Key Takeaways

- Fragmetric Protocol is Solana’s pioneering liquid (re)staking protocol, now evolved into the FRAG-22 asset management standard for advanced, multi-asset DeFi strategies.

- FRAG-22 enables transparent, real-time reward distribution, modular yield sourcing, and seamless composability across Solana’s DeFi ecosystem.

- Fragmetric empowers users to maximize returns through staking, liquid staking, restaking, and liquid restaking tokens, while supporting the security and growth of the Solana network.

- The SANG community (SolanA Network Guard) consists of users who stake assets via Fragmetric, contributing to both network protection and decentralized governance.

- The FRAG token is central to protocol governance, incentives, and ecosystem growth, with a transparent, community-driven tokenomics model.

Fragmetric Protocol is redefining DeFi on Solana (SOL) by putting liquid restaking and modular asset management at the heart of its FRAG-22 standard. By integrating transparent reward distribution, yield aggregation, and community governance, Fragmetric empowers users and developers to maximize returns and actively participate in the security, growth, and decentralization of the Solana ecosystem. This Crypto Deep Dives article discusses how Fragmetric is revolutionizing Solana DeFi with FRAG-22, liquid (re)staking, multi-asset management, and community-driven governance through the FRAG token and SANG network.

Fragmetric: Solana’s Advanced Liquid (Re)Staking and Asset Management Protocol

Fragmetric Protocol is revolutionizing the Solana DeFi landscape by introducing the FRAG-22 standard, a cutting-edge asset management infrastructure that brings together staking, restaking, and advanced liquidity management under one protocol. Built on Solana’s high-performance blockchain, Fragmetric empowers users and developers to access sophisticated DeFi strategies, maximize returns, and contribute to the ongoing security and decentralization of the Solana ecosystem.

From Staking to Liquid Restaking: Maximizing Capital Efficiency

Fragmetric Protocol provides a seamless journey for SOL holders, moving from traditional staking to liquid staking, and ultimately to restaking and liquid restaking:

- Staking: Users delegate SOL to validators, securing the network and earning rewards.

- Liquid Staking Tokens (LSTs): Receive liquid tokens like mSOL or JitoSOL, maintaining asset liquidity and enabling DeFi participation while continuing to earn staking rewards.

- Restaking: Put staked assets (including LSTs) to work again by securing new decentralized services (Node Consensus Networks, or NCNs) and earning additional yield.

- Liquid Restaking Tokens (LRTs): Represent restaked assets with ongoing liquidity and multiple reward streams, opening up new layers of composability and yield in Solana DeFi.

What Makes Fragmetric Protocol Unique?

1. FRAG-22 Asset Management Standard

Fragmetric’s FRAG-22 protocol extension allows for:

- Multi-asset deposits, supporting advanced yield aggregation and diversified reward streams.

- Transparent, real-time reward tracking, users can always see their yield accruals and liquidity status.

- Secure, modular infrastructure enabling both plug-and-play DeFi integrations and easy onboarding for developers.

2. SANG: SolanA Network Guard

SANG is both a community identity and a call to action. By re-staking with Fragmetric, users join SANG—becoming active protectors of the Solana ecosystem, collaborating with the team (including the cofounder, Sang) in research, innovation, and protocol development. Every SANG helps secure, govern, and grow Solana’s decentralized finance ecosystem.

3. Powering Solana’s Next DeFi Evolution

Fragmetric unlocks a new era of capital efficiency and security for Solana. By making it easy to restake, participate in Node Consensus Networks, and earn multiple streams of rewards, Fragmetric ensures that user deposits not only secure the base chain but also support oracles, bridges, co-processors, and more. Real-world examples like Jito’s TipRouter show how restaked assets deliver fair, transparent, and decentralized MEV rewards back to the community.

FRAG Tokenomics and Governance

The FRAG token is at the heart of the protocol, serving as both a governance and incentive mechanism. Key aspects include:

- Governance Participation: Stake FRAG to earn FVT (Fragmetric Vote Token) and shape protocol direction via time-weighted voting.

- Grants and Ecosystem Growth: FRAG holders decide on grants, supporting R&D, community projects, and ecosystem expansion.

- Incentives: Staked FRAG earns additional rewards, boosts campaign points, and encourages long-term protocol alignment.

