The following content is released by JuCoin Labs Research Institute: Recently, the crypto project World Liberty Financial (WLFI), endorsed by the Trump family, has become a focal point in the crypto market. Since its launch, the WLFI token has attracted significant attention due to its “political halo,” but it also comes with massive capital operations and notable policy risks. Currently, the WLFI token has not yet officially launched. On July 16, the community passed a “token circulation” proposal with a high support rate of 99.94%, meaning WLFI will officially transition from a governance-only staking token to a freely tradable asset. The project’s underlying capital structure, ecosystem construction, and the stability of the USD1 stablecoin are becoming core factors in assessing its risks and investment value.

1. The Trump Family Project Centered on the USD1 Stablecoin

World Liberty Financial (WLFI) is a crypto financial project directly participated in and led by the Trump family, the current US president. Its core product is the USD stablecoin called USD1. USD1 is backed 1:1 by US dollars in cash and US Treasury bonds, positioning itself as a compliance-oriented stablecoin, while attempting to introduce traditional political and business networks into the crypto finance field.

WLFI plans not only to build stablecoin and lending services but is also actively exploring multiple product lines such as on-chain payments and DeFi apps, showing a multi-pronged strategy involving USD stablecoins, on-chain lending, and payment networks. However, USD1 remains its only substantive product currently deployed, while other business areas are still in the planning stage.

WLFI’s project characteristics lie in the high exposure and political influence of the Trump family, combined with the on-chain USD stablecoin business, creating an image of a politically and business-linked compliance stablecoin project distinct from mainstream projects like Circle and Tether.

2. Family Capital Operating Team Integrating Politics and Business

The core driving force behind WLFI is the Trump family itself. According to early disclosures on the project’s official website, the co-founding team includes Donald Trump Jr., Eric Trump, and Barron Trump, with Donald Trump himself appearing as an “honorary co-founder.” In addition, the WLFI team structure incorporates diverse backgrounds from real estate, diplomacy, and the crypto industry. New York real estate tycoon Steven Witkoff is listed as an “honorary co-founder,” with family members Zach Witkoff and Alex Witkoff acting as co-founders responsible mainly for expanding funds and business in the Middle East. It is worth noting that the public roles of Trump family members in the WLFI team have changed multiple times—for example, Donald Trump was previously listed as a “co-founder” but later changed to “honorary co-founder.” Currently, WLFI no longer displays team member information on its official website, focusing mainly on promoting its USD1 stablecoin.

After USD1’s launch, WLFI’s capital and resource network further expanded, attracting deep involvement from Tron founder Justin Sun and Binance founder CZ. Justin Sun joined as an “advisor” and “largest investor,” providing resources and policy influence to WLFI; meanwhile, CZ supports USD1 and WLFI by providing traffic and user base through the BNB Chain ecosystem and Binance platform. On-chain data shows the Trump family’s holding in WLFI has decreased from an initial 75% to about 40%, with some shares suspected to have transferred to Justin Sun, DWF Labs, and the Aqua 1 Foundation, which announced a $100 million investment. It is noteworthy that Aqua 1’s background is questionable; although the fund claims to originate from the UAE, there are indications it is linked to Web3port, which is suspected of market manipulation, and its capital flow paths are opaque, raising concerns about WLFI’s funding structure and capital security. In response, the Aqua 1 Foundation stated that the project is operated by an independent team, with founder Dave Lee having no equity or financial ties to Web3port and currently collaborating with Middle Eastern institutions.

3. Concerns Over WLFI’s Distribution and Unlocking

WLFI’s governance token has a total supply of 100 billion tokens, with 35% allocated for token sales, though only 25% of the public sale portion has been completed so far, and the remaining 10% has not been disclosed. Sold public tokens have an expected 12-month lockup period, and currently both public and private sale portions are non-transferable. A major concern is that the specific allocation plan, unlocking conditions, and schedule for the private sale portion have never been disclosed to the market, creating significant uncertainty. Without clearly announcing unlocking plans and community governance procedures beforehand, there is a risk of early unlocking and concentrated dumping. Previously, WLFI only existed as a governance token without dividend or equity rights, and its value fully depended on participation in platform governance. On July 16, the community approved a proposal to convert WLFI into a tradable asset, officially opening the circulation path.

