Key Takeaways

- GameStop acquired 4,710 Bitcoin in May 2025, valued at $512 million, making it the 13th largest public corporate Bitcoin holder.

- The GameStop Bitcoin acquisition, funded by a $1.5 billion convertible note offering, reflects GameStop’s strategic pivot toward digital assets and treasury diversification.

- CEO Ryan Cohen’s leadership emphasizes operational streamlining and innovative financial strategies, including Bitcoin and stablecoin investments.

- The move aligns with a broader trend of corporate Bitcoin adoption, with over 210 public firms holding $52 billion in Bitcoin by mid-2025.

- While promising, the GameStop Bitcoin acquisition carries risks like price volatility and regulatory uncertainty, requiring careful management.

GameStop’s acquisition of 4,710 Bitcoin, valued at approximately $512 million, marks a pivotal moment in both the company’s transformation and the broader narrative of corporate cryptocurrency adoption. This strategic move, funded by a $1.5 billion convertible note offering in March 2025, positions GameStop as the 13th largest public corporate Bitcoin holder, aligning it with a growing cohort of firms leveraging digital assets as treasury reserves. The decision not only signals a dramatic shift in GameStop’s financial strategy but also reflects the accelerating institutional embrace of Bitcoin as a hedge against macroeconomic uncertainty and a tool for shareholder value maximization.

GameStop’s $512M Bitcoin Move: A Strategic Shift Under Ryan Cohen

Historically, GameStop has been synonymous with brick-and-mortar video game retail. However, the company’s relevance has been challenged by the rise of digital distribution and shifting consumer habits. The “meme stock” phenomenon of early 2021 provided a temporary resurgence, but long-term sustainability required a fundamental reimagining of its business model. Under CEO Ryan Cohen, GameStop has pursued aggressive cost-cutting, operational streamlining, and exploratory forays into digital assets, NFTs, and Web3 initiatives.

The move to acquire Bitcoin for its corporate treasury is the culmination of this strategic reinvention. In March 2025, GameStop’s board amended its investment policy to permit Bitcoin and US dollar-denominated stablecoins as reserve assets, explicitly aiming to diversify its portfolio and maximize liquidity utilization for shareholder benefit. The company’s statement emphasized that there is no upper limit on the amount of Bitcoin it may accumulate, and it retains the flexibility to sell as needed, underscoring a commitment to dynamic treasury management.

