Key Takeaways

- Berachain is an EVM-identical Layer 1 blockchain utilizing Proof-of-Liquidity (PoL), prioritizing users and applications over validator rewards.

- The platform employs a tri-token system: BERA (gas token), BGT (soulbound governance token), and HONEY (native stablecoin).

- Proof-of-Liquidity radically changes L1 economics by incentivizing liquidity provision, contributing to efficient trading and price stability.

- Berachain’s BeaconKit is a modular framework for building EVM consensus clients with benefits like increased composability and single slot finality.

- The platform launched its mainnet on February 6, 2025, and has seen significant adoption with approximately $1.55 billion in Total Value Locked (TVL).

Berachain has firmly established itself as a cornerstone of the decentralized finance ecosystem with its innovative approach to blockchain technology. This high-performance EVM-identical Layer 1 blockchain introduces the novel Proof-of-Liquidity (PoL) consensus mechanism, offering a fresh perspective on how blockchain networks can align incentives between validators, users, and applications.

Initially starting as an NFT project called “Smoking Bears” in August 2021, Berachain has evolved into a comprehensive DeFi hub featuring advanced tokenomics, fast transaction finality, and a robust ecosystem of decentralized applications. The project officially launched its mainnet on February 6, 2025, marking a significant milestone in its development journey. As of April 15, 2025, BERA is trading at $4.00, with a circulating supply of approximately 107.48 million tokens and a market capitalization of $430.99 million.

What Is Berachain?

