Ethereum Foundation’s Strategic Shift: From Financial Layer to Global Digital Infrastructure

On July 10, 2025, the Ethereum Foundation (EF) released its first major roadmap update in four years — “The Future of EF Ecosystem Development,” introducing a dual-mission strategic framework:

-

Expand beneficiaries: developers, enterprises, DAOs, and institutional users to surpass 1 billion;

-

Strengthen techno-social resilience: withstand regulatory shocks and preserve decentralization and open collaboration.

This shift stems from fundamental user structure changes: from 2024 to 2025, enterprise on-chain interactions surged 170%, DAO treasury sizes hit $28 billion, and traditional demand is pushing Ethereum to evolve from a financial tool into infrastructure for digital innovation.

This market insight article explores the Ethereum Foundation’s 2025 roadmap’s four strategic pillars and how they reframe ETH as a global infrastructure through technical upgrades, enterprise integration, and decentralized governance.

The Four Strategic Pillars: Scaling the Ecosystem

Pillar 1: Ecosystem Acceleration — Empowering Practice

EF established four special teams to address key bottlenecks:

-

Developer Growth Team led by Austin Griffith provides over 3,000 hours of practical guidance annually, covering ZK-Rollups, account abstraction, etc.

-

Enterprise Relations Team co-designed a “45-day fast onboarding path” with Deloitte and EY, reducing integration from 6 months to 1.5 months.

-

Applied Research Team released “RWA On-Chain Compliance Framework V2.1” to tokenize real estate and carbon credits.

-

Founder Support Team incubates 50 early-stage projects annually, offering tech audits and legal compliance packages.

Pillar 2: Ecosystem Expansion — Global Reach

Brand upgrade initiatives target global penetration:

-

Restructuring the digital studio, with YouTube/Twitter content in 95% of languages;

-

“ETH Everywhere” team adds hubs in Seoul, Dubai, and São Paulo, localizing in 40 countries;

-

Internal AI tool EF Copilot is in testing, capable of auto-generating smart contract audit reports;

-

Devcon 2025 (Singapore) will feature an enterprise track to connect traditional capital with Web3 protocols.

Pillar 3: Ecosystem Support — Funding and Strategy

ESP funding program undergoes revolutionary reform:

-

Shift from passive grants to strategic support — $32 million disbursed in Q1 2025 for 101 projects;

-

45% of funds focused on ZK-proof innovation (e.g., =nil; Foundation received $5.2M to optimize ZK circuits);

-

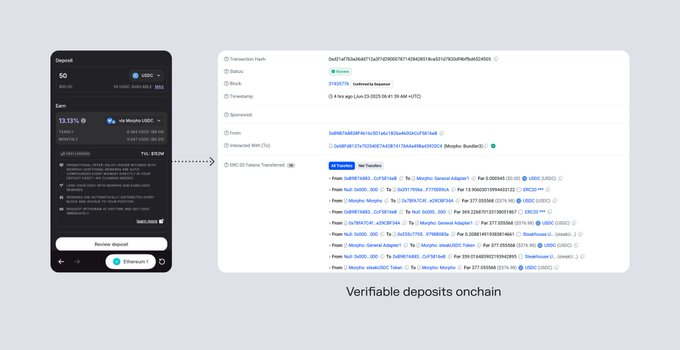

Launchpad Program supports protocols like Morpho with “funding + governance + compliance.”

Pillar 4: Long-Term Throughput — Breaking Barriers

Two new institutions tackle frontier challenges:

-

Institutional Secretariat works with BlackRock and Fidelity to define Ethereum ETF redemption standards;

- Academic Secretariat partners with MIT and Ethereum Zurich to build a regulatory sandbox and FATF Travel Rule solutions.

Simultaneously advancing Danksharding (testnet throughput of 105,000 TPS) and compliant nodes for enterprise KYC.

Tech Framework Upgrade: Modularization and Platformization

Execution Layer UX Overhaul

-

Account Abstraction (AA) adoption: ERC-4337 monthly active users surpassed 9 million, with 37% of transactions gasless;

-

ZK-Rollup cost optimization: zkSync, Scroll L2 fees dropped to $0.002, removing enterprise entry barriers.

Settlement and Consensus Layer Enhancements

-

Data Availability (DA) standardization: EIP-4844 Blob reduces L2 data publishing costs by 98%;

-

Censorship resistance: proposals require >99% block inclusion rate to combat regulatory pressure;

-

Distributed Validators (DVT): Obol and SSV supported by EF, reducing staking threshold to 4 ETH and mitigating Lido/Coinbase’s 35% dominance.

Market Response and Ecosystem Reshaping

Capital and On-Chain Data Validation

-

ETH hits $3,200: 11% surge in 24 hours post-roadmap release, four-month high;

-

Corporate holdings disclosed: SharpLink Gaming (12,430 Ethereum), Bitmine (8,200 ETH) list Ethereum on their balance sheets;

-

L2 dominance: TVL hits $42.8B (68% of Ethereum ecosystem), with 290% YoY growth.

Competitive Landscape Restructuring

-

Enterprise chain replacement battle: EF partners with JPMorgan Onyx and Visa CBDC, squeezing Ripple/Corda’s market;

-

Developer migration: Solana dev attrition rises from 8% to 15%, shifting toward ETH L2s.

Challenges and Outlook: The Art of Balancing Scale and Values

Core Risk Warnings

-

Staking centralization paradox: Lido + Coinbase control 35% of ETH staking, while DVT penetration remains at 12%;

-

Regulatory arbitrage conflicts: MiCA demands L2s hold EMT licenses, clashing with EF’s “L2 autonomy” principle;

-

Enterprise compliance trade-offs: Compliant nodes may fragment the network and weaken censorship resistance.

Growth Catalysts and Strategic Significance

-

Short-term milestone: Devcon 2025 to release enterprise onboarding standard 1.0;

-

Long-term goal: 1 billion users by 2028 and $1 trillion ETH market cap;

-

Paradigm shift: EF roadmap marks ETH’s “coming of age” — from tech idealism to sustainable infrastructure.

For deeper insight into regulation-tech balance, see the JuCoin Compliance Report.

The Roadmap’s Essence: A Trust-Scaling Experiment

As enterprise demand flows into open networks, and regulatory frameworks collide with decentralization ideals, Ethereum is using modular architecture and strategic resilience to explore a third path — one that preserves core values without detaching from real-world relevance. Its outcome will define whether blockchain can truly serve as the foundation for the next generation of digital infrastructure.

Technology is the skeleton, community is the blood, but only the art of balance can help the giant walk steadily.