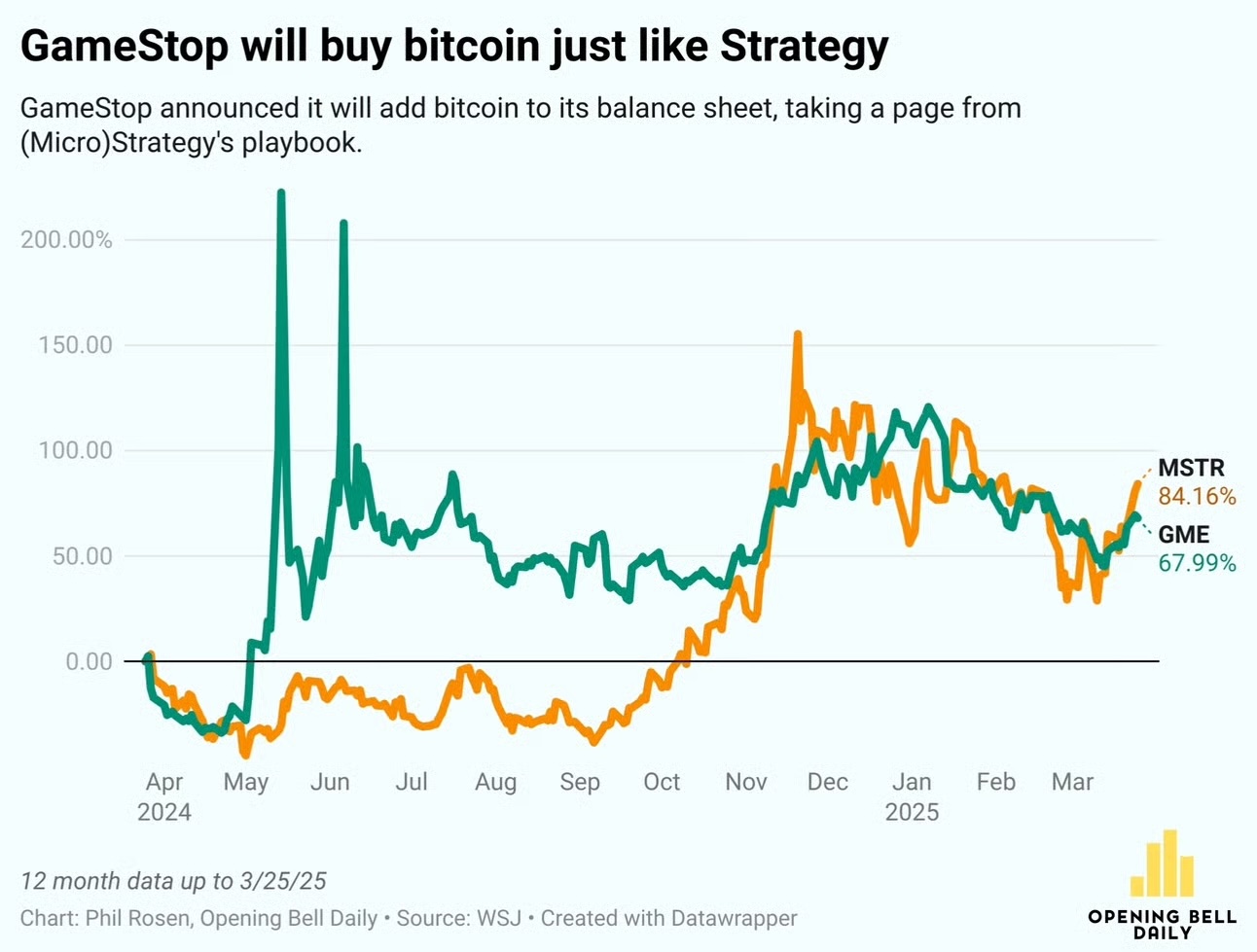

This shift is not occurring in isolation. The GameStop Bitcoin acquisition mirrors the high-profile strategy of MicroStrategy (now rebranded as Strategy), which has amassed over 580,000 BTC, and follows a broader trend of public companies integrating Bitcoin into their balance sheets. According to industry data, more than 210 publicly traded firms globally now hold Bitcoin, collectively accounting for about 3% of the total supply, or roughly $52 billion in value as of mid-2025.

The GameStop Bitcoin Acquisition & Investment: Market Reactions & Financial Impact

The GameStop Bitcoin acquisition was executed in late May 2025, at an average price of $108,950 per coin, as confirmed by SEC filings and company announcements. The purchase was financed through a $1.3 billion convertible bond offering completed in March, providing the necessary liquidity for such a substantial investment. This financial maneuver reflects confidence in Bitcoin’s long-term appreciation potential and demonstrates GameStop’s willingness to leverage capital markets to reposition itself as a forward-looking, digital-native enterprise.

The immediate market reaction to the GameStop Bitcoin acquisition announcement was mixed. While the company’s stock briefly rose on speculation of a Bitcoin investment, it ultimately declined by nearly 11% following the official disclosure, amid heightened trading volumes. This volatility is emblematic of investor uncertainty regarding the risks and rewards of corporate crypto holdings, particularly given Bitcoin’s historical price swings and the lack of detailed guidance on GameStop’s ongoing accumulation strategy. Nonetheless, the move has catalyzed renewed debate about the role of digital assets in corporate finance and the potential for Bitcoin to serve as a hedge against currency debasement and inflation.

GameStop Joins the Trend: Why Companies Are Embracing Bitcoin In 2025

GameStop’s foray into Bitcoin is part of a sweeping institutional shift that has accelerated over the past two years. Public companies, once wary of Bitcoin’s volatility and regulatory ambiguity, are increasingly recognizing its potential as a non-correlated, scarce asset capable of preserving value in times of macroeconomic stress. The collective holdings of public firms doubled from 394,131 to 786,857 BTC between November 2024 and May 2025, with projections suggesting that corporate treasuries could eventually control over 11% of all Bitcoin in existence if current trends persist.