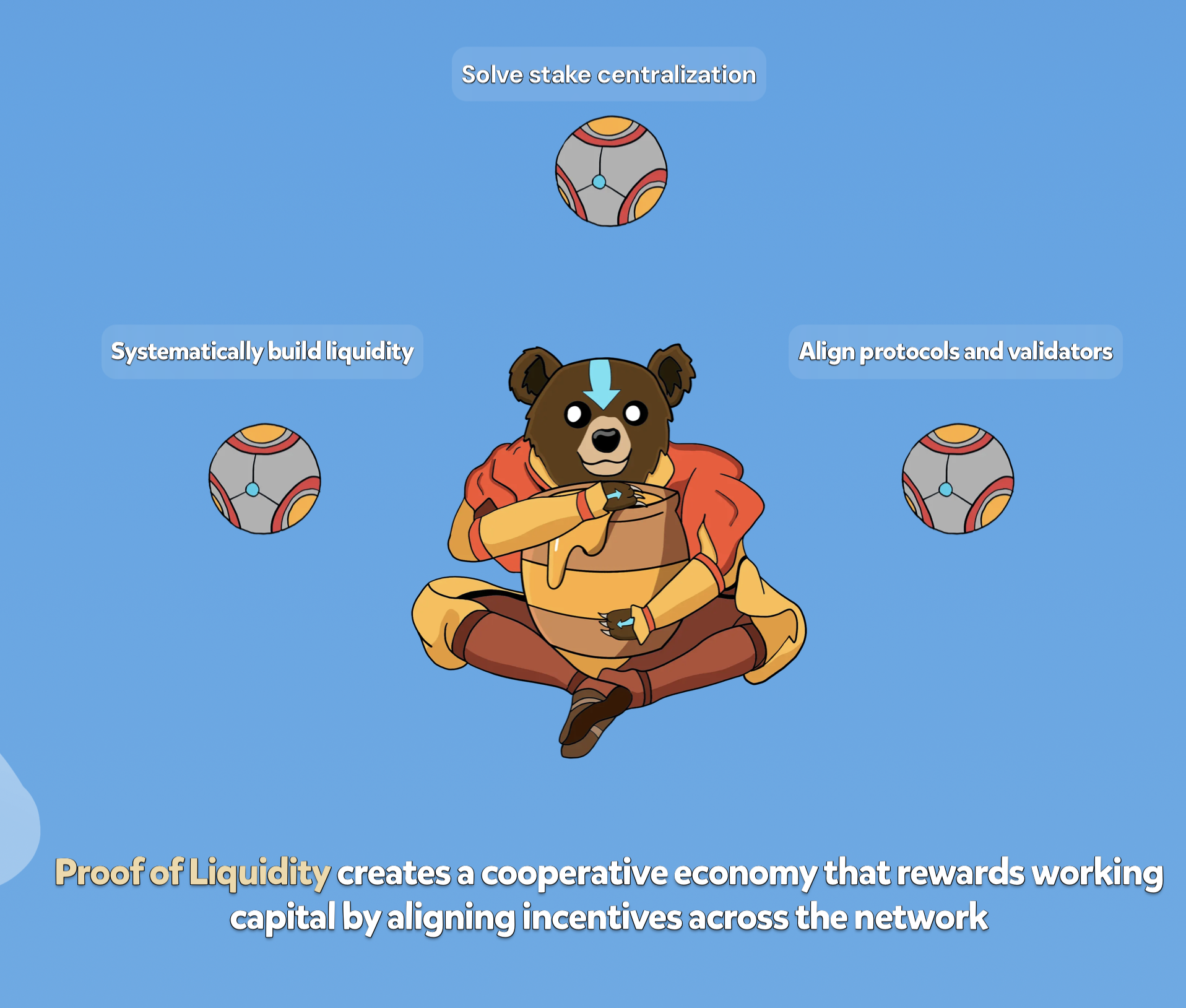

Berachain is an EVM-identical Layer 1 blockchain built on the Cosmos SDK, designed to address key challenges in the decentralized finance landscape. At its core, Berachain operates using the innovative Proof-of-Liquidity (PoL) consensus mechanism, which radically changes traditional L1 economics by prioritizing users and applications over validator rewards. This approach encourages the provision of liquidity within the ecosystem, contributing to efficient trading, price stability, and overall network growth.

The project emerged at a time when most DeFi applications operated exclusively on Ethereum, which was suffering from expensive and slow transactions due to network congestion. Berachain offers users a welcome alternative with significantly lower fees and faster processing times while maintaining complete compatibility with Ethereum’s infrastructure. This compatibility allows existing Ethereum smart contracts, wallets, tools, and infrastructure to be ported directly over to Berachain, reducing friction for both developers and users.

Who Is Behind Berachain?

Unlike many cryptocurrency projects with visible founders and public teams, Berachain was created by a group of anonymous developers who refer to themselves as “Chefs.” The team reportedly consists of more than a dozen developers led by two individuals known by the pseudonyms “Hops” and “Thumper”. This approach to anonymity follows a tradition established by earlier DeFi projects, where development teams often maintain pseudonymous identities to emphasize the decentralized nature of their platforms.

Berachain’s development has been significantly supported by Binance, the world’s largest cryptocurrency exchange and creator of BNB Chain. This relationship has proven instrumental to Berachain’s growth and adoption, providing both technical infrastructure and marketing support. The platform secured over $1 million in its initial seed round in June 2020, followed by a more substantial $4 million fundraise in July 2021.

More recently, in April 2023, Berachain developers raised $42 million in a Series A funding round at a valuation of $420.69 million, led by Polychain Capital with participation from Hack VC and other investors. In April 2024, it raised an additional $100 million in a round co-led by Polychain Capital and Framework Ventures, demonstrating strong institutional confidence in the project’s vision.

How Berachain Works: A Technical Explanation

Berachain’s technological foundation rests on three key pillars: its Proof-of-Liquidity consensus mechanism, EVM-identical architecture, and the innovative BeaconKit framework. The Proof-of-Liquidity (PoL) system represents a significant departure from traditional Proof-of-Stake (PoS) or Proof-of-Work (PoW) mechanisms. Instead of validators simply staking tokens to secure the network, Berachain encourages them to provide liquidity to DeFi applications within the ecosystem. This creates a synergy between validators and the ecosystem of projects, ensuring that liquidity is always available for trading and other financial activities.

The platform employs a tri-token system to support its operations. BERA serves as the gas token, used for transaction fees and validator staking. BGT (Berachain Governance Token) is a non-transferable, soulbound token earned by providing liquidity, which plays a crucial role in governance and directing rewards. Finally, HONEY is the network’s native stablecoin, designed to maintain a stable value pegged to the US dollar and backed by a diverse basket of cryptocurrencies.

Berachain’s EVM-identical execution layer means it uses existing unmodified execution clients like Geth, Reth, Erigon, and Nethermind to handle smart contract execution. This ensures compatibility with all tooling that comes native with the EVM and allows Berachain to adopt the latest EVM upgrades straight out of the box. For developers, this means they can deploy their Ethereum-based applications on Berachain without modifications, significantly reducing the barrier to entry.

Current Status Of Berachain In The Wider Ecosystem

In the competitive landscape of decentralized finance, Berachain has quickly established itself as a notable player since its mainnet launch in February 2025. The platform’s focus on liquidity provision at the consensus level has resonated with DeFi users seeking efficient trading environments and yield opportunities. As of early April 2025, Berachain has accumulated approximately $1.55 billion in Total Value Locked (TVL), demonstrating significant user adoption and confidence in the platform’s security and functionality.

