Key Takeaways

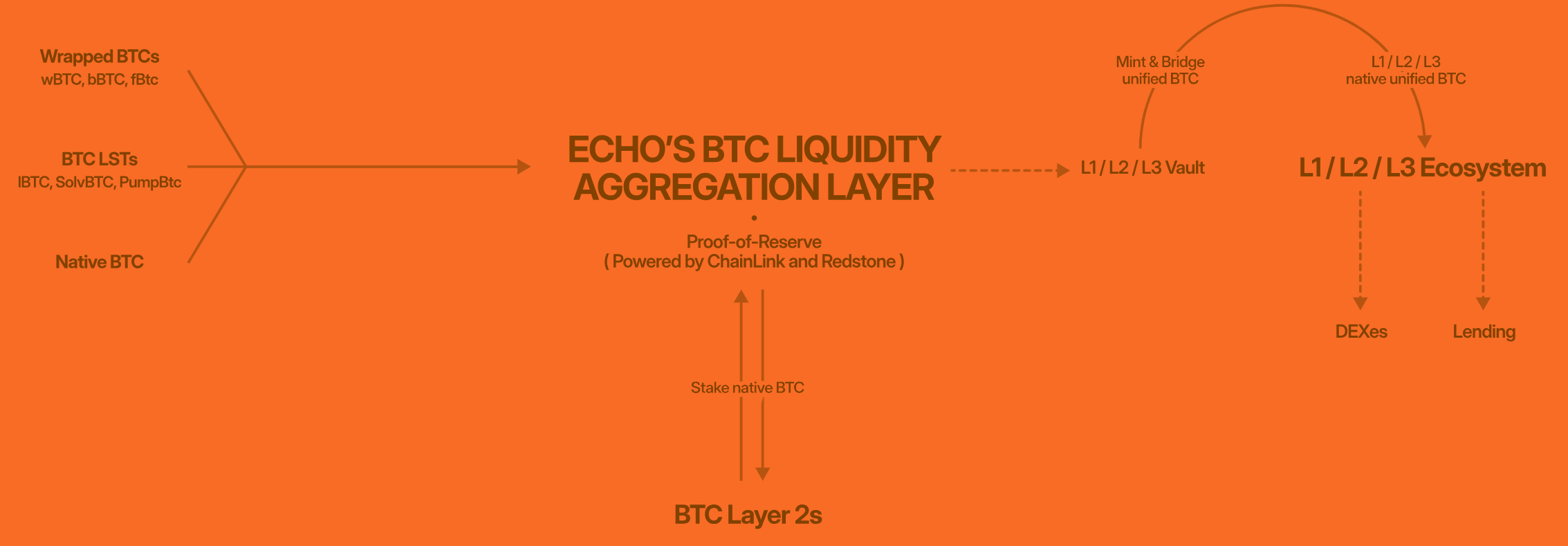

- Echo Protocol is a unified BTC liquidity aggregation and yield optimization layer bridging native Bitcoin, LSTs, and wrapped BTC across DeFi and multiple chains.

- It provides secure, transparent Proof-of-Reserve-backed BTC aggregation, mitigating depegging risks and ensuring all assets are always 1:1 collateralized.

- Echo enables users to maximize BTC yield through innovative products like leveraged liquid staking (eMSTR), lending/borrowing, and CeDeFi delta-neutral strategies.

- Seamless cross-chain support unlocks BTC utility for MoveVM, EVM, and SVM-based ecosystems, boosting DeFi participation and unlocking new financial primitives for Bitcoin holders.

- The ECHO token powers governance, value accrual, and rewards, underpinning decentralized control and sustainable protocol growth.

Echo Protocol (ECHO) is leading the charge to unify BTC liquidity, maximize yield, and connect Bitcoin with the world of DeFi. By aggregating BTC assets, securing them with Proof-of-Reserve, and delivering seamless cross-chain integration, Echo unlocks unprecedented utility and opportunity for all BTC holders and DeFi builders. This Crypto Deep Dives article discusses how Echo Protocol unifies and optimizes BTC liquidity, yield, and utility across DeFi, providing a transparent, secure infrastructure for the next generation of Bitcoin finance.

Echo Protocol: Powering Unified BTC Liquidity, Yield, and DeFi Integration

Echo Protocol is building the essential liquidity and aggregation layer for Bitcoin, bringing together native BTC, Bitcoin Liquid Staking Tokens (LSTs), and wrapped BTC assets from multiple chains into a single, unified asset that’s fully DeFi-ready. By solving fragmentation and making Bitcoin capital efficient, Echo is unlocking a new era for BTC holders: easy yield, seamless DeFi participation, and cross-chain composability.

Challenges in Bitcoin Liquidity and DeFi Integration

- Fragmented Standards: The proliferation of native BTC, LSTs (such as LBTC, PumpBTC, SolvBTC), and wrapped tokens (like wBTC, fBTC) across chains creates integration headaches, liquidity silos, and price inefficiency.

- Lack of Trustless Bridges: Most BTC bridges are either custodial or rely on federated models, exposing users to security and trust risks. BitVM-based solutions promise trust-minimized bridging but are not yet fully live.