This institutional embrace is driven by several factors. Persistent inflation, concerns over sovereign debt, and the search for yield in a low-interest-rate environment have all contributed to Bitcoin’s appeal as a “digital gold” alternative. The maturation of Bitcoin markets, improved custody solutions, and evolving regulatory clarity have further reduced barriers to entry for corporate treasuries. Companies like MicroStrategy and Tokyo-listed Metaplanet have demonstrated that large-scale Bitcoin holdings can drive shareholder returns and market capitalization growth, providing a template for others to follow.

GameStop’s entry into this arena signals a new phase in the evolution of corporate asset management. The company’s willingness to allocate a significant portion of its liquidity to Bitcoin, with no predefined cap, suggests a growing confidence in digital assets as a core component of treasury strategy. This move also reflects the increasing convergence of traditional finance and the crypto ecosystem, as firms seek to balance risk, diversification, and long-term value creation.

Analyzing GameStop’s Bitcoin Strategy: Innovation vs. Volatility Risks

The strengths of the GameStop Bitcoin acquisition strategy lie in its alignment with prevailing market trends and its potential to reposition the company as a digital innovator. By leveraging Bitcoin’s scarcity and global liquidity, GameStop aims to hedge against fiat currency risks and participate in the upside of a maturing asset class. The move also enhances the company’s visibility among a new generation of investors attuned to the intersection of technology, finance, and culture.

However, this strategy is not without significant risks. Bitcoin’s price volatility can introduce substantial fluctuations to GameStop’s balance sheet, potentially impacting earnings and investor sentiment in unpredictable ways. The lack of a defined cap on Bitcoin accumulation raises questions about capital allocation discipline and the company’s ability to manage downside risk in the event of a prolonged market downturn. Furthermore, regulatory uncertainty remains a persistent challenge, as governments continue to refine their approach to corporate crypto holdings and related disclosures.

There is also the question of execution. While MicroStrategy’s Bitcoin strategy has been lauded for its boldness and market impact, it has also subjected the company to heightened scrutiny and periods of extreme stock volatility. GameStop, with its legacy as a “meme stock” and its ongoing turnaround efforts, faces a delicate balancing act between innovation and prudent risk management. The company’s future success will depend on its ability to integrate Bitcoin into a coherent, long-term vision that resonates with both traditional investors and the crypto-savvy community.

How GameStop’s Bitcoin Holdings Stack Up Against Corporate Giants

GameStop’s Bitcoin acquisition places it in the company of major corporate holders, but its approach contains unique elements. Unlike MicroStrategy, which has pursued a relentless accumulation strategy regardless of market conditions, GameStop has signaled flexibility in both buying and selling Bitcoin as circumstances dictate. This dynamic approach may offer greater agility but could also expose the company to criticism if perceived as opportunistic or lacking conviction.

In contrast to firms that have capped their crypto exposure or limited it to a small percentage of reserves, GameStop’s open-ended policy reflects a willingness to embrace higher risk in pursuit of outsized returns. This stance may appeal to investors seeking exposure to digital assets but could alienate those with a lower risk tolerance or a preference for more traditional capital management practices.

Bitcoin In Gaming: GameStop Bitcoin Acquisition Strategy & Its Industry-Wide Implications

GameStop’s Bitcoin treasury strategy has broader implications for the gaming industry and the future of corporate finance. As digital assets become increasingly integrated into business operations, companies across sectors may feel compelled to explore similar strategies to remain competitive and relevant. For the gaming sector, which is already at the forefront of digital innovation, the adoption of Bitcoin and other cryptocurrencies could pave the way for new business models, payment systems, and community engagement mechanisms.

More broadly, the normalization of Bitcoin as a corporate treasury asset could accelerate its adoption as a mainstream financial instrument, influencing regulatory frameworks, market infrastructure, and investor behavior. The resulting feedback loop may drive further institutional participation, enhance liquidity, and contribute to the ongoing evolution of the global financial system.

GameStop’s $512M Bitcoin Play: The Future Of Treasury Innovation

GameStop’s entry into the ranks of major corporate Bitcoin holders is a watershed moment for both the company and the evolving relationship between traditional finance and digital assets. By allocating a significant portion of its treasury to Bitcoin, GameStop is betting on the continued institutionalization and appreciation of the world’s leading cryptocurrency, while simultaneously redefining its corporate identity in an era of rapid technological change.