Crypto derivatives have become essential instruments in modern digital asset markets, enabling traders, institutions, and decentralized organizations to manage risk, speculate on asset price movements, and build advanced financial strategies. These products, which derive their value from underlying cryptocurrencies such as Bitcoin or Ethereum, mirror their counterparts in traditional finance, futures, options, and swaps, but are uniquely adapted to the decentralized, 24/7 nature of blockchain economies.

Over the past few years, the market for crypto derivatives has grown exponentially. From centralized exchanges offering perpetual swaps to decentralized protocols enabling options vaults and synthetic futures, derivatives now play a pivotal role in liquidity provision, price discovery, and capital efficiency across Web3.

This Crypto Deep Dives article explores the mechanics, use cases, and evolving infrastructure of crypto derivatives, highlighting their critical role in market structure, liquidity, and risk management across both centralized and decentralized platforms.

What Are Crypto Derivatives?

Crypto derivatives are financial contracts whose value is based on the price of a digital asset. Rather than owning the asset directly, participants use these contracts to gain exposure, often with leverage. These instruments allow traders to speculate on price direction, hedge existing positions, or generate yield through structured strategies.

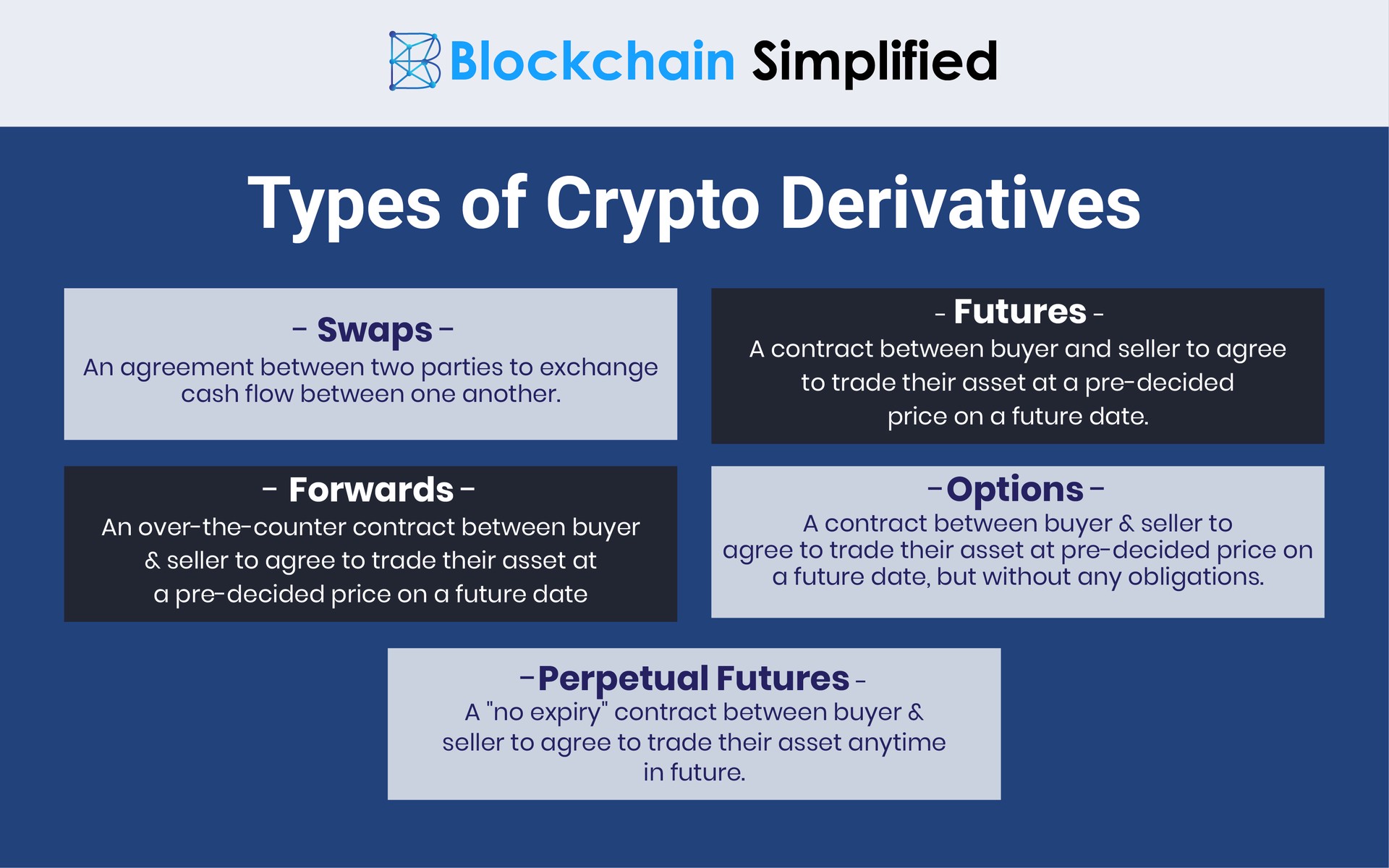

There are four main categories of crypto derivatives:

- Futures Contracts: Agreements to buy or sell an asset at a predetermined price at a future date. Crypto futures may be cash-settled or physically settled, and are common on both regulated venues like the CME and offshore platforms like Binance Futures.

- Perpetual Swaps: A crypto-native innovation, perps function like futures but without an expiry. A funding rate is exchanged between long and short traders to maintain price parity with the spot market.

- Options: Contracts granting the right, but not the obligation, to buy or sell a cryptocurrency at a specific price before a certain expiry. These instruments allow for volatility trading, income generation, and risk management.

- Structured Products: Financial instruments composed of multiple derivative layers (e.g., covered calls, straddles, volatility tranches) designed to deliver specific risk-return profiles. Many protocols automate these using smart contracts.