Berachain’s ecosystem has grown to encompass various DeFi applications, including decentralized exchanges, lending platforms, and yield farming opportunities. Notably, the platform launched with Boyco, a pre-launch liquidity platform designed to bootstrap liquidity for decentralized applications on the Berachain ecosystem. By the time Boyco concluded and funds began bridging to Berachain’s mainnet, the platform had amassed an impressive $3 billion in total value locked, indicating strong initial interest from the DeFi community.

The platform’s cross-chain compatibility has been enhanced through integration with deBridge, enabling users to transfer assets between Berachain and 16 other supported blockchains. This interoperability is crucial for Berachain’s growth strategy, as it allows users from various blockchain ecosystems to explore and interact with applications built on Berachain without abandoning their existing assets or wallets.

Berachain’s Price Journey

BERA’s price history reflects both the enthusiasm surrounding its innovative technology and the broader market conditions affecting the cryptocurrency space. Following its launch on February 6, 2025, BERA experienced explosive initial growth, reaching its all-time high of $14.99 on the same day. This peak valuation was driven by the excitement surrounding the mainnet launch and airdrop of 79 million tokens, representing 15.75% of the total supply.

However, as often occurs with new token launches, profit-taking and market uncertainty triggered a steep decline, dragging BERA to a local low of $4.74, marking an almost 70% retracement from its peak in just a few days. Throughout March 2025, BERA traded in a consolidation range, finding support between $5.50 and $7.00, with occasional tests of higher levels around $8.50.

April 2025 has seen additional volatility, with BERA experiencing a significant correction to around $3.21 on April 9 before bouncing back to the $4.00 level where it currently trades as of April 15, 2025. This price action reflects the balance between continued user engagement with the platform and the ongoing challenges of maintaining token value in a competitive DeFi landscape.

Current Data & Interesting Statistics About Berachain

- Total Value Locked (TVL) in Berachain stands at approximately $1.55 billion, making it a significant player in the DeFi ecosystem.

- The platform’s 24-hour trading volume recently reached $1.56 billion, demonstrating substantial daily activity and liquidity depth.

- Berachain’s market capitalization is approximately $430.99 million as of April 15, 2025.

- Approximately 107.48 million BERA tokens are currently in circulation out of a total supply of 500 million.

- Berachain has recently implemented a new tokenomics model aimed at cutting emissions by 43% and redirecting incentives to long-term holders.

- The platform’s integration with deBridge enables interoperability with 16 other blockchain networks, enhancing its accessibility and utility.

- Berachain’s mainnet launch accumulated a remarkable $3 billion in total value locked through its pre-launch liquidity platform Boyco.

What Is The Future Of Berachain?

Berachain’s roadmap reveals ambitious plans to expand beyond its current functionality and establish itself as a comprehensive DeFi hub. The development team is focusing on enhancing cross-chain capabilities, implementing new financial instruments, and optimizing the platform’s tokenomics to ensure long-term sustainability. The recent implementation of new tokenomics represents a significant step toward reducing token emissions and incentivizing long-term holding, potentially addressing concerns about inflationary pressures on the BERA token.

As regulatory scrutiny of DeFi increases globally, Berachain’s ability to adapt to changing compliance requirements while maintaining its core decentralized values will be crucial to its long-term success. The platform’s strong community governance model positions it well to navigate these challenges through collective decision-making. Ultimately, Berachain’s success will hinge on its ability to deliver on the promise of combining high performance with user-aligned incentives in a way that truly differentiates it from existing blockchain solutions.

The Bear Necessities Of DeFi Innovation

Berachain has carved out a distinctive position in the blockchain landscape by reimagining how network incentives can align with user behavior through its innovative Proof-of-Liquidity consensus mechanism. From its humble beginnings as an NFT project to its current status as a fully-operational Layer 1 blockchain with billions in locked value, Berachain demonstrates how novel approaches to tokenomics and consensus can create vibrant ecosystems.

While the platform faces significant challenges, including regulatory uncertainty and fierce competition from established blockchain networks, its focus on liquidity provision at the consensus level offers a compelling value proposition for DeFi users and developers. As blockchain technology continues to evolve, Berachain’s experiment in liquidity-based consensus may prove to be an important chapter in the ongoing story of decentralized finance, potentially influencing how future networks approach the fundamental relationship between security, decentralization, and usability.