Key Takeaways

- Stablecoins, tokenization, and privacy infrastructure dominated discussions, while NFTs received little attention.

- Robinhood and Arbitrum captured significant mindshare with new announcements; Polygon’s brand saw renewed momentum with Katana.

- Ethereum DeFi is seen as stronger than ever, with projects like Aave, Ethena, and Etherfi leading adoption.

- Sentiment towards L2s improved following the Robinhood announcement, and attention shifted towards bringing value back to ETH as an asset.

- There is a growing institutional focus on compliant DeFi, seen as both necessary and challenging for the ecosystem’s evolution.

- Privacy is being recognized as a fundamental prerequisite for institutional adoption, not just a technical feature.

- Mobile-first crypto applications are rapidly gaining traction, reflecting a shift towards user-friendly, consumer-facing design.

- Tokenization of stocks and commodities is drawing real-world interest, though true integration remains a work in progress.

- Vitalik Buterin called for a philosophical return to the first principles of decentralization, freedom, and resilience.

This Crypto Deep Dives article about ETHCC 2025 discusses the major trends, signals, and insights from the 2025 Ethereum Community Conference (ETHCC) in Cannes, including key narratives around stablecoins, institutional DeFi, privacy, tokenization, mobile-first crypto applications, and Vitalik Buterin’s vision for the future of Ethereum and blockchain.

Conference Overview: Energy and Focus in Cannes

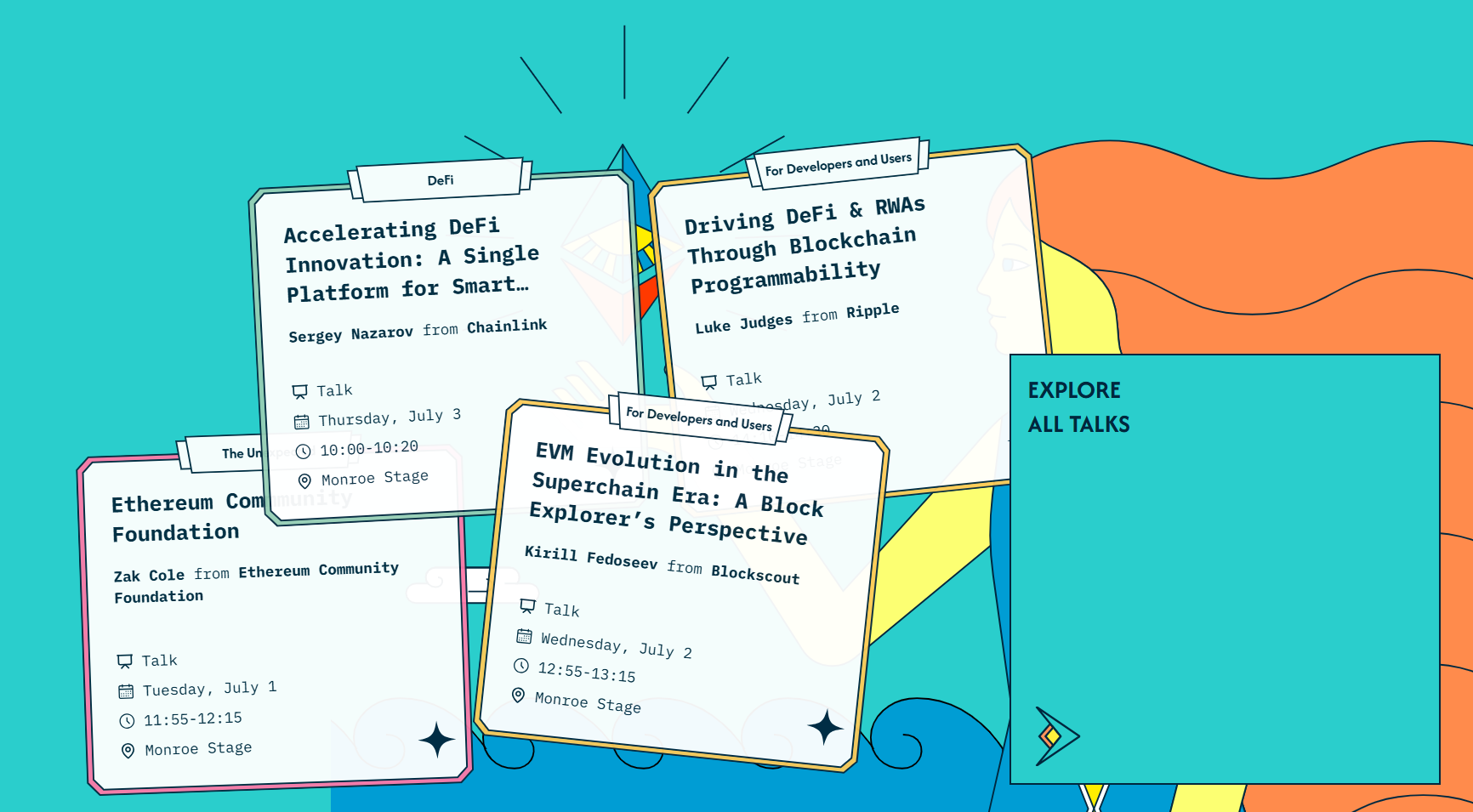

The 2025 Ethereum Community Conference (ETHCC) brought together thousands of developers, founders, investors, and institutional participants, proving that even the Mediterranean heat could not dampen the crypto industry’s enthusiasm for meaningful progress.

