With new progress in U.S. stablecoin legislation, the GENIUS Act is expected to advance formal legislation within the year. This policy signal has significantly boosted market expectations for compliant stablecoin development and has once again driven capital back into on-chain native assets and financial infrastructure sectors. Against this backdrop, on-chain stable yields, DeFi banks, data, and AI computing power have become focal points, catalyzing the rise of the next round of early-stage projects with real demand and high growth potential.

This issue of the JuChain potential projects series focuses on four early-stage projects characterized by light startup, fast growth, and strong reflexivity: JBank, Resolv Labs, LAGRANGE, and Calcify Tech. They respectively cover DeFi banking, stable yields, infrastructure, and computing power markets, showcasing JuChain’s diversified layout and cutting-edge exploration in financial infrastructure, asset management, AI computing, and more.

1. JBank

Project Overview

JBank is the first native decentralized self-custody banking protocol within the JuChain ecosystem, aiming to build a fully functional on-chain banking system. JBank supports user account management and on-chain lending, combines AI intelligent wealth management and real-world payment systems, and connects on-chain and off-chain payment channels through JuCard, providing users with a true one-stop Web3 financial services platform.

JBank is also the “world’s first Olympus DAO model on-chain bank,” meaning it can build a long-term sustainable financial model through liquidity management, token staking, and deflationary mechanisms. Supported strongly by JuChain’s native ecosystem and traffic inflow capabilities, JBank is not only a key incubated project on the platform but also a flagship project for JuChain’s DeFi module.

Key Highlights

JBank’s core strength lies in its full-stack financial functionality. Users can use JuCard for off-chain consumption and on-chain asset switching, achieving efficient asset circulation. The platform emphasizes a self-custody banking model, where all assets are controlled by users themselves, eliminating centralized trust risks common in traditional finance. Additionally, JBank integrates smart contract-driven automated wealth management, allowing users to configure time deposits, strategy investments, or join mutual insurance pools, with execution handled automatically.

Leveraging JuChain’s high-performance infrastructure, JBank launched JuCard to seamlessly connect on-chain assets with off-chain consumption scenarios, building a global digital payment network. This combination of DeFi, payments, and intelligent wealth management forms JBank’s differentiated advantage in next-generation decentralized financial services.

Project Progress

Within less than a week after launch, JBank’s TVL (total value locked) surpassed $4 million. According to the platform, the current annualized yield is as high as 7,814%, and total platform TVL has exceeded $7.6 million. JBank is constructing a full “on-chain credit account” ecosystem and will gradually expand lending markets and yield strategy products. Future launches of on-chain stablecoins or bond tools could further enhance its central role in the DeFi ecosystem, adding a critical piece to JuChain’s financial infrastructure puzzle.

Investment Logic

JBank is JuChain’s first native financial protocol with a clear positioning and comprehensive functionality, featuring strong user stickiness and ecological synergy. Its core logic is account management and intermediary-free lending, reducing financial trust barriers through on-chain self-custody, and expanding income sources with intelligent advisory systems. Its investment logic leans toward long-term products and user base accumulation, distinguishing it from traditional incentive-driven DeFi protocols.

Given that its JuCard payment system has initially connected to off-chain consumption scenarios, if a payment loop is completed and user growth continues, JBank has the potential to become JuChain’s financial “middle platform,” driving ecosystem TVL and real-use scenarios to explode. Based on the project fundamentals and current token market stage, JBank presents a typical high-potential cyclical alpha opportunity, suitable for early positioning and long-term tracking.

2. Resolv Labs

Project Overview

Resolv Labs is a decentralized stable yield protocol based on the “True Delta-Neutral Architecture,” aiming to build a trustless, low-risk on-chain stablecoin and crypto investment system. Its core products include the stablecoin $USR and liquidity certificate $RLP, allowing users to gain sustainable returns without bearing the frequent price volatility risk typical in traditional DeFi.

Resolv emphasizes steady returns over high volatility speculation, suitable for low-risk users seeking capital preservation and growth on-chain. Integrated on high-performance infrastructures like Base chain, Resolv leverages composability and permissionless features to integrate restaking, derivatives markets, and cross-chain asset strategies into a unified architecture, maximizing capital efficiency.

