Key Takeaways

- dYdX is a decentralized perpetual futures exchange built on a Layer-1 network using the Cosmos SDK, offering professional trading features with deep liquidity and up to 100x leverage across 198+ markets.

- The platform launched a significant buyback program on March 24, 2025, allocating 25% of net protocol fees to purchase DYDX tokens, strengthening tokenomics by reducing circulating supply.

- dYdX v4 represents full decentralization where no central party receives trading fees, with all components including orderbook and matching engine operated on-chain.

- As of March 2025, 85% of DYDX tokens have been unlocked, with emissions set to drop by 50% in June 2025 and all token unlocks complete by June 2026.

- The transition from Ethereum Layer-2 to an independent blockchain demonstrates dYdX’s commitment to scalability and performance while maintaining decentralization principles.

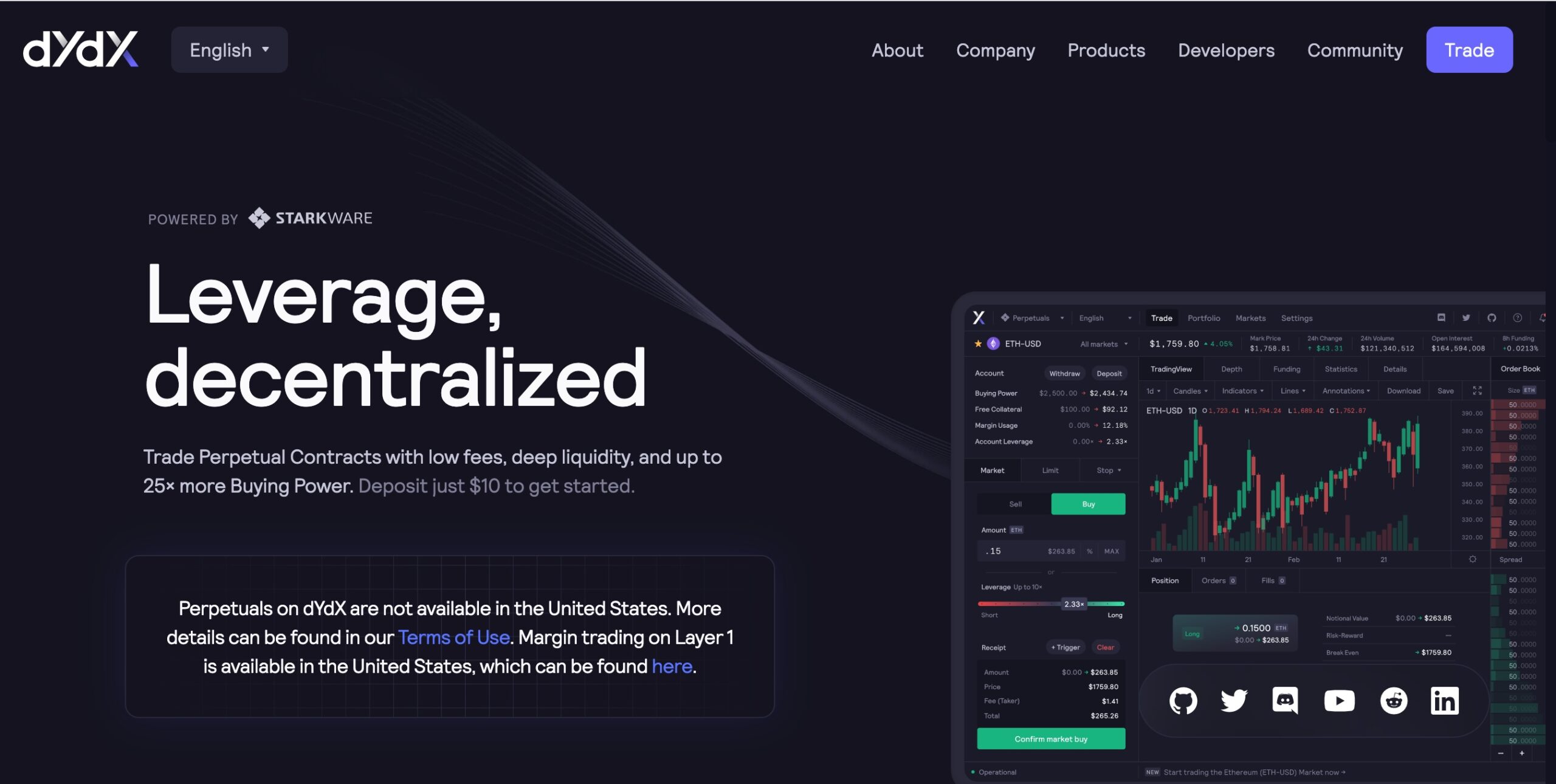

dYdX has established itself as a frontrunner in the decentralized finance (DeFi) space, offering a professional-grade perpetual futures trading platform that combines the freedom of decentralization with features typically found on centralized exchanges. Founded in 2017, dYdX has evolved from a simple margin trading protocol to a fully decentralized exchange with an independent Layer-1 blockchain.

