Xeleb Protocol targets “verifiable utility of AI agents.” With a launchpad and no-code tools, creators can quickly generate, ship, and monetize agents. XCX acts as the fuel for payments, governance, and incentives, stressing visible, utilitarian value accrual. This Innovation and Tech article analyzes Xeleb’s model, token, and milestone evaluation points.

Summary: Xeleb records real agent behavior with a PoU mechanism and issues rewards by usage and contribution; XCX has a fixed supply with transparent allocation, covering governance, staking, and ecosystem incentives.

What exactly are Xeleb Protocol’s positioning and PoU model?

As an “AI Agent Launchpad,” Xeleb Protocol provides an end-to-end toolchain for agent creation, on-chain issuance, and monetization, and uses Proof-of-Utility (PoU) to account for an agent’s real value: every verified action is recorded, and only impactful behavior earns rewards—shifting attention from hype to sustainable utility. The official docs also emphasize decentralized governance and partner support, offering transparent incentive rules for creators and brands.

How does PoU run through the product path?

From persona and task definition to on-chain issuance and brand integrations, Xeleb records interactions, conversions, and revenue splits on-chain; XCX settles payments and governance votes, and can gate access to higher-tier agent capabilities or campaign thresholds.

How are XCX token economics allocated, and do utilities form a closed loop?

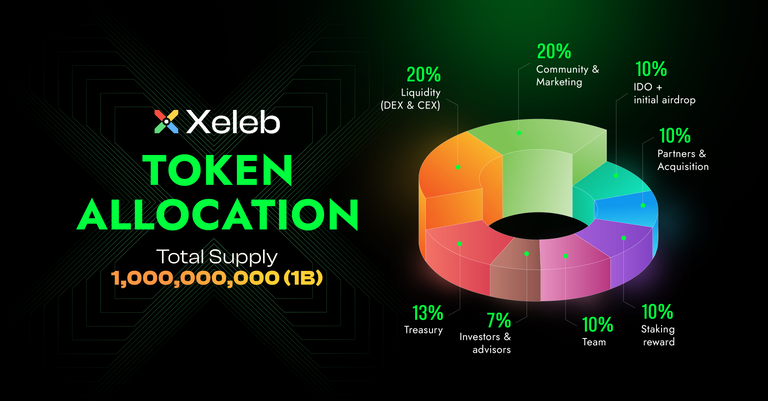

Xeleb’s official GitBook lists a total supply of 1 billion with the following allocations: Sale 10%, Staking 5%, Team 10%, Marketing 10%, Partners & Acquisitions 25%, Ecosystem 30%, CEX/Airdrop 5%, Liquidity 5%. Most tranches carry 6–12-month cliffs with 36–48-month linear vesting. Utilities span governance and launch/retail access, brand bidding, staking and insurance pools, and NFT/metaverse use cases.

CoinMarketCap likewise lists a 1 billion cap but with a different split (e.g., “Community & Marketing 20%,” “Liquidity 20%,” etc.). Use official docs as primary sources and cross-check third-party pages and the block-explorer contract address (BEP-20: 0xE32f…448Eaf).

How does it make AI agents produce “verifiable utility”?

Within the BNB ecosystem, Xeleb offers no-code building and on-chain issuance for agents. Through a closed loop of “tasks → behavior → settlement,” brand bidding, fan engagement, and creator revenue are bound to auditable on-chain events. Usage-based rewards and audited contributions (e.g., performance improvements, compliance reviews) are settled in XCX to align growth with value capture.

How is it different from traditional “traffic revenue sharing”?

Xeleb Protocol maps “who delivered actual outcomes” to measurable indicators, reducing distortions from pure-exposure rewards. PoU records combined with governance voting improve explainability for long-term retention and brand repurchase.

Compared with other AI platforms, where are Xeleb Protocol’s boundaries and advantages?

Launchpad positioning: integrated “create → launch → monetize → govern,” lowering first-launch and scale-up barriers.

Economic alignment: fixed XCX supply with fee recycle; incentives distributed around actual usage and performance.

Ecosystem embedding: listings in the BNB ecosystem directory and disclosures from security auditors improve discoverability and risk control.

What do ecosystem collaborations and recent milestones indicate?

Future roadmap

-

PoU data layer opening: finer-grained behavioral metrics and open APIs for third-party analytics and performance provenance.

-

Brand bidding & marketplace upgrades: enhance auction/rebuy incentives to improve budget efficiency and stabilize creator revenues.

-

Creator-economy expansion: introduce advanced components (skill packs/knowledge bases/NFT passes) and secondary trading to reinforce value accrual.

-

Multichain & cost optimization: extend to more chains and optimize settlement while staying compliant, reducing fees and latency for high-frequency interactions.

-

Governance & grants: proposal → vote → milestone-based disbursement for ecosystem tools and vertical agents to deepen community participation.

-

Compliance & transparency: ongoing disclosures of contracts, unlocks, and activity data plus audits/privacy settings to raise institutional trust.

Milestone tracking checklist (for operations and research)

New brands/creators onboarded; monthly PoU-verified actions; campaign GMV and repurchase rate; contract/network expansion progress; governance pass rate and grant recovery efficiency.

The BNB ecosystem directory lists the project under “AI Agent Launchpad/Creation/Platform” with “XCX powering transactions, rewards, and governance.” Major data sites provide first-listing dates, totals, and contract information to support pre-compliance checks and activity tracking. Overall, Xeleb Protocol’s public materials converge on three threads: Proof of Utility, creator economy, and usage-based incentives.

FAQ

How is PoU different from “on-chain scoring”?

PoU targets verified, concrete actions—aligning contribution and rewards—rather than static scores or one-off campaign grants.

What are XCX’s main uses?

Governance and access, brand bidding, staking and insurance pools, NFT/content unlocks—centered on a usage-based economic loop.

Why do I see two allocation versions?

Official GitBook vs. some third-party sites differ; prioritize the official version and cross-verify with explorers and audit reports.

Where can I view the project overview and contract networks?

See the BNB DappBay project page for positioning, networks, and auditor sources, then return to official docs for tokenomics and governance details.

Any external partnerships and media coverage?

Official materials and data sites include “partners and investors” narratives and listing schedules for cross-checking activities and cadence.

Key Takeaways

PoU binds “real behavior → value distribution,” avoiding incentive distortions from pure exposure or wash activity.

XCX has a 1 billion fixed supply with public allocations/vesting, covering governance, access staking, brand bidding, and insurance pools.

The launchpad and no-code tools reduce creator/brand onboarding costs and support repeatable funnel design.

Xeleb’s ecosystem pages and data sites provide contracts and key metadata, aiding risk control and diligence.

Usage-based rewards extend to “behind-the-scenes” contributions like auditing and optimization.

Prefer official docs and cross-check third-party splits and contract addresses.