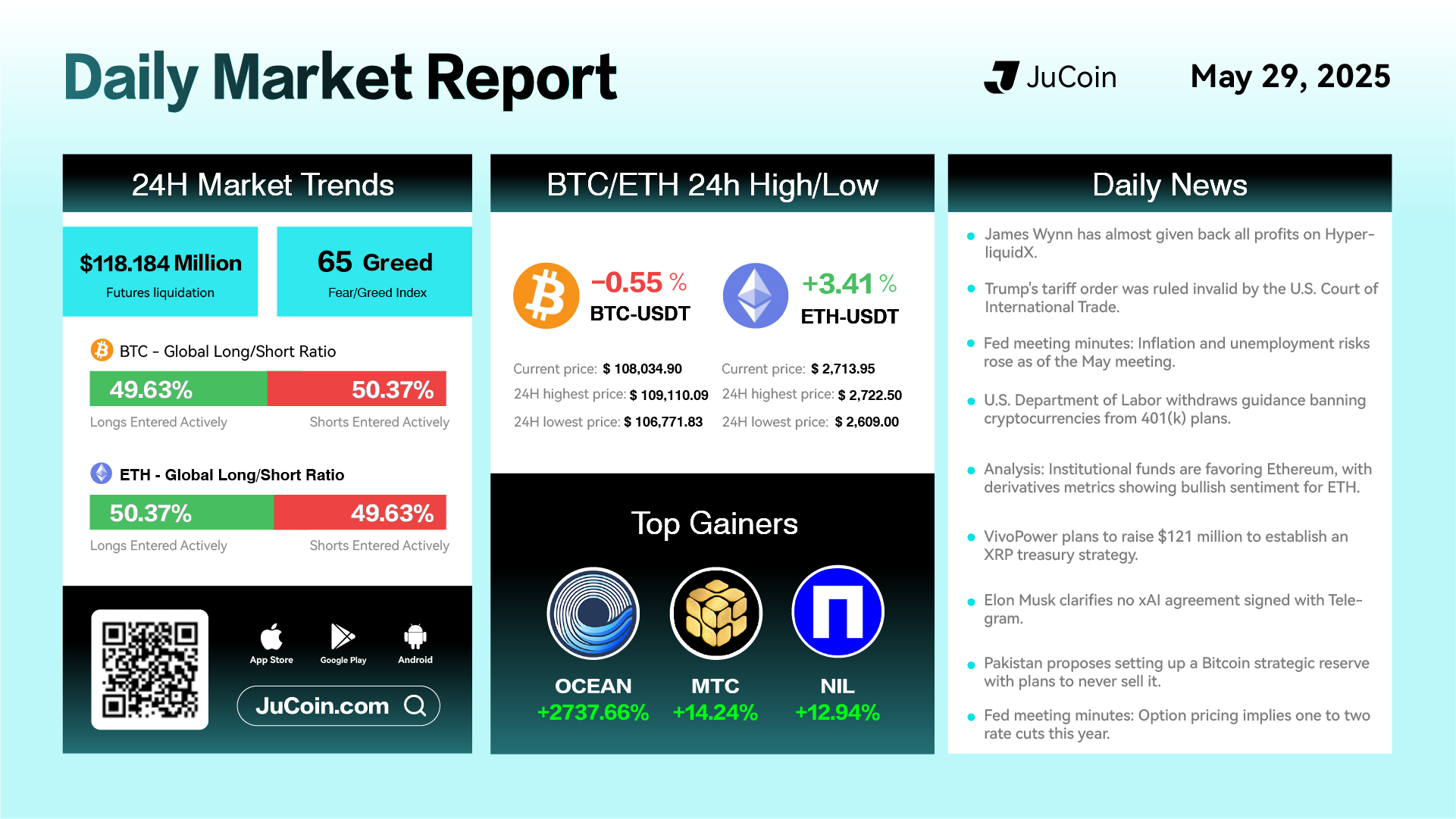

Daily Market Report – May 29, 2025

Markets diverged on Wednesday as Ethereum (ETH) surged 3.41% to $2,713.95, outperforming Bitcoin (BTC), which slipped 0.55% to $108,034.90. Futures liquidation totaled $118.18 million, and the Fear & Greed Index dipped slightly to 65, still signaling bullish sentiment. Derivatives positioning continues to show equilibrium, with both BTC and ETH long/short ratios nearly even, indicating traders remain cautious amid recent macro uncertainty.

Top gainers included OCEAN/USDT, which skyrocketed +2,737.66%, MTC/USDT up +14.24%, and NIL/USDT rising +12.94%, with lower-cap tokens once again drawing speculative inflows.

On the macro front, the U.S. Court of International Trade ruled that Trump’s tariff order was invalid, adding to regulatory shake-ups. Meanwhile, Fed meeting minutes revealed rising concerns around inflation and unemployment, though option pricing suggests 1–2 rate cuts may still be on the table for 2025.

Crypto policy also saw a positive turn: the U.S. Department of Labor officially withdrew its previous guidance restricting cryptocurrency exposure in 401(k) retirement plans. In the institutional space, new analysis highlighted an increase in ETH-focused derivative activity, showing funds may be pivoting from Bitcoin to Ethereum amid broader optimism.

Elsewhere, VivoPower announced a $121 million XRP treasury initiative, while Pakistan floated a Bitcoin strategic reserve plan with a long-term holding mandate. Elon Musk publicly denied rumors of a formal xAI partnership with Telegram, and James Wynn reportedly gave back most of his profits on HyperliquidX, underscoring the volatility in altcoin and DeFi markets.