The platform reached a significant milestone on March 24, 2025, with the launch of its first-ever DYDX buyback program, dedicating 25% of net protocol fees to purchase tokens from the open market. This initiative strengthens the alignment between platform growth and token value, while reducing circulating supply. As of April 23, 2025, DYDX is trading at approximately $0.6387, with a circulating supply of 183.77 million tokens and a market capitalization of around $117.45 million.

What Is dYdX?

dYdX is a permissionless perpetual futures trading exchange designed to offer traders a sophisticated platform that combines the best aspects of decentralized and centralized exchanges. The current iteration, known as dYdX v4, is built on a Delegated Proof-of-Stake (DPoS) Layer-1 network developed using the Cosmos SDK and secured by the CometBFT consensus mechanism. This architecture allows dYdX to provide institutional-grade performance with deep liquidity and lightning-fast execution while maintaining the benefits of decentralization.

The platform enables users to trade perpetual contracts with up to 100x leverage across more than 198 crypto markets. To begin trading, users connect a supported wallet and deposit USDC or another supported token, which is then converted to USDC on the Noble Chain for use on dYdX. The platform also offers a mobile application for iOS devices in eligible jurisdictions, making advanced trading accessible on the go. Crucially, no central party receives trading fees on dYdX, reinforcing its status as a truly decentralized exchange where all revenue is distributed back to the ecosystem through various mechanisms.

Who Is Behind dYdX?

dYdX was founded by Antonio Juliano in July 2017 with the vision of building “a decentralized protocol for financial derivatives built on the Ethereum blockchain.” Juliano, who previously worked at Coinbase, recognized the need for sophisticated trading tools in the emerging DeFi ecosystem and set out to create a platform that could rival centralized exchanges in functionality while maintaining the principles of decentralization.

The project has evolved significantly since its inception, with the dYdX Foundation now playing a crucial role in governance and ecosystem development. Established alongside the launch of the DYDX token in August 2021, the Foundation helps coordinate community governance and protocol upgrades. The current ecosystem also includes dYdX Trading Inc., which initially developed the protocol, and a community of developers, validators, and governance participants who collectively guide the platform’s future.

In 2018, the team launched its V1 Margin Protocol, which introduced flash loans and DEX aggregators. The project continued to evolve through various iterations, eventually launching a Layer-2 product built using Starkware in April 2021. This evolution culminated in the November 2023 launch of the dYdX Chain, which represented a major milestone in the project’s journey toward full decentralization.

How dYdX Works: A Technical Explanation

dYdX’s architecture represents a significant evolution in decentralized exchange technology, particularly with its transition to v4. The platform operates as a standalone blockchain with its own consensus mechanism, orderbook, and matching engine—all decentralized end-to-end. This structure differs from many other DeFi protocols that typically build on existing blockchains, allowing dYdX to optimize specifically for trading performance.

The core innovation of dYdX lies in its orderbook trading model, which enables professional trading experiences not possible with automated market makers (AMMs) commonly used in DeFi. This orderbook approach allows for advanced order types, precise price execution, and deep liquidity pools that attract both retail traders and institutional participants. The matching engine processes orders with sub-second latency, handling tens of millions of orders per day while maintaining high throughput. This performance is achieved through a specialized Layer-1 blockchain that prioritizes trading efficiency.

Beyond the core trading functionality, dYdX incorporates several distinctive features that enhance the user experience. The platform offers passive yield generation through MegaVault, allowing users to earn returns on USDC deposits without complex staking requirements. For team trading, dYdX provides Permissioned Keys that enable custom access levels and automated execution while maintaining secure control over accounts. The platform also supports instant market listings through a permissionless framework, allowing new assets to be traded before they appear on centralized exchanges.

The DYDX token serves multiple functions within this ecosystem, acting as both a governance token and utility token. Token holders can vote on protocol changes, participate in staking to secure the network, and benefit from various incentive programs. The recent buyback program further strengthens the token’s position by creating constant buying pressure and reducing the circulating supply over time.

Current Status Of dYdX In The Wider Ecosystem

Within the competitive landscape of decentralized exchanges, dYdX has carved out a distinctive position as a leading perpetual futures platform. The exchange has grown to become one of the largest decentralized exchanges by trading volume, actively challenging major centralized exchanges for market share. This achievement is particularly notable given the complex nature of derivatives trading, which has traditionally been dominated by centralized platforms due to performance requirements.

