Euler Finance is a permissionless lending and risk-management protocol on Ethereum, targeting “long-tail assets + institutional-grade controls.” Featuring modular design and auditable governance, it supports custom markets and multi-network expansion. This Token Insights article organizes its technical architecture (EVK/EVC), EUL distribution and utilities, governance and roadmap, and key risk considerations.

Summary: Via EVK/EVC, Euler enables composable collateral; oracle ratings and governance tools control risk, forming a sustainable permissionless lending ecosystem.

Project Overview

Euler Finance aims to make more assets borrowable/lendable within safe boundaries, offering componentized tools for developers and transparent governance for users. Compared with traditional lending products, the protocol breaks “market creation—pricing—liquidation—governance” into pluggable modules, enabling finer-grained risk parameters and faster listings for new assets.

What is the core design?

Euler Finance achieves scalability through “permissionless market creation + risk-tiered parameters + upgradable governance.” Each market’s interest curve, collateral factors, liquidation discounts, and other parameters are configured independently and continuously tuned via on-chain governance.

How does it differ from traditional lending?

Euler Finance uses Uniswap v3 TWAP as the primary pricing source and introduces an “oracle risk rating” tool that helps users assess the cost of manipulating prices. It also employs gentler liquidation and discount curves to reduce cascade effects during extreme volatility.

Technical Architecture

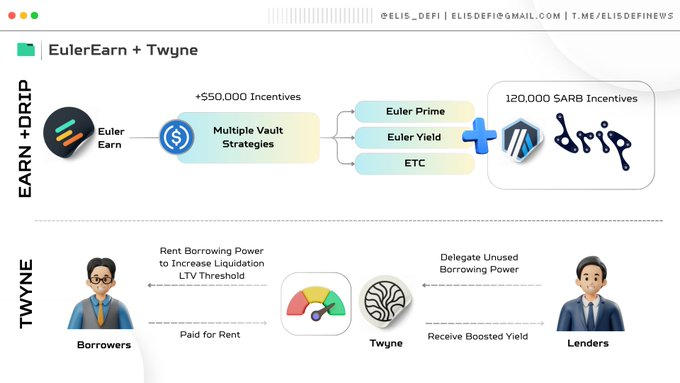

In V2, the core is “Euler Vault Kit (EVK) + Ethereum Vault Connector (EVC).” EVK lets teams create custom vaults; EVC allows vaults to interoperate and be reused as collateral, building “composable collateral” across strategies to improve capital efficiency.

Oracle & Pricing

Euler Finance defaults to a 30-minute Uniswap v3 TWAP, complemented by a risk-rating dashboard. The methodology estimates the cost to push TWAP far enough to enable arbitrage; markets below a threshold are flagged as high risk. According to Messari, the protocol uses parameterized liquidation discounts and “time-weighted” mechanics (e.g., rate and position weighting) to handle anomalies, aiming to reduce one-shot liquidations’ impact on depth and to give collateral holders space to adjust.

Modular Components: EVK & EVC

Developers can use EVK to build bespoke rate models and risk logic, then leverage EVC so assets in one vault can serve as collateral for others—creating “composable collateral.” This makes Euler’s lending relationships closer to “money LEGO.”

Tokenomics (EUL)

Euler’s native governance token is EUL, with a fixed supply of 27,182,818. Per official disclosures, the token is used for governance, Fee Flow auctions, and user rewards. Allocations span DAO/users/ecosystem, foundation, strategic partners, and team/contributors, and are adjusted over time via governance proposals.

Supply & Allocation

EUL supply is fixed. A portion in the DAO treasury is used for ecosystem incentives and protocol-owned liquidity (POL). The foundation primarily supports POL and operating budget. Strategic partners and team/advisors unlock per established vesting schedules. Example data (as of 2025-01-31): DAO treasury ~6,236,107 unencumbered; the foundation had received 1,000,000 for ecosystem initiatives; team + contributors ~7,203,446, vesting linearly or non-linearly.

Utilities & Governance

EUL confers voting power over parameters, treasury disbursements, and module upgrades. Fee Flow auctions convert protocol fees into bid assets. Users can also earn EUL via reward streams to increase participation.

Emissions & Incentives

Early phases used epoch-based vote allocations and borrower incentives; later, governance shifted some budget toward continuous rewards and POL management to reinforce Euler Finance’s long-term sustainability.

Ecosystem & Integrations

The protocol provides developer docs, a Vault Explorer, and an Oracle Dashboard; protocol stats are queryable on data platforms like DeFiLlama for institutional risk comparisons. A governance portal and forum publish proposals to boost transparency and participation. Market makers, institutional lenders, and yield strategists can create markets and reuse collateral; for everyday users, front-end aggregators on supported networks can plug directly into Euler vaults to access a wider range of collateralizable assets.

Progress & Roadmap

In 2024 Euler launched an independent governance portal and brand refresh, emphasizing “modular DeFi.” In 2025 the community discussed governance-data visualization dashboards to improve delegate voting and tracking. Looking ahead, Euler will continue refining EVK/EVC, cross-chain features, and multi-network deployments. Keep an eye on whether oracle-rating tools and TWAP parameters are adjusted for market conditions, on governance proposals for rewards and Fee Flow changes, and on bridge/risk consistency as deployments expand.

Risks & Compliance

Coindesk reported that Euler suffered a major 2023 exploit but most funds were later returned, prompting upgrades to governance and risk disclosures. Ongoing watch-items include: liquidity drought risk in long-tail assets, pricing bias from oracle dependence, liquidation slippage in extreme markets, and regional access restrictions. Prefer higher-rated, deeper-liquidity collateral; monitor governance changes to rates and liquidation thresholds; for large positions, favor multi-source pricing and longer TWAP windows, and configure alerts and auto-deleveraging.

FAQ

Does Euler Finance support permissionless listings?

Yes. Anyone can create a market within risk boundaries, but oracle conditions and parameters must be assessed to evaluate post-listing risk.

What are the core utilities of EUL?

Governance voting, Fee Flow auctions, and user rewards are the main uses; future utilities follow governance proposals.

What if the oracle is manipulated?

Use longer TWAP windows, raise the cost required to move prices, and constrain parameters in lower-rated markets—these are common Euler practices.

How do I get started?

Read developer docs, validate vault logic in test environments, then deploy to mainnet and pursue governance/community consensus.

How does Euler Finance relate to aggregators?

Aggregators can connect directly to vaults and EVC, routing strategy capital to the most suitable markets to enhance capital efficiency.

Key Takeaways

Euler Finance extends borrow/lend boundaries for long-tail assets through modular lending and risk tiering.

V2 introduces EVK and EVC to strengthen capital efficiency via “composable collateral.”

EUL powers governance, Fee Flow auctions, and rewards, with allocations adjusted by governance.

Key risks center on oracle dependence and long-tail liquidity; manage exposure with ratings and parameter controls.