Sidekick is the world’s first LiveFi platform, sharing real-time market insights via livestreams and enabling asset trades directly within the stream. Backed by YZi Labs, HashKey Capital, Mirana Ventures, and others, Sidekick fuses interactivity, content, and DeFi trading to offer an unprecedented “watch-and-trade” experience. This Innovation and Tech article provides a deep dive across five dimensions: core advantages, real-time interactive trading model, token economics, compliance & security, and ecosystem collaborations.

Summary: Sidekick’s LiveFi model integrates streaming, instant trading, and token incentives, supporting multi-chain livestreams and trades. “Kickers” (hosts) earn revenue via real-time revenue shares and token rewards, while viewers trade live and earn token incentives.

What are Sidekick’s core advantages?

According to CoinDesk, Sidekick deeply integrates livestreaming with on-chain trading to create a novel interactive environment. Viewers can place buy/sell orders directly within the stream—no protocol switches required. Real-time charts and order panels embed into the video, letting viewers chat and execute trades instantly, boosting engagement and conversion. The platform supports Ethereum, Solana, BSC, and more—and boasts endorsements from YZi Labs, HashKey Capital, Mirana Ventures, accelerating ecosystem growth.

How does Sidekick enable real-time interactive trading?

Sidekick’s LiveFi protocol packages streaming, order flow, and on-chain transactions into one synchronized execution: as a Kicker streams, the video displays live prices, wallet balances, and trade signals. When viewers click “Buy” or “Sell,” a MetaTx bundles all interactions into a single on-chain transaction—one signature completes the trade. Upon execution, the contract emits a receipt shown in the livestream, delivering a seamless “watch-and-trade” experience that reduces latency, avoids repeated gas fees, and significantly enhances efficiency and stickiness.

What are the features of the $K tokenomics?

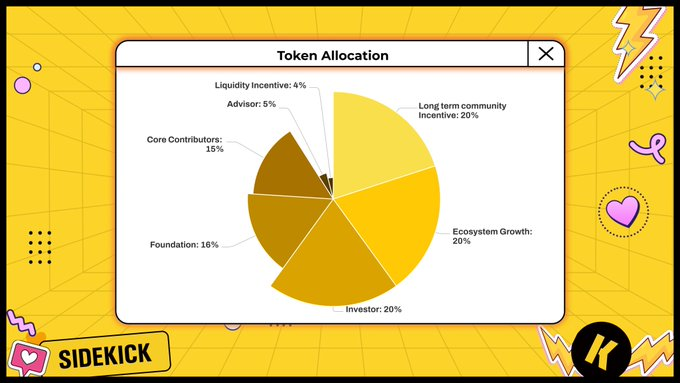

Sidekick’s native token $K has a total supply of 1,000,000,000 with the following allocation:

-

Ecosystem Growth: 20% (200 M $K)

-

Community Incentives: 20% (200 M $K)

-

Liquidity Incentives: 4% (40 M $K)

-

Foundation: 16% (160 M $K)

-

Advisors: 5% (50 M $K)

-

Core Contributors: 15% (150 M $K)

-

Investors: 20% (200 M $K)

Initial Circulation & Unlock Rules

-

Initial Circulation: 111,333,333 $K (11.13% of total), comprising Ecosystem Growth 6.883%, Community Incentives 1.5%, Liquidity Incentives 2%, Foundation 0.75%

-

Lockup & Linear Release: Investors, Advisors, Core Contributors locked for 12 months, then linearly released over 24 months

Community Incentives and Ecosystem Growth released in phases per official GitBook.

How does Sidekick ensure compliance & security?

Smart Contract Audits & On-Chain Proofs

Core protocols audited by security firms; audit-report hashes on-chain. Regular re-audits before major updates.

MetaTx Simulation & Risk Control

All trades simulated on-chain to guard against re-entrancy and slippage. Users can review full execution flow front-end. System auto-adjusts slippage thresholds and pauses trading during anomalies.

Multi-Sig & Time-Lock Upgrades

Critical upgrades and fund movements require multi-party signatures and time-locks. If signatures fall short, a second vote is triggered.

Optional KYC/AML

For large withdrawals or specific regions, zero-knowledge-proof KYC/AML preserves privacy while ensuring compliance.

What ecosystem collaborations & future outlook does Sidekick have?

Multi-Platform & Aggregator Integration

Per chaincatcher, Sidekick integrates with Solana Foundation, Base, OKX Wallet, and will add Zapper, Zerion etc., letting users view livestreams and trading data within their favorite DeFi dashboards.

Global Kicker Ecosystem

Plans to recruit 500+ Kickers across education, gaming, DeFi projects—hosting online/offline trainings and hackathons, supporting creators with technical and marketing resources.

DAO Governance & Token Incentives

$K holders will govern rewards, feature roadmaps, and fund usage; reputation-based proposals will earn extra ecosystem rewards.

AI Agent Support

Real-time AI Agents will provide Kickers with smart signals and viewers with personalized investment advice, learning from interactions to optimize content and strategies.

FAQ

What is Sidekick?

Sidekick is the world’s first LiveFi platform—users can one-click on-chain trade while watching Kicker livestreams for a seamless “watch-and-trade” experience.

How to become a Kicker?

Apply on the website, complete basic verification and optional KYC, then start streaming and earn $K via engagement and trades.

How are livestream trades charged?

Trades are bundled into a single MetaTx—users pay one gas fee. A small platform fee is collected and distributed to $K holders by stake.

What are $K token uses?

$K is used for tipping hosts, unlocking premium features, governance voting, staking for additional yield, and future airdrops & liquidity incentives.

How is user safety guaranteed?

Multi-layer security: third-party audited contracts, MetaTx risk simulations, multi-sig & time-locks, and optional KYC/AML ensure fund and data safety.

Key Takeaways

Integrated LiveFi Experience: Streaming, live quotes, and on-chain trades in one operation—no protocol switching.

Multi-Layer Security: Audits & proofs, risk simulations, multi-sig upgrades, optional KYC maintain security and compliance.

Robust Tokenomics: 1 B $K total, 11.13% initial circulation, clearly allocated across seven categories.

Flexible Incentives: Tips, fee-sharing, feature unlocks, and staking rewards drive long-term engagement.

Ecosystem Expansion & Governance: Multi-chain & aggregator support now; DAO governance & AI Agents planned for a diversified LiveFi ecosystem.