Evolution of The Crypto Derivatives Market

Crypto derivatives began gaining traction in 2016–2017 with early platforms like BitMEX introducing perpetual contracts and leverage trading. The launch of CME Bitcoin futures in 2017 marked the first step toward institutional legitimacy.

By 2020, Binance, OKX, and Bybit had become major players in offering high-leverage derivatives, serving both retail and professional traders. Simultaneously, DeFi protocols such as dYdX, Synthetix, and Opyn began building decentralized counterparts, enabling users to trade derivatives without intermediaries, custody risk, or permissioned access.

Between 2023 and 2025, innovation accelerated with the rise of intent-based derivatives, on-chain vaults, modular options infrastructure, and Layer 2-native trading platforms offering cross-margin and real-time execution.

Core Mechanisms & Technical Concepts of Crypto Derivatives

Perpetual Contracts

Perpetuals are the most widely traded crypto derivatives. Unlike standard futures, perps have no expiry and rely on funding rates to maintain a close alignment with spot prices. When the perp price is above the spot price, long traders pay short traders a fee and vice versa. This continuous adjustment helps anchor the contract to real market dynamics.

For example, on dYdX, traders can go long or short on ETH-USD perpetuals using USDC as collateral. The platform uses oracles to calculate mark price, and a smart contract-based funding rate to rebalance incentives every hour.

Options Trading

Options introduce flexibility by allowing traders to profit from directional moves, volatility, or to generate yield. Crypto options are largely European-style, meaning they are settled at expiry.

Deribit dominates the crypto options market for BTC and ETH. In DeFi, platforms like Lyra offer options via automated market makers (AMMs), and protocols like Dopex provide structured vaults like covered calls, which automatically execute weekly options strategies for depositors.

Structured Products

Protocols such as Ribbon Finance and Opyn introduced DeFi-native structured products. These are often sold in the form of vaults, where users deposit crypto into a contract that uses the funds to sell options, harvest premiums, and auto-roll strategies over time.

Use case: A USDC deposit into a Ribbon vault might earn 10% APY by selling ETH call options weekly, giving the user a relatively passive income stream with defined risk exposure.