At the token’s actual control level, WLFI’s operating structure is equally complex. The official registered entity is DT Marks DEFI LLC, controlled by the Trump family, with Donald Trump himself indirectly holding token rights via a trust structure, with a holding of about 1.575 billion tokens, approximately 15.75% of total supply. Public information shows that by July 2025, the Trump family has realized approximately $500 million in cash through token subscriptions, dividends, and related business channels. This figure has attracted attention regarding the “family capital” cash-out path and has been questioned by policymakers and market participants over severe conflicts of interest and manipulation suspicions. After WLFI becomes a freely tradable asset, related risks may further intensify.

4. Dual Endorsement of Middle Eastern Funds and Centralized Platforms in Capital Structure

WLFI’s capital structure exhibits a clear “political-business capital and Middle Eastern funds” dual model. In May 2025, Abu Dhabi’s sovereign investment fund MGX invested $2 billion in Binance, designating the USD1 stablecoin as the payment medium. This deal became the core driver of USD1’s rapid issuance expansion. This transaction not only brought massive capital inflows to USD1 but also made Middle Eastern capital a key support behind WLFI.

Besides Middle Eastern funds, WLFI’s deep binding with the Binance ecosystem is also noteworthy. To date, 92.88% of USD1’s total issuance is held in two Binance custody addresses, making Binance an implicit backer of USD1 at the capital level. From an ecosystem cooperation perspective, WLFI is focusing on Ethereum and BNB Chain, the two major mainstream ecosystems, and has established partnerships with on-chain projects like Aave and Lista, attempting to expand USD1 and WLFI’s application base in DeFi scenarios.

WLFI’s current capital operation logic has deviated from traditional VC funding and retail fundraising routes. Instead, it builds a highly politicized and platform-oriented capital model through deep cooperation between Middle Eastern sovereign capital and centralized exchanges. This special capital structure provides resource advantages but also hides risks of excessive centralization and manipulation by centralized capital.

5. Business Data—Centralized Limitations of USD1 and “Regulated” Growth

Currently, USD1 on-chain exhibits a typical broker custody-type structure, rather than a decentralized circulating stablecoin form. Its real usage demand and decentralized ecosystem expansion are still at an early stage, relying more on custody at the capital level and block trades. USD1 mainly distributes on BNB Chain, Ethereum, and Tron networks, but its scale growth and asset distribution show extremely high centralization characteristics. The specific business data are as follows:

-

USD1 On-Chain Circulation Data:

-

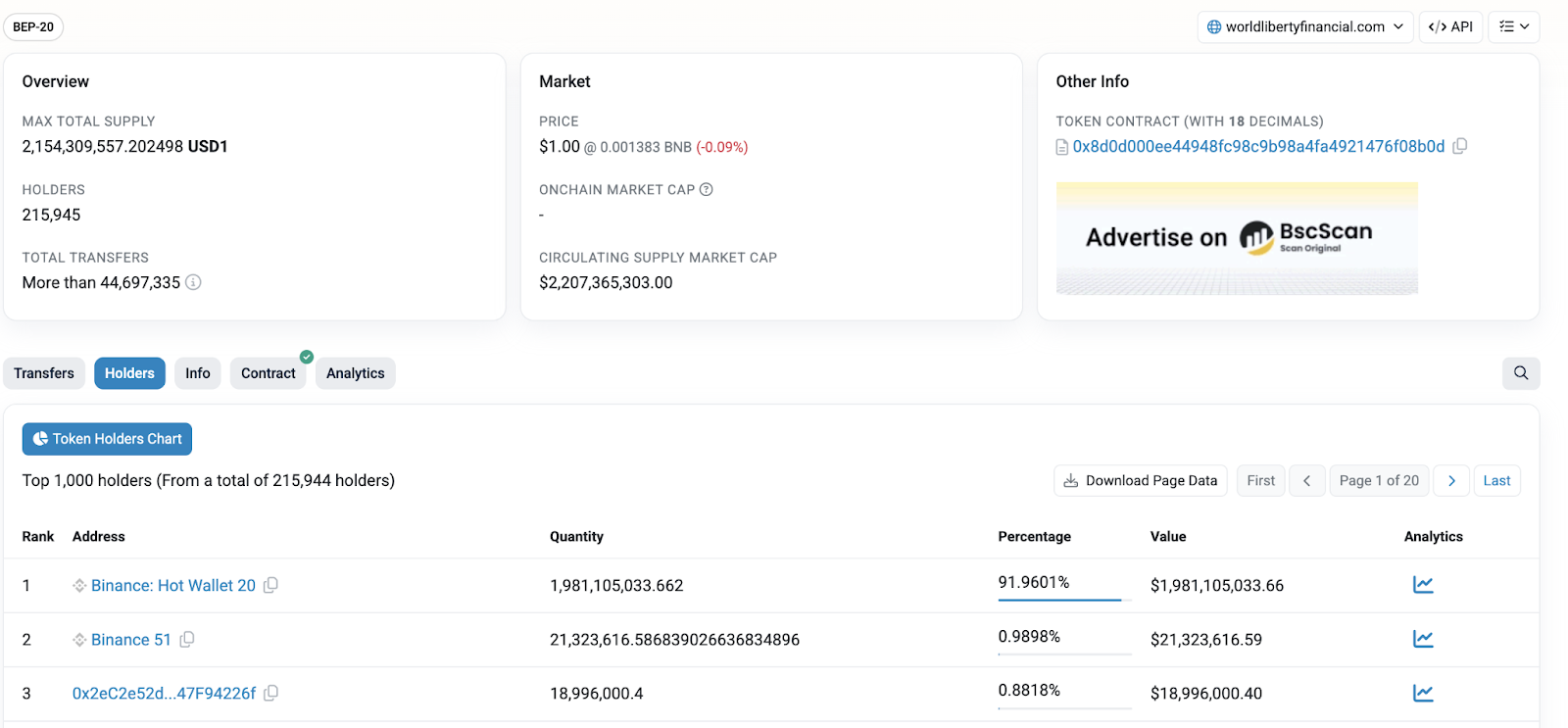

Total circulation: approximately $2.2 billion.

-

BNB Chain proportion: 97.9% (approximately $2.154 billion).

-

Ethereum proportion: about $48 million.

-

Tron proportion: negligible, almost zero.

-

Custody concentration: 92.88% of USD1 assets are concentrated in two Binance custody addresses, with $1.9 billion locked in Binance’s main address (0xF977814e90dA44bFA03b6295A0616a897441aceC).

-

-

On-Chain Address Data:

-

Number of holding addresses on BNB Chain: 215,900.

-

Ethereum holding addresses: 64,000.

-

Tron only has 466 addresses.

-

-

Business Characteristics:

-

Growth model: Growth depends on “capital channel” events (such as MGX’s investment in Binance) rather than natural trading demand or DeFi application-driven growth.

-

Significant centralization: Binance currently controls 97.9% of USD1 circulating assets, lacking diversified on-chain holder structures, and the decentralized ecosystem has yet to form.

-

6. Summary

The core competitiveness of World Liberty Financial is not technological innovation or product differentiation, but the political endorsement by the Trump family and the capital channel resources they control. The main product USD1 rapidly scaled through a specific capital cooperation model but remains essentially a centralized capital management stablecoin with weak decentralized finance attributes.

At the same time, the governance token WLFI lacks direct binding with actual business, posing a significant risk to the project. If the Trump family ceases brand endorsement or transfers interests, the WLFI ecosystem could quickly lose core support and market attention.

WLFI’s growth path relies on family political capital, centralized platform cooperation, and infusions of Middle Eastern funds, clearly exhibiting a “policy finance” characteristic. Its operational logic resembles a closed capital experiment rather than an open crypto financial ecosystem. In the short term, WLFI has certain market attention due to its topical nature; however, from a mid-to-long-term perspective, governance structure risks, token-business decoupling, and highly centralized capital architecture may become structural challenges that are difficult to overcome in its sustainable development.