This Innovation and Tech article discusses Theoriq, a groundbreaking decentralized protocol that combines artificial intelligence with blockchain technology to create autonomous AI agent collectives. Theoriq has secured $10.4 million in funding from leading investors including Hack VC, Foresight Ventures, and HashKey Capital, making it one of the most well-funded AI-blockchain projects entering 2025. The protocol’s native THQ token serves as the coordination layer for agent activities, staking rewards, and governance, while its successful testnet attracted over 500,000 users testing collaborative AI systems.

Summary: Theoriq raised $10.4M to develop the first decentralized AI agent protocol on blockchain. The platform enables specialized AI agents to form collaborative “collectives” that solve complex Web3 tasks autonomously, with the token powering the ecosystem economics and governance.

What is Theoriq and How Does It Work?

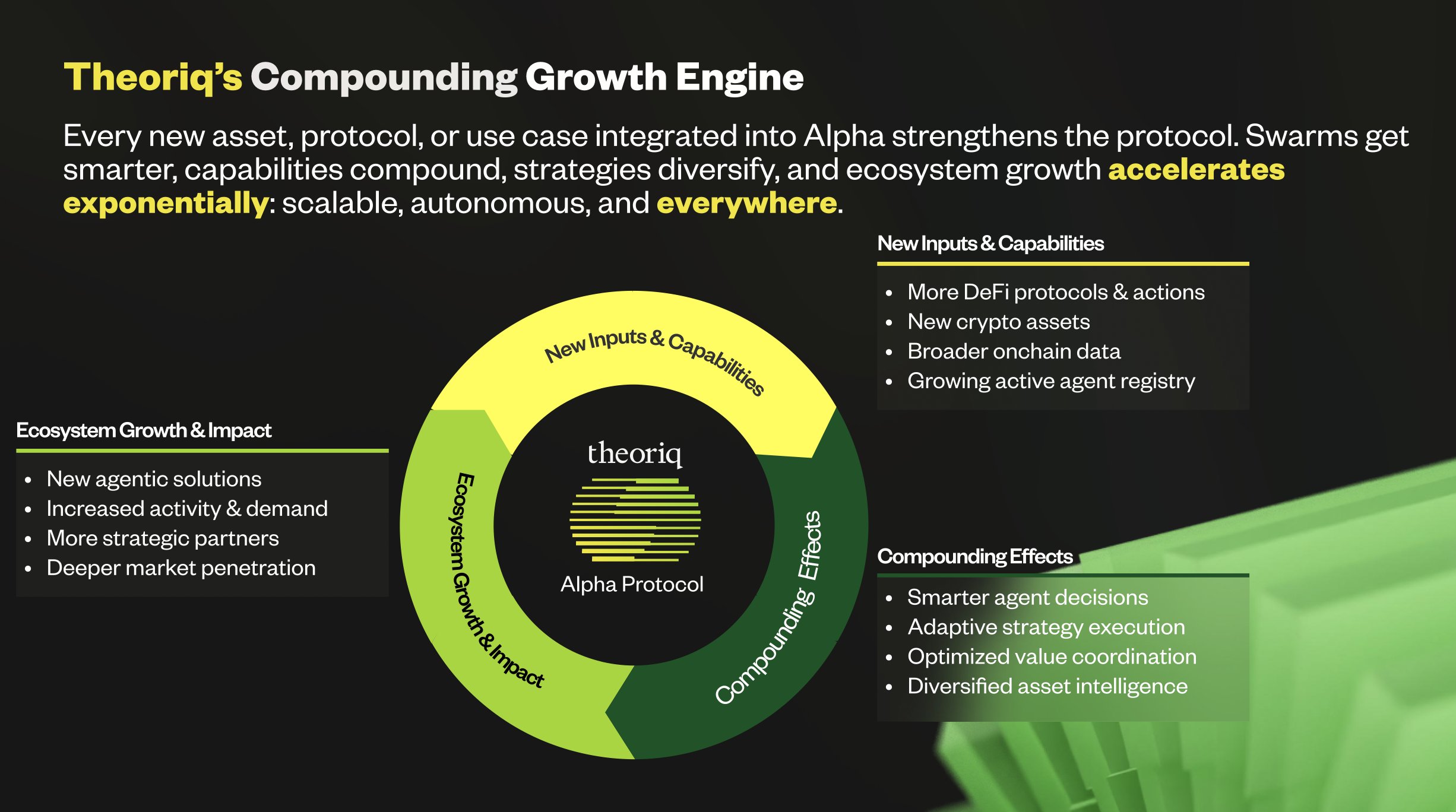

Theoriq represents a fundamental shift in how AI systems operate by enabling multiple specialized AI agents to collaborate autonomously on blockchain networks. Rather than relying on monolithic AI models, it orchestrates “collectives” of specialized agents that communicate and coordinate their actions to tackle complex tasks across Web3 applications.

