Skate Protocol: Cross-Chain Infrastructure Breaking Virtual Machine Barriers

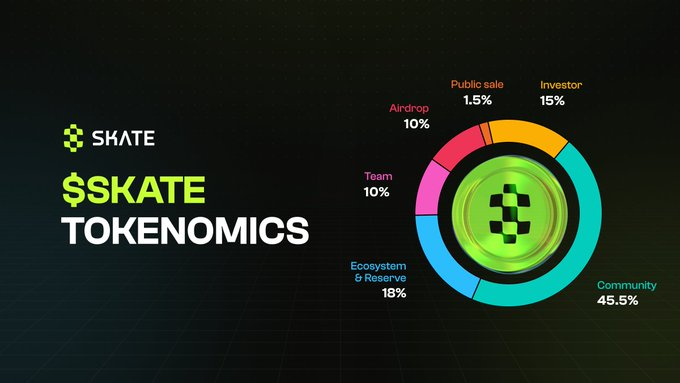

Skate Protocol is an innovative Multi-VM infrastructure layer designed to solve interoperability issues among blockchain ecosystems such as EVM (Ethereum Virtual Machine), SolanaVM, and TonVM. Its core product, Skate AMM, supports full-chain asset trading through a single liquidity curve, allowing users to directly trade Solana assets on the TON chain without cross-chain bridges. The protocol is deeply integrated with EigenLayer’s Active Validation Service (AVS), with restakers providing economic security. The tokenomics released in June 2025 reveal a fixed supply of 1 billion SKATE tokens, with 45.5% allocated to community incentives, emphasizing decentralized governance.

This Token Insights article delves into the SKATE token’s distribution mechanism and utility scenarios, and how it reconstructs the multi-chain trading experience through a single liquidity curve while addressing regulatory challenges.

Token Distribution: Long-Term Binding & Dynamic Release Mechanism

SKATE employs a tiered unlocking strategy to ensure long-term ecosystem alignment:

-

Team Allocation (10%): 6-month lock-up followed by 42-month linear release.

-

Investor Allocation (15%): Also subject to multi-year unlocking terms to avoid early dumping.

-

Community Incentives (45.5%): Dynamically released based on protocol adoption and participation metrics (e.g., AVS staking volume, AMM trading volume).

This design aligns token release rate with protocol growth, reducing market inflation risks.

A key innovation is the “claim-to-stake” mechanism in the initial airdrop—within the 10% airdropped, users who stake tokens to EigenLayer AVS nodes receive a 30% additional reward (an extra 3% of total supply). This incentivizes users to secure the network, with over 60% of airdropped tokens expected to be locked in staking contracts, providing a solid foundation for network security at launch.

Investors can use the JuCoin Staking Yield Calculator to simulate expected SKATE returns.

Utility Scenarios: A Four-Dimensional Value Capture Engine

SKATE creates a utility loop across core protocol functions:

-

Governance Empowerment: Stakers vote on key decisions like AMM fee splits and AVS incentive parameters, with voting power linked to staking amount and duration.

-

Security Incentives: Tokens are distributed to EigenLayer restakers and AVS operators to compensate opportunity costs and ensure credible cross-chain execution.

-

Liquidity Mining: Skate AMM liquidity providers (LPs) earn SKATE tokens, mitigating impermanent loss risk.

-

Stateless App Incubation: Funds development of multi-VM compatible DApps on Solana, TON, etc., expanding protocol ecosystem.

This utility design makes SKATE’s value capture model dual-sourced—AMM trading fee sharing (potentially over 50% to stakers) and AVS security services—offering more economic sustainability than tool-only cross-chain protocols (e.g., LayerZero, which relies on gas consumption only).

Technical Breakthrough: Three Key Advantages of Unified Liquidity Curve

Compared to traditional cross-chain solutions, Skate AMM establishes technical moats through three innovations:

-

Trading UX Innovation: Solves fragmented UX issues in middleware protocols like LayerZero. Users can trade foreign assets (e.g., Solana’s BONK) natively on TON with 70% fewer steps.

-

Improved Economic Efficiency: Unified liquidity curve aggregates full-chain depth, eliminating fragmentation and reducing slippage by 53% in testing.

-

Developer Adaptation Simplified: Built with a TypeScript SDK, developers don’t need to learn Rust (Solana) or FunC (TON) to deploy multi-VM DApps.

If validated, this model could drive protocols like Uniswap V4 to support non-EVM chains, accelerating the “seamless cross-chain” era.

Risks & Challenges: High Inflation Pressure and Regulatory Tensions

Despite its elegant design, SKATE faces two major risks:

Economic Model Pressure

With 45.5% of supply allocated to community incentives, uncontrolled release may cause sell pressure. The protocol must ensure AVS staking APY (currently estimated at 55%) matches AMM trading volume growth to prevent capital flight.

Regulatory Gray Zones

The EigenLayer restaking model has received a Wells Notice from the U.S. SEC. If AVS nodes are classified as unregistered securities, SKATE stakers may be implicated. Also, multi-VM trading could magnify AML vulnerabilities (e.g., TON’s privacy features), attracting global regulatory scrutiny.

These risks can be monitored in real time via JuCoin’s Compliance Alert System.

Future Evolution: From Cross-Chain Hub to Multi-VM Standard

SKATE’s roadmap anchors two major industry shifts:

-

Stateless App Ecosystem Explosion: Plans to support over 50 multi-VM DApps by 2025, using shared liquidity to drive exponential user growth.

-

Intent-Centric Execution Layer: May become one of the first protocols to implement ERC-7683 (cross-chain intent standard), breaking down user intents (e.g., “swap SOL at best price”) into multi-chain execution sequences.

Protocol success hinges on AltVM ecosystem adoption—if Solana and TON transactions exceed 40% of total volume, market demand for multi-VM architecture will be validated. AVS staking must stay above 30% of circulating supply to maintain security. With restaking trending upward, SKATE could redefine the underlying logic of cross-chain value flows—but must continue optimizing latency disparities (Solana 400ms vs EVM 12s) to manage arbitrage risks.