Key Highlights

Resolv’s innovation lies in its “True Delta-Neutral” mechanism, combining ETH restaking yields, stablecoin trading pair arbitrage, and strategic market making to generate $USR, a stablecoin that maintains near-constant price anchoring and continuous yield distribution without relying on over-collateralization or centralized assets. This makes $USR different from traditional stablecoins and avoids off-chain credit or RWA models, forming an on-chain pure asset, risk-neutral alternative stablecoin framework.

Additionally, the $RLP liquidity certificate allows liquidity providers to share protocol returns with additional incentives, combining staking and LP features. Users face no minimum thresholds and can enter or exit freely, enjoying a simple and frictionless experience. Resolv also emphasizes community governance and sustainable adjustments, such as the dynamic Spectra YT point system, reflecting flexible user incentives and maintaining long-term balance of the protocol’s yield structure.

On-chain Data

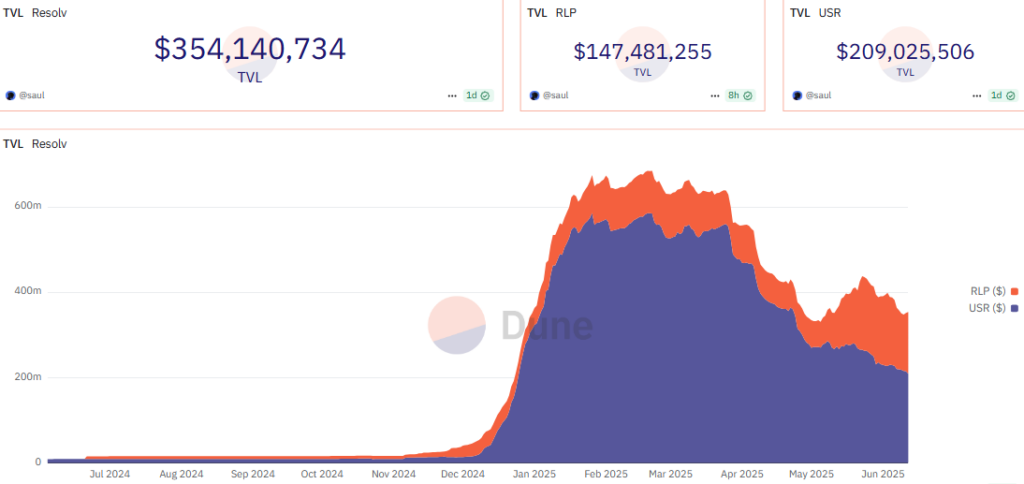

Resolv Labs’ on-chain performance remains robust, with total TVL around $350 million. USDR accounts for over $210 million, and RLP locked value exceeds $150 million. The platform has over 50,000 users with about 56% active users, and a 7-day average APY of about 11%. Core stablecoin USDR’s price remains stable between $0.998 and $1.00, with good trading liquidity supporting the system’s trust mechanism. Resolv has paid out over $10 million in yield and processed over $1.7 billion in stablecoin minting and redemption.

Investment Logic

Resolv serves an underestimated niche market: low-risk on-chain wealth management. As the market matures and user structures diversify, protocols emphasizing capital preservation and stable yields like Resolv will become key gateways for mainstream capital. In the long run, Resolv’s gradual expansion into structured products like Restaking, along with its stable strategies and modular architecture, positions it to become an important platform for on-chain asset yield aggregation.

3. Lagrange

Project Overview

Founded in 2023, Lagrange Labs aims to build the world’s first decentralized zero-knowledge (ZK) verification network, providing auditable, secure, low-cost ZK infrastructure for AI inference, on-chain data verification, and cross-chain computation. Its foundational network has attracted over 85 top validators including Coinbase, OKX, Kraken, serving mainstream L2 networks like Base, Arbitrum, and zkSync.

The Lagrange mainnet is live; in 2025 it began expanding ecosystem cooperation and commercial deployments. To date, it has generated over 9 million ZK proofs and is the main provider for more than 75% of outsourced proof tasks on zkSync. Through modular design and parallel proof mechanisms, Lagrange supports L2 scaling and modular blockchains, and with its DeepProve protocol addresses AI inference black box problems, aiming to become a trusted computing hub in Web3.