The protocol addresses a critical limitation in current AI development where individual agents operate in isolation, creating fragmented solutions and inefficiencies. Theoriq enables AI agents to work together in specialized teams, with each bringing unique expertise to solve complex Web3 problems. These agent collectives can handle diverse functions including portfolio management, data analytics, trend analysis, and automated DeFi strategies.

At the core of the architecture are standardized “Behaviors” that define specific agent capabilities like code generation, chat interaction, or data analysis. These behaviors function as universal translators for AI systems, enabling seamless interoperability between agents regardless of their underlying implementation or deployment environment.

Key Components of the Theoriq Ecosystem:

- Agents: Autonomous software systems that perform specific functions using AI models

- Collectives: Groups of specialized agents that collaborate on complex tasks

- Aggregators: Specialized agents that orchestrate collaboration within collectives

- Evaluators: Systems that assess agent performance and generate reputation scores

- Optimizers: Agents that identify optimal collective compositions for specific tasks

THQ Token Economics and Utility

The THQ token serves as the economic foundation of the Theoriq ecosystem, designed with a fixed supply of 1 billion tokens to ensure long-term scarcity and value alignment. The token distribution reflects a strategic approach to fostering ecosystem growth while maintaining founder and investor incentives.

THQ Token Allocation:

- Community: 18% (180 million tokens)

- Treasury: 28% (280 million tokens)

- Core Contributors: 24% (240 million tokens)

- Investors: 30% (300 million tokens)

The fuel of this ecosystem is $THQ the value and coordination layer that secures agents operating on chain, rewards holders and stakers with protocol fees, partner incentives, and sustainable emissions generated by agent activity.

Multi-Layered Token Utility:

THQ operates through a sophisticated staking and delegation system that creates multiple value accrual mechanisms. Token holders can stake THQ to mint sTHQ (staked THQ), which serves as a security layer and insurance against agent failures while earning token emissions. Advanced users can lock sTHQ for 1-24 months to mint αTHQ (Alpha THQ), receiving enhanced emissions funded by protocol fees and partner token distributions.

The delegation system allows αTHQ holders to delegate portions of their stake to specific AI agents, unlocking protocol fee discounts and shared rewards from agent operators. This delegation acts as slash-eligible collateral, providing economic consequences for agent misbehavior while boosting agent discovery rankings and execution capacity.

Investment Analysis and Market Position

Theoriq’s $10.4 million funding round demonstrates strong institutional confidence in the convergence of AI and blockchain technology. Hack VC led the funding round, with Foresight Ventures, Inception Capital, HTX Ventures, Figment Capital, Hypersphere Ventures and Alumni Ventures participating. This funding includes a $6.2 million seed extension completed in May 2024, following an initial $4 million seed round in September 2022.

Competitive Advantages:

The protocol’s hybrid on-chain/off-chain architecture optimizes for scalability while maintaining security through Ethereum-based smart contracts for critical functions like agent registration and proof verification. Off-chain Theoriq Nodes handle computationally intensive tasks like AI inference and evaluation processing, creating an efficient balance between decentralization and performance.

The project differentiates itself from competitors like Fetch.ai, Autonolas, and MyShell through its focus on agent collectives rather than individual agents. This collaborative approach mirrors successful human organizational structures and addresses the complexity limitations of monolithic AI systems.

Strategic Partnerships and Ecosystem Growth:

The project has secured partnerships with major technology providers including Google Cloud, NVIDIA, Filecoin, and Space and Time. These collaborations provide access to advanced AI capabilities, data infrastructure, and cloud resources that enhance its technical capabilities and market reach.

Testnet Performance and User Adoption

The protocol recently completed a successful testnet with an impressive 500,000 users, which laid the groundwork for its current “Build in Public” campaign demonstrating real-world DeFi applications in action. The testnet validation demonstrates strong user interest and validates core protocol concepts before mainnet deployment.

The incentivized testnet program allows users to earn experience points (XP) through various activities including AI agent interactions, social quests, feedback provision, and referrals. Users receive 100 XP for social quests, 50 XP daily for agent interactions, and additional rewards for successful referrals, creating an engaged community that provides valuable feedback for protocol development.

Real-World Applications Being Tested:

- Automated yield farming and liquidity optimization

- Cross-protocol arbitrage and market making

- Risk management and portfolio rebalancing

- Social sentiment analysis and trading signals

- Predictive analytics for DeFi protocols

Technical Innovation and Safety Measures

Theoriq introduces novel concepts including Proof of Contribution and Proof of Collaboration mechanisms that ensure transparent assessment and accountability in agent activities. These cryptographically verifiable certificates provide immutable records of agent performance and collective optimization processes.

