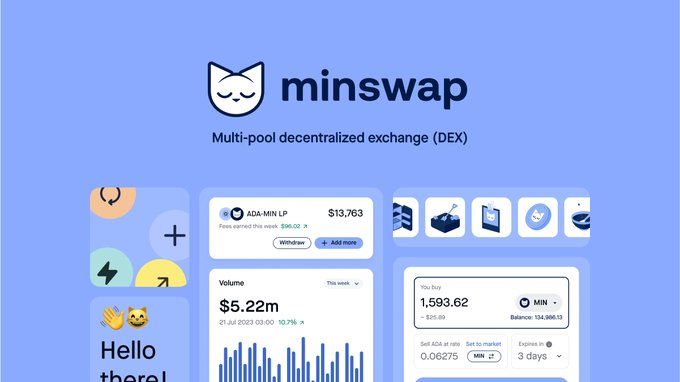

Minswap is the leading decentralized exchange (DEX) in the Cardano ecosystem, renowned for its multi-pool automated market maker (AMM) model. The platform achieves community-driven governance by fair-launching the MIN token with zero presale; it also supports innovative features such as one-click Zap-In, multi-asset stable pools, and dynamic fees. Whether swapping tokens, providing liquidity, or yield farming, users enjoy low or zero fees, fast confirmations, and deep liquidity. This Innovation and Tech article will comprehensively dissect Minswap’s architectural advantages, core features, governance model, yield mechanisms, and future ecosystem collaborations.

Summary: Minswap offers a variety of AMM liquidity pools, simplifies pool entry with Zap-In, and combines fair MIN token distribution with community governance to deliver an efficient, decentralized Cardano DeFi experience.

What are Minswap’s core advantages?

Minswap’s multi-pool AMM model integrates stable pools, concentrated liquidity, and multi-asset pools to provide traders with deep, low-slippage liquidity. By fair-launching MIN without any presale, the platform prioritizes community participation. Regardless of trade size, users pay minimal or zero ADA fees and can use Zap-In to join a liquidity pool with a single asset, streamlining the process. This design not only optimizes capital efficiency but has also attracted over 248,083 active traders, with an average daily volume exceeding 8.04 B ₳ and a TVL of 110.68 M ₳.

What are Minswap’s core features?

According to learncardano, Minswap offers a multi-pool AMM model supporting stable-asset pools, regular AMM pools, and concentrated liquidity pools. Transactions are automatically routed to the optimal pool to maximize pricing efficiency and depth. The Zap-In feature allows users holding only one asset to join a pool in one click; the system automatically splits and swaps assets as needed, greatly simplifying operations.

Additionally, the Launch Bowl platform provides fair-liquidity onboarding for new projects, helping them launch quickly and connect with the community. All trades enjoy zero to minimal ADA fees and fast confirmations. Coupled with these innovative tools, Minswap delivers a comprehensive and efficient DeFi experience for Cardano users.

How does Minswap’s governance model work?

Fair Launch & Community-Driven

MIN tokens are distributed fairly through liquidity mining and farming rewards, with no private or VC allocations, ensuring equal governance weight for early and later participants.

Proposal & Voting Mechanism

Any user holding a minimum amount of MIN can submit governance proposals—ranging from fee adjustments and pool additions to protocol upgrades. Voting power is linear: 1 MIN equals 1 vote. Once a proposal reaches the threshold, the smart contract automatically executes the decision without manual intervention.

Governance Fund & Transparency

The protocol reserves a portion of MIN as community and development funds for subsidizing new pools, sponsoring projects, and conducting security audits. All proposals, voting records, and execution processes are recorded on-chain for real-time community audit, ensuring transparency and efficiency.

What are Minswap’s yield farming and liquidity mechanisms?

Users earn yield by providing liquidity: all fees generated from trades are distributed proportionally to liquidity providers (LPs) in real time. LPs receive LP tokens representing their share, which can then be staked in farming pools for additional MIN rewards. Zap-In participants receive extra MIN incentives.

LP tokens can be flexibly moved between pools or used in Launch Bowl to support new projects, maximizing returns. This dual mechanism of “fee sharing + MIN farming rewards” not only deepens liquidity but also offers users attractive passive income.

What does Minswap’s future look like and who are its ecosystem partners?

Multi-Chain & Cross-Protocol Integration

The team is building cross-chain bridges to Ethereum, BSC, Avalanche, and more, enabling liquidity aggregation and asset swaps.

Community & Project Partnerships

Minswap has already partnered on liquidity with multiple Cardano projects (e.g., SundaeSwap, ADAX) and plans to expand strategic partnerships with Solana, Polygon, and beyond to build a global DeFi network.

Technical Iteration & Security Audits

Regular smart-contract audits are scheduled, and the team intends to introduce hybrid fee models (centralized + decentralized) to dynamically optimize fees and pool depth.

Education & Ecosystem Support

Developer grants and hackathons will be launched to fund community tool and DApp development, fostering a vibrant Cardano DeFi ecosystem.

FAQ

What is Minswap?

Minswap is a multi-pool AMM DEX on Cardano offering various AMM pools, yield farming, and community governance.

How to provide liquidity?

Connect a compatible wallet (e.g., Nami, Yoroi), choose a pair on the “Pools” page, deposit assets, and receive LP tokens to start farming.

What are the advantages of Zap-In?

Provide liquidity with a single asset; the system handles splitting and swapping, simplifying entry.

How to obtain MIN tokens?

Earn via LP staking in farms or buy on decentralized exchanges.

What’s new in Minswap V2?

New concentrated liquidity pools, dynamic fee adjustments, and cross-chain bridge support, enhancing capital efficiency and flexibility.

Key Takeaways

Multi-Pool AMM Architecture: Stable, regular, and concentrated pools coexist, optimizing pricing and depth.

Zap-In Simplification: One-click pool entry lowers participation barriers.

Community Governance: Fair MIN distribution, transparent DAO voting, and automated execution.

Dual Yield: Fee sharing + MIN farming rewards boost returns.

Cross-Chain Vision: Building bridges and global partnerships to expand DeFi frontiers.