Compared to previous years, there was a distinct shift in tone: people were relaxed but focused, with an increased sense of maturity and urgency across the ecosystem. Major themes included the rise of stablecoins, renewed excitement around tokenization, and a serious institutional push for privacy and compliance.

DeFi & Institutionalization: Stronger, Smarter, More Compliant

Ethereum DeFi is, by many accounts, in its strongest position since inception. Projects like Aave, Ethena, and Etherfi are capturing real adoption, and sentiment around Layer 2 solutions has improved noticeably, especially in the wake of Robinhood’s big Arbitrum announcement. There’s also a clear pivot towards institutional-grade and compliant DeFi, with many considering it a “necessary evil” to unlock the next wave of capital and users.

Significantly, there was little talk of “ETH to $10K” price targets, which in itself might be considered bullish, suggesting a more grounded and product-driven mindset among builders and investors alike.

Stablecoins & Tokenization: The Next Frontier

If there was a single narrative that overshadowed all others at ETHCC, it was stablecoins, mentioned constantly in both formal sessions and corridor conversations. Closely related, tokenization markets (especially tokenized stocks and commodities) were another recurring theme. Robinhood’s tokenized stocks and BackedFi’s xStocks launch grabbed headlines, but participants agreed the true value of tokenization would come from deeper integration into lending, collateral, and yield strategies, rather than simple trading.

Commodities, including digital gold and even uranium, were surprisingly popular topics. The consensus is clear: start with familiar assets, prove the on-chain pipeline, and gradually move to markets where blockchain’s 24/7 settlement and fractional ownership offer a true competitive edge.

To participate in the growing crypto ecosystem, users can buy, sell, or manage assets directly on JuCoin.

Mobile-First Crypto: User Experience Front and Center

A notable takeaway was the mobile-first approach now dominating crypto product development. From the upcoming Coinbase Wallet redesign to the rise of mobile-friendly perpetual platforms like Lootbase and Dexari, there is an industry-wide pivot towards building for thumb-first, on-the-go users. Features like social dynamics, in-wallet trading, and instant DeFi access are being natively integrated, showcasing a new era of consumer crypto apps.

Privacy: From Technical Feature to Institutional Requirement

Privacy was a headline issue at ETHCC 2025. Not only were advanced technologies like TEE, FHE, MPC, and ZK mentioned frequently, but there was also recognition that privacy is a must-have for real-world adoption, especially among institutions. Paul Brody of EY stated unequivocally that privacy is not optional for business use: “No company would transfer high-value business logic or transactions on-chain without privacy.”

Coinbase’s launch of an open-source MPC library was cited as an important step to raise the security baseline, while Aztec’s relaunch demonstrated growing user excitement for privacy-first consumer apps. The challenge remains to integrate these tools in a way that is both robust and user-friendly.

Vitalik’s Vision: Back to First Principles

Ethereum co-founder Vitalik Buterin’s keynote was a standout, mixing technical rigor with philosophical reflection. He cautioned against superficial solutions to governance and privacy, emphasizing that decentralization is a value—not a slogan. Buterin stressed the need for immutable dapp frontends, robust governance (not auction-based voting), and privacy as a fundamental right.

His remarks underscored a larger industry inflection point: “Growing the cryptocurrency space is not a clear line. The clear goal is to create the right kind of things. We need a philosophical transformation.” He called for a renewed focus on freedom, resilience, and meaningful decentralization, noting that the true test is whether users retain control even if companies disappear.

Risks, Gaps, and Ongoing Challenges

Despite the optimism, challenges remain. NFTs, once the star of previous cycles, received almost no attention—a sign that market focus is shifting, but also that speculative hype may be cooling. Sentiment around altcoins (beyond BTC) is tepid. And while privacy tech is advancing, many solutions are still too complex for mass adoption.

Competition among major projects is heating up, with Chainlink, Circle, and others making major marketing pushes. Yet, there remains skepticism about the real-world readiness of many products, and plenty of new projects are still flying under the radar.

Conclusion: Crypto’s New Chapter—Decentralized, Private, and Institutional

ETHCC 2025 highlighted a maturing crypto industry—one that is shifting its focus from hype cycles to real utility, institutional adoption, and long-term resilience. As stablecoins, tokenization, and privacy infrastructure move from buzzwords to essential features, and as mobile-first apps and compliant DeFi gain traction, the Ethereum ecosystem appears well-positioned for the next phase of growth.

Whether the philosophical transformation called for by Vitalik Buterin materializes remains to be seen—but the energy, urgency, and focus on building the “right kind of things” were on full display in Cannes.