The protocol implements comprehensive safety measures through AI and Human Evaluators that assess agent behavior across dimensions including transparency, fairness, and safety compliance. This dual evaluation approach addresses potential AI alignment issues while maintaining decentralized governance principles.

Security and Governance Framework:

Agent activities are recorded on blockchain to build reputation scores and enable trustless collaboration at scale. The protocol uses Byzantine Fault Tolerance mechanisms for model inference verification and implements slashing conditions for misbehaving agents, creating strong economic incentives for honest behavior.

Investment Risks and Considerations

Despite its technological innovation and strong funding, Theoriq faces several investment risks that potential THQ holders should consider. The project operates in the emerging intersection of AI and blockchain, creating regulatory uncertainty and technical complexity that could impact adoption.

Key Risk Factors:

- Market Competition: Intense competition from established AI platforms and emerging blockchain-AI projects

- Technical Complexity: Challenges in achieving seamless agent interoperability across diverse AI frameworks

- Regulatory Environment: Potential regulatory restrictions on AI agents handling financial transactions

- Adoption Challenges: Need to overcome user experience barriers for mainstream Web3 adoption

Economic Model Risks:

The token’s value depends heavily on agent activity generating sufficient protocol fees to sustain staking rewards and ecosystem incentives. Economic sustainability requires achieving network effects where agent collectives create more value than individual AI solutions, which remains unproven at scale.

THQ Price Outlook and Market Predictions

While THQ tokens are not yet publicly tradeable, the protocol’s strong funding, technical innovation, and growing user base suggest potential for significant value creation upon mainnet launch. The fixed supply model and multi-layered utility mechanisms create multiple value accrual pathways that could drive token demand.

Industry analysts note that AI-blockchain convergence represents one of the highest-growth sectors in crypto, with protocols that successfully combine both technologies likely to capture substantial market share. Theoriq’s focus on practical DeFi applications rather than speculative use cases positions it well for real-world adoption.

Catalysts for Price Appreciation:

- Mainnet launch and the token generation event

- Partnership announcements with major DeFi protocols

- Demonstration of profitable agent collective use cases

- Integration with institutional trading and asset management platforms

Frequently Asked Questions

What makes Theoriq different from other AI blockchain projects? Theoriq focuses on collaborative agent collectives rather than individual AI agents, enabling more sophisticated problem-solving through specialized team-based approaches that mirror successful human organizational structures.

How can investors participate in Theoriq before mainnet launch? Users can participate in the ongoing incentivized testnet to earn XP rewards and gain early exposure to the platform. While no official airdrop is confirmed, testnet participation may factor into future token distribution.

What are the main revenue sources for the Theoriq protocol? Revenue comes from protocol fees on agent activities, partner project payments for platform access, and transaction fees from agent-to-agent micropayments and smart contract interactions.

When will THQ tokens be available for trading? While originally planned for late 2024, the mainnet launch has been delayed as the team refines the architecture based on testnet feedback. Official launch timing has not been announced for 2025.

What are the staking rewards for THQ holders? Staking rewards come from protocol fees generated by agent activities, with enhanced rewards available through the time-locked αTHQ system and additional partner token distributions.

How does Theoriq ensure AI agent safety and reliability? The protocol implements dual AI and Human Evaluator systems with Proof of Contribution mechanisms, slashing conditions for misbehaving agents, and reputation systems that create economic incentives for honest behavior.

What partnerships has Theoriq secured? Strategic partnerships include Google Cloud for infrastructure, NVIDIA for AI capabilities, Filecoin for data storage, Space and Time for analytics, and Truflation for real-world asset data integration.

Can individual developers build agents on Theoriq? Yes, Theoriq provides no-code builder tools and comprehensive SDKs for Python and JavaScript, enabling developers to create, deploy, and monetize AI agents through the Infinity Hub marketplace.

Key Takeaways

- Theoriq has raised $10.4 million to build the first decentralized protocol for AI agent collectives, demonstrating strong institutional backing from leading crypto venture capital firms

- THQ token serves multiple functions including staking rewards, governance participation, protocol access, and agent delegation, creating diverse value accrual mechanisms

- The testnet attracted 500,000 users validating market demand for collaborative AI solutions in Web3, with practical applications in DeFi optimization and automated trading

- Technical innovation includes Proof of Contribution and Collaboration mechanisms that ensure transparent agent evaluation and accountability in decentralized systems

- Investment opportunity exists for early participants through testnet engagement, though mainnet launch timing remains uncertain as the team refines the protocol architecture

Theoriq represents a pioneering attempt to combine the power of artificial intelligence with blockchain technology’s transparency and decentralization benefits. While the project shows strong technical innovation and market validation through its successful testnet, investors should carefully consider the risks associated with emerging AI-blockchain convergence technologies and the uncertainty around mainnet launch timing and token availability.