Ecosystem Layout & Key Highlights

Lagrange’s technical architecture centers on three modules. The ZK Prover Network is the first production-grade decentralized proving network; validators stake $LA tokens to obtain task rights and must produce proofs within 0.1 seconds or face slashing. It integrates EigenLayer’s restaking system, leveraging up to $29 billion worth of ETH economic security, providing unprecedented resilience and anti-attack capabilities for on-chain verification.

The SQL Coprocessor module solves inefficiencies in blockchain historical data retrieval and state snapshots, allowing developers to generate ZK proofs of on-chain query results via SQL-like language. Lastly, the DeepProve protocol focuses on AI trust issues, supporting mainstream models like GPT-4 and Llama-3, having performed over 3 million AI inference verifications and being used in healthcare platforms like DiagnosTech to meet FDA auditing requirements.

On-chain Data

Lagrange launched native token $LA in June 2025 with a total supply of 1 billion tokens: 40% allocated to community and ecosystem (vested linearly over 4 years), 20% to early contributors (vested after 12 months). $LA has triple functions: payment, governance, and node staking. Developers pay proof fees (~$0.001 per proof) in $LA, validators stake $LA for task priority and earn 8-12% annual yield.

Its economic model balances deflation and subsidy: part of ETH or USDC fees repurchase and burn $LA, forming a deflationary cycle; 4% annual inflation incentivizes early validators. $LA is listed on Binance, Coinbase, and JuCoin with a current circulating market cap of $164 million and daily trading volume over $213 million.

Investment Logic

Lagrange’s sector has strong trend drivers: growing demand for trustworthy AI inference especially in regulated industries like healthcare and finance, and Web3’s need for efficient, low-cost, general-purpose cross-chain verification. Lagrange’s DeepProve and ZK Coprocessor form a closed ZK verification loop connecting AI inference, on-chain state, and cross-chain interoperability, serving as a highly reusable middleware network.

Lagrange completed a $17.2 million seed round with investors including Founders Fund and Fenbushi. As the only crypto-native AI project in NVIDIA’s Inception program, Lagrange is exploring deep integration of DeepProve with NVIDIA GPU training stacks to promote ZK proofs as part of AI infrastructure. If its verifiable computing model is widely adopted, $LA could become the foundational bandwidth token of the ZK ecosystem, creating new value capture pathways.

4. Calcify Tech

Project Overview

Calcify Tech is a blockchain platform focused on decentralized computing resource leasing, aiming to provide global users with on-demand access to high-performance GPU, CPU, and memory computing power. By building a blockchain-based computing power market, Calcify allows providers to lease idle hardware on-chain, while users can access these resources directly via smart contracts, effectively breaking the monopoly of centralized cloud computing platforms.

Key Highlights

Calcify Tech’s core strength lies in integrating computing resources-as-a-service with decentralized governance. The platform supports fine-grained leasing of GPU, CPU, and memory resources, enabling users to flexibly configure and pay based on actual needs, truly achieving fragmented supply and customized use of resources. Calcify also uses smart contract-driven matching mechanisms and dynamic pricing strategies, making computing power leasing more efficient and transparent, while creating long-term income models for providers. On the UI/UX front, Calcify is pushing for a more Web2-friendly experience to lower entry barriers for non-crypto native users.

Project Progress

Calcify Tech’s native token $CALCIFY is now listed on JuCoin with a 24-hour increase of 18.3%. The team is actively iterating the core system, optimizing computing task scheduling and resource pricing models, and testing multi-chain deployment and contract compatibility. The computing task manager feature is being refined, with a Beta version upcoming.

Investment Logic

With booming AI model training demand and increasingly prominent centralization issues in traditional cloud services, Calcify Tech’s decentralized, rentable, and verifiable computing power model has strong industry benchmark value. As an early-stage project, Calcify offers a high-quality opportunity for investors optimistic about AI and Web3 integration trends for medium- to long-term attention.

Summary

Amid the gradual warming and structural opportunities in the crypto market, JuChain’s related early-stage projects demonstrate significant growth potential and innovation. This issue’s selected projects cover on-chain stable yields, DePIN resource networks, native financial instruments, and more emerging sectors, fully reflecting JuChain’s keen capture of early narratives and platform empowerment execution. For investors focused on early growth, ecological synergy, and narrative-driven strategies, JuChain is undoubtedly a promising public chain worthy of continued tracking!