Tanssi Network: The Modular Engine Redefining Blockchain Deployment

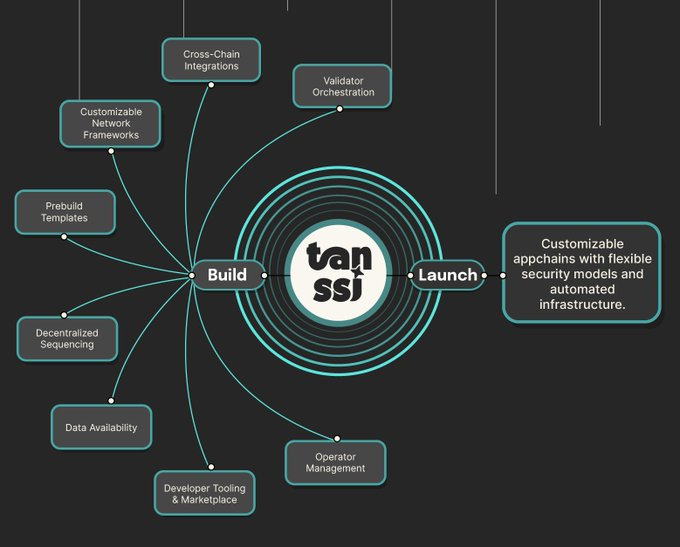

Tanssi Network is an application chain infrastructure protocol built by the Moondance Labs team, aiming to address key pain points in blockchain development. Traditionally, launching a chain takes months of coordination among validators, coding base layers, and integrating cross-chain tools, while general-purpose platforms force developers to compromise between performance and sovereignty. Tanssi compresses the deployment process into under 10 minutes through modular architecture while retaining full sovereignty. Dubbed the “WordPress for appchains” or “Kubernetes for blockchains,” it raised $6 million in strategic funding in March 2024 (led by Scytale Digital and KR1) and officially launched on Binance Alpha Exchange on July 9, 2025, marking its mainstream technical validation.

This Token Insights article explores how Tanssi reduces blockchain deployment from months to minutes, breaking down its four-layer technical framework and token economic model.

Technical Architecture: Four-Layer Engine Enabling Minute-Level Deployment

Development Framework Layer: Substrate SDK Enables Flexible Customization

Based on the Substrate framework, Tanssi offers preconfigured EVM-compatible chain templates. Developers can select modules such as oracles or smart contracts and customize consensus and governance rules. This modular design supports deep adaptation for gaming, DeFi, and RWA use cases, avoiding redundant development. For example, a gaming chain can integrate custom NFT standards, while a financial chain can embed KYC layers.

Security Layer: Ethereum-Grade Shared Economic Security

By integrating with the Symbiotic restaking protocol, Tanssi provides over $350 million in economic security for appchains. Using already-staked ETH, WBTC, and other assets on Ethereum, new chains inherit robust base-layer security without building their own validator sets. A dynamic validator rotation mechanism prevents single points of failure and ensures 12-second finality.

Orchestration Layer: Fully Automated Node Management

Tanssi’s core innovation lies in its Orchestration Layer, which automatically assigns decentralized block production nodes (collators) and includes prebuilt infrastructure like RPC endpoints, block explorers, and wallet plugins. Developers no longer need to coordinate third-party services, significantly reducing operational complexity. What once took months now happens instantly via automation.

Interoperability Layer: Seamless Connection with Polkadot and Multi-Chain Ecosystems

As a Polkadot parachain, Tanssi leverages the XCM protocol for global security sharing and cross-chain communication. It also integrates with Wormhole for Ethereum asset migration, enabling appchains to access liquidity across major ecosystems. This dual-track interoperability allows chains to plug into both Polkadot and Ethereum DeFi simultaneously.

Token Economy: A Utility Model Anchored to Ecosystem Growth

1 Billion TANSSI Token Allocation and Core Utilities

Token distribution focuses on long-term ecosystem development:

-

39.7% for community incentives (developer airdrops, liquidity rewards)

-

24% to early investors (released linearly after a 12-month lock)

-

22% to core contributors

Core utilities include:

-

Paying for block production and data access services

-

Governance voting (e.g., adding supported chains)

-

Staking to secure the network and earn rewards

Deflationary Design and Value Anchoring

A portion of on-chain service fees will be burned to counter inflation. Token value is directly tied to ecosystem activity—each new appchain increases network service demand, forming a positive cycle: “deployment growth → more service usage → greater token scarcity.” Detailed economic model analysis is available in JuCoin’s research library.

Development Updates: Testnet Validation and Exchange Listings

Incentivized Testnet Fuels Ecosystem Expansion

The “Let’s Forkin’ Dance” testnet campaign launched in April 2024 attracted over 700 appchain deployments across DeFi, gaming, real estate, and other sectors. Notably, 60% were first-time Substrate developers, validating its low-barrier advantage. By March 2025, testnet deployments exceeded 2,000, laying the groundwork for mainnet launch.

Exchange Listings and Airdrop Plan

On July 9, 2025, at 19:05 (GMT+8), Binance Alpha launched TANSSI spot trading and opened airdrop claims: users holding ≥140 points could redeem exclusive tokens by spending 15 points. At 19:30, Binance Futures listed TANSSI/USDT perpetual contracts (50x leverage). MEXC Launchpad had earlier distributed 1.16 million tokens at $0.006 each on July 7.

Challenges and Outlook: Breaking Through Modular Blockchain Barriers

Core Risks and Countermeasures

-

Security reliance: Symbiotic protocol has a 0.7% historical vulnerability rate; audits must be continually enhanced

-

Competitive pressure: AltLayer, Eclipse, and other modular protocols have captured market share

-

Regulatory fit: RWA use cases must dynamically comply with varying jurisdictions

Growth Catalysts

If Binance listing drives over $5M in weekly volume, it could attract institutional interest. If mainnet’s minute-level deployment performs as promised, a developer migration wave could follow. Deep integration with Symbiotic may channel billions in liquidity.

Industry Paradigm Value

Hyper-abstracted infrastructure allows developers to focus on business logic. Shared security solves the “decentralization vs. efficiency” paradox.

If by Q4 2025, over 5,000 appchains are deployed and more than 50% are new developers, Tanssi will be established as the orchestration layer for the “Internet of Blockchains.” The essence of modular blockchain is productivity liberation, and Tanssi’s automated orchestration and shared security represent a critical breakthrough for Web3 infrastructure.