- BTC LST Transparency & Depegging: Many BTC LSTs lack robust Proof-of-Reserve standards. Without clear 1:1 backing, depegging risks can cascade through DeFi, especially when these tokens are used as collateral.

- DeFi Productivity & Slippage: Integration is complex, and new BTC assets often lack liquidity, increasing slippage and limiting utility across DEXs and lending platforms.

Echo Protocol directly addresses these pain points with a unified, secure, and productive BTC aggregation platform, designed for both retail and institutional users.

Echo’s Unified BTC Liquidity & Aggregation Layer

Echo enables users to deposit a wide variety of BTC standards, including native BTC, LSTs, and wrapped BTC, into its Vaults. The protocol mints Echo’s unified BTC on supported destination chains (such as Aptos, Movement, Morph, and Hemi), ready for direct DeFi use. Every accepted asset is subject to:

- Rigorous Proof-of-Reserve (PoR): Each asset undergoes real-time, transparent verification with partners like Chainlink and Redstone, ensuring 1:1 backing and on-chain/off-chain monitoring.

- Strict Due Diligence: Echo’s team vets every BTC standard for safety, liquidity, and integrity, mitigating risks for all participants.

With this approach, Echo’s unified BTC delivers strong price efficiency, prevents depegging, and brings immediate, productive liquidity to any supported DeFi protocol.

BTC Yield Optimization: Echo’s DeFi Product Suite

Echo’s Yield Layer enables BTC holders to maximize returns through several yield-enhancing products:

- Echo Strategy: Automated, cross-protocol yield optimization for BTC—combining leveraged liquid staking, lending, and borrowing strategies tailored to user risk profiles.

- eMSTR: The first on-chain leveraged BTC strategy that avoids liquidation risk, using convertible notes to offer 2.5x+ exposure to Bitcoin’s upside while minimizing downside risk.

- CeDeFi Integration: By partnering with Ceffu for secure custody, Echo offers delta-neutral strategies, stable returns, and additional on-chain yield—all with institutional-grade asset protection.

Users stake their unified BTC across supported strategies, earning both protocol rewards and ecosystem incentives, while maintaining flexibility and security.

Liquidity, Price Efficiency, and DeFi Integration

Echo actively ensures deep liquidity for its unified BTC across multiple DEXs, minimizing slippage and maximizing utility. Through arbitrage and direct protocol partnerships, Echo’s unified BTC is always productive and price-efficient, regardless of the destination ecosystem (Aptos, Movement, Morph, Hemi, etc.).

How Echo Protocol Works: End-to-End BTC DeFi Workflow

- BTC Staking: Users stake native BTC on L2s (e.g., Babylon), minting BTC LSTs (like LBTC or PumpBTC).

- Vault Deposit: BTC LSTs or wrapped BTC are deposited into Echo’s Vault on the target chain.

- Unified BTC Minting: Echo mints unified BTC (e.g., aBTC, mBTC, mphBTC) for use on the selected chain—ready for DeFi, lending, or farming.

- Yield Layer: Stake unified BTC in Echo’s yield layer (Echo Strategy, eMSTR, Echo Lending) for extra DeFi rewards and Echo points.

- Additional Rewards: Users can compound yield by staking resulting APT (on Aptos) or other ecosystem tokens, maximizing returns through the complete workflow.

All steps are designed for transparency, security, and optimal yield.

Tokenomics: The ECHO Token Economy

- Staking & Value Accrual: $ECHO stakers receive $twECHO, a time-weighted, value-accruing token representing locked ECHO. Longer locks yield higher accruals.

- Governance: $vetwECHO enables on-chain governance, proposal voting, and gauge-based emission control—empowering the community to steer protocol rewards and direction.

- Echo Fuel: A liquidity incentive program for $aBTC pools, offering reward multipliers for LPs based on the size of LP position vs $twECHO holdings.

- Penalty and Redistribution: Early LP withdrawals incur penalties, redistributing forfeited rewards to committed stakers, aligning incentives and discouraging short-term speculation.

Key Advantages and Stakeholder Value

- For Bitcoin L2s: Expanded utility and cross-chain DeFi opportunities for LSTs and BTC-native assets.

- For BTC Holders: Access to combined yield streams—L2/LST rewards, DeFi incentives, and on-chain points—with security and flexibility.

- For DeFi Protocols: Instant access to unified, yield-bearing BTC primitives, driving protocol growth and liquidity.

- For Move/EVM/SVM Ecosystems: A new bridge for net liquidity, onboarding millions in BTC into productive DeFi use cases.

Unleashing the True Power of Bitcoin in DeFi

Echo Protocol is leading the charge to unify BTC liquidity, maximize yield, and connect Bitcoin with the world of DeFi. By aggregating BTC assets, securing them with Proof-of-Reserve, and delivering seamless cross-chain integration, Echo unlocks unprecedented utility and opportunity for all BTC holders and DeFi builders. As Bitcoin continues to take center stage in the digital asset economy, Echo’s unified approach ensures that BTC’s next growth wave will be capital efficient, productive, and accessible to every corner of Web3.