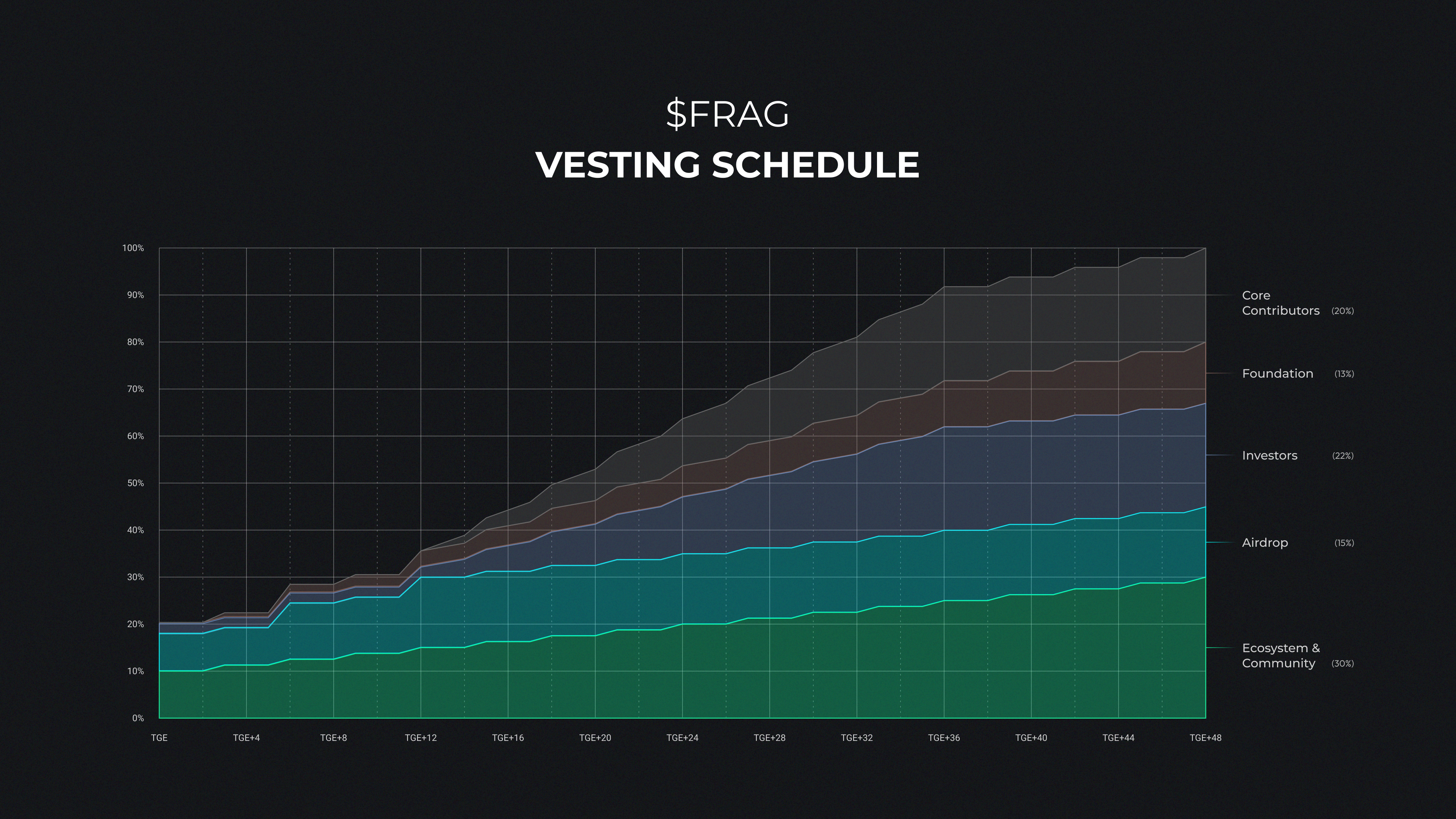

Token Distribution Highlights:

- Core Contributors: 20% (with 1-year cliff, 2-year vesting)

- Investors: 22% (10% immediate, remainder vested)

- Foundation: 13% (quarterly over 4 years)

- Ecosystem & Community: 30% (1/3 unlocked, rest vested)

- Airdrop: 15% (with major airdrop events and ongoing rewards)

The design aligns incentives for developers, users, and long-term supporters, ensuring sustainable protocol growth and decentralized governance.

The FRAG-22 Revolution

Fragmetric Protocol’s advanced liquid (re)staking and asset management infrastructure set a new standard for DeFi on Solana. Users play a crucial role in securing, governing, and growing Solana’s future. They can stake twice, earn more, and help shape the next evolution of DeFi.