Institutional & Retail Use Cases

Crypto derivatives serve distinct needs across user segments:

- Speculation: Retail traders use leverage to bet on short-term price movements. This is especially prevalent on perpetual swap platforms like Binance and Bybit.

- Hedging: Institutional players, miners, and DAO treasuries use futures or options to mitigate price exposure. A miner may short BTC futures to lock in future profits, while a DAO may use put options to hedge treasury volatility.

- Volatility Exposure: Sophisticated traders speculate directly on volatility using straddle/strangle strategies or derivatives like Squeeth, which track squared volatility.

- Yield Generation: Users can sell options (e.g., covered calls or cash-secured puts) to earn premium income. Protocols such as Thetanuts and StakeDAO automate these strategies for passive investors.

- DAO Treasury Management: DAOs like Lido and Aave use derivatives to manage reserves and protect protocol stability in bear markets through hedged positions or synthetic delta-neutral vaults.

Crypto Derivatives Market Infrastructure & Leading Platforms

Centralized Exchanges

CEXs remain dominant in terms of derivatives volume and depth. Top players include:

- Binance Futures: Offers BTC, ETH, and altcoin futures and perps with high leverage.

- Deribit: Specializes in options, serving institutions with deep liquidity and complex order types.

- CME Group: Offers regulated BTC and ETH futures for institutional exposure.

- OKX / Bybit: Feature rich perpetual and options markets with cross-margin support and liquidity pools.

In addition, JuCoin provides USDT-margined futures contracts. These contracts allow traders to engage in leveraged trading using USDT as collateral, enabling both long and short positions on various cryptocurrency pairs. This feature is particularly beneficial for traders looking to hedge positions or speculate on market movements without holding the underlying assets.

JuCoin’s USDT-margined futures platform supports a range of trading pairs and offers leverage options, providing flexibility for both retail and institutional traders. The platform’s interface is designed to facilitate efficient order execution and real-time risk management.

For more detailed information on available trading pairs, leverage limits, and platform features, please visit JuCoin’s official website.

Decentralized Derivatives Protocols

DEXs bring transparency, self-custody, and permissionless access. Major platforms include:

- dYdX: A decentralized perpetuals exchange, moving toward full decentralization with its own Cosmos-based appchain.

- GMX: A perpetual DEX that uses a shared liquidity pool (GLP) instead of order books. Popular for passive yield and low-fee trading.

- Lyra: On-chain options AMM with integration into Optimism and Arbitrum.

- Synthetix/Kwenta: Offers synthetic perpetuals with real-time pricing and native leverage on L2s.

- Aevo: Advanced DEX for options and perps with customizable strategies and an orderbook model.

The Role of Derivatives In Market Structure & Price Discovery

Crypto derivatives play an essential role in shaping the broader structure and behavior of digital asset markets. One of their most critical functions is in price discovery. In highly liquid markets, derivatives, especially perpetual futures, often lead spot prices during periods of high volatility or market stress. This is because futures markets concentrate a large share of leverage, allowing traders to rapidly express directional views. As a result, changes in open interest or shifts in funding rates often serve as leading indicators for broader market sentiment.

In terms of market depth and liquidity, derivatives significantly enhance the efficiency of crypto markets. They enable more participants to engage with fewer capital constraints by offering leverage and capital efficiency. This increased activity tightens bid-ask spreads and improves order book resiliency across centralized and decentralized exchanges. For example, platforms like Binance Futures routinely support higher daily trading volumes than their spot counterparts, underscoring how derivatives act as liquidity amplifiers.

Additionally, derivatives provide infrastructure for arbitrage between markets. Traders often exploit temporary price discrepancies between spot and derivatives platforms, such as between on-chain perps on GMX or Synthetix and off-chain contracts on Binance or OKX. These arbitrage mechanisms help align market pricing across ecosystems, reduce fragmentation, and stabilize trading conditions. Over time, the presence of efficient derivatives markets contributes to more transparent and responsive asset pricing, forming the backbone of an increasingly institutionalized and data-driven crypto economy.

