing future regulations.

Cryptocurrency & Web3 Highlights

The Solana ecosystem continues to gain momentum, with the PAWS Token Generation Event (TGE) held on April 16, marking a significant milestone in its evolution from Telegram’s #1 Mini App to a fully decentralized brand. This move is expected to drive unprecedented retail adoption, leveraging Solana’s high-performance infrastructure to enhance scalability and user engagement. In addition, the GMCI Solana Select Ecosystem index, launched recently, tracks leading protocols and projects built on Solana, showcasing innovative initiatives that harness the blockchain’s capabilities to revolutionize decentralized applications.

On the Web3 front, Push Protocol is developing Push Chain, a Layer 1 blockchain focused on chain abstraction, aiming to build Web3 applications accessible across different networks. This initiative seeks to enhance interoperability and user experience in the decentralized web.

Furthermore, World3, a Microsoft for Startups-backed project, is launching an airdrop for its utility token, WAI, in the first half of 2025. The project envisions creating ‘autonomous worlds’ where AI agents can manage themselves, collaborate seamlessly, and enable creators, businesses, and users to unlock unprecedented potential.

International Macroeconomic & Financial Highlights

U.S. consumer sentiment has declined sharply, with recent surveys indicating that 72% of households are increasingly concerned about a potential recession. This growing unease is reflected in consumer behavior, as many anticipate higher prices and adjust their spending accordingly. In response to these economic uncertainties, Federal Reserve Chair Jerome Powell stated that the Fed will maintain current interest rates while awaiting greater clarity on the economic impacts of tariffs. He acknowledged signs of slower U.S. economic growth and modest consumer spending, noting that the consequences of tariffs and associated policies are still evolving and might be more substantial than previously expected.

U.S. Equity Market Recap

On April 16, U.S. stock markets experienced significant declines amid escalating trade tensions with China. The S&P 500 dropped 2.2% to 5,275.70, the Dow Jones Industrial Average fell 1.7% to 39,669.39, and the Nasdaq Composite decreased 3.1% to 16,307.16. The Russell 2000 index of smaller companies declined 1% to 1,863.48.

The market downturn was exacerbated by the Federal Reserve’s warning that President Trump’s tariffs could lower economic growth and increase inflation more than previously anticipated. Nvidia’s stock plummeted after the company projected billions in lost revenue due to new U.S. export restrictions on AI chips to China. United Airlines issued dual financial forecasts, one assuming a recession and the other not, highlighting the uncertainty in economic forecasting.