The Trump Family’s Crypto Expansion: Background of the USD1 Stablecoin

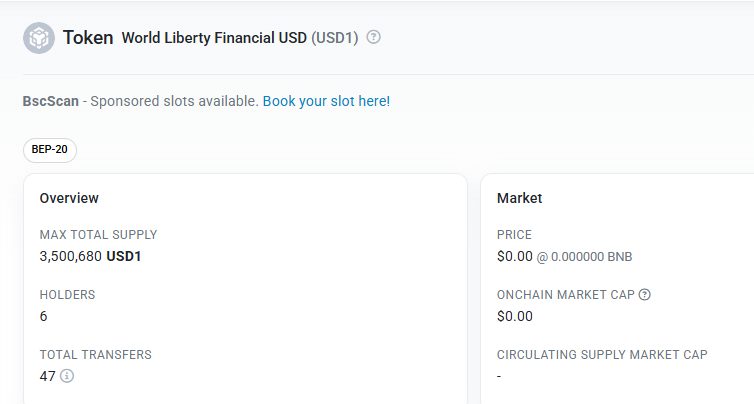

Recently, World Liberty Financial (WLFI), a crypto platform associated with the Trump family, launched the stablecoin USD1 on both the BNB Chain and Ethereum, with a total supply exceeding $3.5 million. This move is seen as another major strategic initiative following the launch of the Meme coin TRUMP in 2024, aimed at expanding the Trump family’s political and financial influence through crypto assets. However, as the Trump family foundation has not yet issued an official statement, the extent of their involvement remains unclear.

WLFI was established in September 2024, with Donald Trump Jr. serving as an advisor. Its core team includes individuals with a real estate background, such as Zachary Folkman and Chase Herro. Previously, the platform raised $550 million through a token sale and planned to build a decentralized lending market and on-chain payment tools. The launch of USD1 further reinforces its vision of “making cryptocurrency and America great again,” attempting to deeply integrate crypto payments with Trump’s political brand.

Technical Architecture of USD1 and Market Testing Progress

USD1 utilizes an over-collateralization mechanism, supports cross-chain transfers, and is planned to be integrated with WLFI’s lending protocol. On-chain data show that the public wallet of well-known market maker Wintermute has participated in test transactions, verifying its payment efficiency between the BNB Chain and Ethereum. Binance founder Changpeng Zhao (CZ) confirmed that the USD1 contract was deployed 20 days ago, but the project team emphasized that trading has not officially opened and caution is needed against scams.

Key technical highlights include:

-

Compliance Framework: Combining Worldcoin’s biometric verification with Visa’s KYC/AML systems to strike a balance between privacy and regulation;

-

Cross-Chain Collaboration: Partnering with crypto card service provider Rain, which has previously provided on-chain payment solutions for public chains like Optimism;

-

Smart Contract Optimization: Aiming to reduce cross-border payment costs to below 1% and shorten transaction times to the level of seconds.

Market Reaction: Speculation and Controversy from TRUMP to USD1

The launch of USD1 has sparked polarized market reactions. On one hand, the Trump family’s endorsement and Wintermute’s technical involvement have boosted investor confidence. On the other hand, its association has also raised controversies:

-

Conflict of Interest: WLFI co-founder Chase Herro once lost $1.8 million due to a project vulnerability, and while the Trump family holds 60% of the platform’s equity, specific members have not been disclosed;

-

Token Distribution Concerns: The TRUMP coin was previously criticized as a “scam” because 80% of the tokens were controlled internally, raising worries that USD1 might follow a similar path;

-

Liquidity Incentives: The BNB Chain simultaneously launched a $100 million liquidity program, with USD1 potentially becoming a key supported asset, driving BNB’s price toward a $700 target.

Regulatory Compliance: The GENIUS Act and Potential Risks

The biggest challenge facing USD1 comes from regulatory uncertainty. On March 13, the U.S. Senate passed the GENIUS Act, which requires stablecoin issuers to maintain a 1:1 USD reserve and conduct regular audits, yet USD1 has not yet published any reserve proof. In addition, WLFI may face the following risks:

-

Securities Classification Dispute: If the SEC deems USD1 an unregistered security, WLFI could face litigation;

-

Sanctions Evasion: The U.S. Treasury has warned that countries like Russia might use stablecoins to circumvent sanctions. If USD1 gets entangled, its assets might be frozen;

-

Data Privacy: Worldcoin’s iris scanning technology has triggered investigations in several countries, and USD1 will need to resolve conflicts between biometric data and user privacy.

If Trump is re-elected, some pressure might be alleviated. His digital assets advisor, Bo Hines, noted that the GENIUS Act might be submitted for signing in June, which could pave the way for compliant stablecoins. However, Democratic lawmakers have already called for an investigation into whether WLFI’s token sale constitutes securities fraud.

Future Outlook: A Battle Between Political Empowerment and Technological Implementation

In the short term, USD1 is scheduled to pilot in regions with strong cross-border payment demand, such as Southeast Asia and Latin America, in the second quarter of 2025. Long-term goals include integrating real-world assets (RWA), allowing users to collateralize properties, bonds, and other assets to mint stablecoins, and expanding use cases; creating a “Trump ecosystem” in tandem with the TRUMP coin to attract speculative funds and DeFi users; and AI-driven risk control, by collaborating with OpenAI to develop on-chain transaction monitoring models to intercept suspicious behaviors in real time.

For the industry, the success or failure of USD1 will test the feasibility of fusing political power with crypto technology. If it can balance compliance and innovation, it may drive stablecoins to transition from speculative tools to practical payment media; if it fails, it could lead to tighter regulations and impact overall market confidence.

For more content, please follow the JuCoin Research Institute!