The dYdX ecosystem continues to expand, with 198+ markets now available for trading across a wide range of cryptocurrencies. The platform’s focus on performance and user experience has attracted a diverse user base, from retail traders to sophisticated market makers and institutional participants. This broad adoption is reflected in the platform’s deep liquidity, which is crucial for a functional derivatives exchange.

In terms of tokenomics, dYdX is entering a new phase with 85% of DYDX tokens having been unlocked as of March 1, 2025. Emissions are set to drop by 50% in June 2025, with all token unlocks scheduled to be complete by June 2026. This controlled release schedule, combined with the new buyback program, suggests a maturing approach to tokenomics designed to balance incentives for network participation with long-term value accrual. The migration from Ethereum to dYdX’s Layer-1 in 2023 has also reshaped the token landscape, with 86% of DYDX tokens now on the dYdX Chain and 14% remaining on Ethereum as ethDYDX.

dYdX’s Price Journey

The DYDX token has experienced significant price volatility since its introduction, reflecting both broader market conditions and project-specific developments. According to available data, DYDX was valued at $0.6649 at the same time last week and has experienced a change of +17.29% over that period, bringing its current price to $0.6387. Despite short-term fluctuations, the token has shown a 4.09% increase within the last 24 hours.

Looking at longer-term price projections, some analysts suggest potential upside for DYDX, with predictions indicating a possible surge to $3.23 by 2026. For 2025 specifically, price forecasts suggest DYDX could reach around $5.95, representing a significant increase from current levels. However, it’s important to note that cryptocurrency price predictions are inherently speculative.

The token’s price has been influenced by several factors, including the platform’s technical developments, ecosystem expansion, and broader cryptocurrency market trends. The recent launch of the buyback program on March 24, 2025, represents a significant tokenomics change that could potentially impact price action by reducing circulating supply over time. Additionally, the scheduled reduction in token emissions, with a 50% drop planned for June 2025, may create more favorable supply-demand dynamics for the token moving forward.

Current Data & Interesting Statistics About dYdX

- dYdX offers over 198 markets with up to 100x leverage, making it one of the most comprehensive decentralized derivatives platforms available.

- As of March 1, 2025, 85% of DYDX tokens have been unlocked, with emissions set to drop by 50% in June 2025 and all token unlocks complete by June 2026.

- The dYdX Community Treasury currently holds approximately 190 million DYDX tokens reserved for future community-driven initiatives and ecosystem growth.

- Net protocol revenue is now distributed as: 10% to the Treasury SubDAO, 25% to MegaVault, 25% to the Buyback Program, and 40% to Staking Rewards.

- 86% of DYDX tokens are now on the dYdX Chain, with the remaining 14% on Ethereum as ethDYDX, with proposals to discontinue the cross-chain bridge in June 2025.

- The platform launched dYdX Unlimited in November 2024 and reimagined its mobile trading experience in February 2025, demonstrating ongoing product development.

- dYdX is currently running one of the largest trading competitions in DeFi, “dYdX Surge,” with up to $20 million in DYDX tokens available as rewards.

What Is The Future Of dYdX?

The future outlook for dYdX appears focused on three key areas: enhancing platform capabilities, expanding market offerings, and strengthening tokenomics. The project’s roadmap includes advancements in Spot Trading, Multi-Asset Margining, and EVM Support, which would significantly expand the platform’s functionality beyond perpetual futures. The buyback program launched in March 2025 represents just the beginning of a broader tokenomics strategy, with governance discussions suggesting the allocation for buybacks could increase to 100% of net protocol fees over time.

This would accelerate token supply reduction and potentially strengthen validator incentives and network security. The platform’s continued evolution toward full decentralization, combined with its professional trading tools and deep liquidity, positions dYdX to potentially lead the next wave of DeFi adoption among sophisticated traders. As institutional interest in decentralized finance grows, dYdX’s emphasis on performance and security could prove to be a decisive competitive advantage.

Trading Without Limits: The Future of Decentralized Finance

dYdX represents a significant milestone in the evolution of decentralized finance, successfully bridging the gap between the permissionless nature of DeFi and the performance demands of professional trading. By building a fully decentralized exchange with institutional-grade features, dYdX demonstrates that blockchain-based financial applications can compete directly with traditional centralized alternatives.

The platform’s journey from an Ethereum-based protocol to an independent Layer-1 blockchain illustrates both the challenges and opportunities in scaling decentralized applications to meet real-world demands. As the crypto ecosystem continues to mature, platforms like dYdX that prioritize both technical excellence and user experience will likely play an increasingly important role in expanding the adoption of decentralized finance beyond early adopters to mainstream financial participants.