Derivatives also play a unique role in shaping market behavior and volatility regimes. Changes in funding rates, open interest, or skew in options markets often trigger broader shifts in narrative, serving as key data points for both quantitative and discretionary traders. In short, the presence and health of derivative markets are critical to the maturity and resilience of digital assets.

Risk Management & Safeguards In Crypto Derivatives Protocols

The inherent leverage offered by crypto derivatives makes robust risk management mechanisms essential. Without proper safeguards, derivatives trading can quickly lead to cascading liquidations, insolvency events, or protocol instability. To mitigate these risks, both centralized and decentralized platforms implement a layered approach to margining, pricing, and liquidation.

One of the primary tools used to maintain balance in perpetual contracts is funding rate management. This mechanism continuously incentivizes traders to align perpetual prices with spot markets. For example, when perpetual prices drift above spot, the funding rate turns positive, requiring long traders to pay shorts. This financial incentive encourages rebalancing and helps tether derivatives to real-world asset values, reducing systemic imbalances.

Protocols maintain insurance funds to further protect against market shocks. These pools, funded through trading fees or liquidity provider contributions, act as a backstop in cases where liquidated positions cannot be closed profitably. GMX, for instance, uses a community-sourced GLP pool to underwrite trades, while centralized platforms like Binance maintain dedicated insurance funds to absorb losses and protect against clawbacks.

Liquidation engines are also critical for maintaining market solvency. Advanced engines use partial and progressive liquidation models to reduce systemic risk. Instead of fully liquidating a trader’s position at once, platforms like dYdX and Synthetix perform incremental reductions based on real-time risk thresholds. This approach prevents market-wide liquidation spirals and preserves user capital.

Accurate and timely oracle pricing underpins all of these systems. Protocols like Chainlink and Pyth supply low-latency, tamper-resistant feeds to mark prices, determine collateral values, and trigger margin calls. Without reliable oracles, derivatives contracts would be prone to manipulation and untrustworthy execution.

Finally, modern derivatives platforms are adopting cross-margin and portfolio margin models to improve capital efficiency. These systems evaluate a trader’s entire portfolio rather than assessing each position in isolation, allowing for better risk-adjusted margin usage. Newer decentralized exchanges like Vertex and Helix are incorporating advanced margin engines and cross-chain risk reconciliation to bring institutional-grade sophistication to on-chain derivatives trading.

Together, these mechanisms form the foundation of a secure, scalable, and transparent derivatives ecosystem, one capable of supporting increasingly complex and composable financial applications in the Web3 economy.

The Future of Crypto Derivatives

Looking ahead, the crypto derivatives space is evolving toward higher composability, regulatory compatibility, and mainstream adoption. Key directions include:

- Tokenized Real-World Derivatives: Projects like Synthetix are exploring perps on commodities, forex, and indices.

- Intent-Based Trading: Protocols will allow users to specify trade conditions (e.g., “Buy ETH perp if funding < 0”) and have the network match the execution.

- Decentralized Clearing: New clearing layers may emerge to handle on-chain settlement and margin reconciliation between counterparties.

- Volatility Markets and Derivative Indices: Expect more implied volatility products, VIX-like indexes, and ETF-style derivatives for long-term exposure.

- Modular Derivative Toolkits: Developers will access SDKs to plug customizable derivatives into any DApp or protocol, powering use cases from prediction markets to AI coordination.

Crypto derivatives are far more than speculative tools, they are the infrastructure layer enabling mature market functions, institutional access, and capital-efficient DeFi systems. Whether traded on centralized venues or decentralized platforms, these instruments underpin liquidity, support innovation in protocol design, and help bridge the volatility and complexity of digital assets with the structured needs of global finance.

As crypto continues to evolve, derivatives will remain at the heart of its financial architecture, powering everything from DAO treasuries and on-chain hedge funds to decentralized volatility indexes and programmable trading agents.