Yala is a decentralized protocol dedicated to unlocking Bitcoin liquidity by minting the BTC-backed stablecoin $YU, driving Bitcoin adoption in DeFi and real-world use cases. With the launch of the $YALA token in July 2025, Yala completed a crucial upgrade from a liquidity tool to a full ecosystem. This Token Insights will analyze It’s value proposition and investment opportunities across core protocol logic, tokenomics, ecosystem partnerships, and risk outlook.

Summary:Yala closes the Bitcoin liquidity loop via the $YU stable asset, while the $YALA token powers incentives, governance, and security. Backed by institutions like Polychian and Galaxy, its ecosystem has rapidly expanded to become a hub for BTC-Backed DeFi.

Yala Protocol Overview: Leveraging Bitcoin Liquidity

Yala employs a “BTC Demand → Liquidity → Adoption → Growth” flywheel. BTC holders lock Bitcoin to mint $YU, deploy $YU in DeFi for yield, and thereby create new demand and market cap for BTC. Key modules include:

-

Stability Pool: Users deposit $YU to absorb liquidations, earning $YALA rewards and a share of collateral.

-

Mint & Redeem: Lock BTC to mint equivalent $YU; redeem by burning $YU to unlock BTC.

-

Notary Bridge Network: LayerZero-powered cross-chain verification ensures $YU remains safely pegged to BTC.

This design makes it the first protocol to seamlessly integrate high-frequency BTC liquidity into multi-chain DeFi, lowering barriers and extending Bitcoin’s ecosystem.

$YALA Tokenomics: Allocation, Roles & Incentives

Token Roles

-

Incentives: Rewards for Stability Pool contributors and liquidity providers.

-

Security: Stake $YALA on Notary Bridge validator nodes to secure cross-chain operations.

-

Governance: Holders vote on protocol parameters and upgrades.

Allocation & Vesting

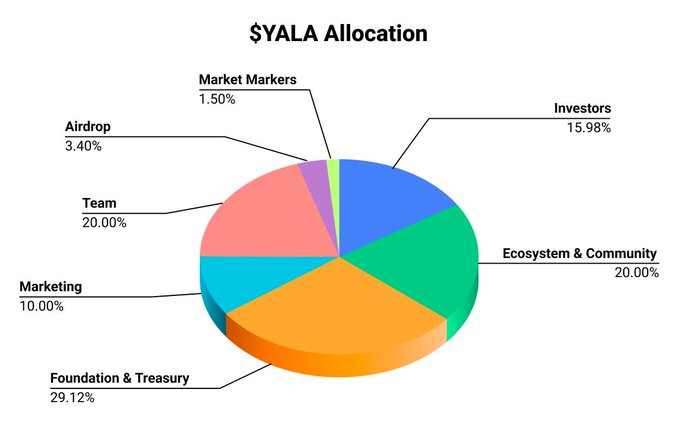

| Category | Share | Unlock Schedule |

|---|---|---|

| Investors | 15.98% | 1-year cliff, then linear quarterly over 18 months |

| Ecosystem & Community | 20.00% | 45% at TGE; remaining 55% linear over 24 months |

| Foundation & Treasury | 29.12% | 30% at TGE; 1-year cliff, then linear over 36 months |

| Marketing | 10.00% | 20% at TGE; 1-year cliff, then linear over 24 months |

| Team | 20.00% | 1-year cliff, then linear monthly over 24 months |

| Airdrop | 3.40% | One-time to early contributors; fully unlocked at TGE |

| Market Makers | 1.50% | Released per market-making agreements to support liquidity |

This model balances long-term growth and market liquidity, preventing large dumps and encouraging sustained community participation.

Ecosystem Partnerships & Institutional Support

-

Backers: Polychian Capital, Galaxy Digital, Ethereal Ventures among strategic investors.

-

Integrations: DeFi protocols across stablecoins, lending, and AMMs broaden $YU’s use cases.

-

Community: AMA sessions and incentive events on Discord and Telegram have drawn over 30,000 active participants.

These collaborations solidify Yala’s leadership in BTC-Backed DeFi and pave the way for further cross-chain integrations and real-world deployments.

Platform Development & Product Updates

-

Mainnet Launch: Deployed LayerZero Notary Bridge on Ethereum, Arbitrum, Polygon, etc.

-

Stability Pool v2: Introduced dynamic reward multipliers that adjust $YALA emission rates based on market risk and TVL.

-

Frontend Enhancements: New dashboard for real-time monitoring of $YU debt positions, liquidation rates, and rewards.

-

Mobile Wallet Support: Integrated Coinbase Wallet, MetaMask Mobile, lowering the barrier for everyday users.

This dual focus on protocol and UX accelerates It’s transition from testnet to mainnet and continuously attracts new liquidity and users.

Risk Assessment & Challenges

-

Collateral Risk: Sharp BTC price swings could overstrain the liquidation module, risking a liquidation spiral.

-

Cross-Chain Security: Notary Bridge relies on LayerZero and validator nodes; flash loans or malicious actors could endanger bridged assets.

-

Token Sell-Pressure: Large unlocks by investors and the foundation may exert short-term downward pressure.

-

Competition: Other BTC-Backed protocols like Sovryn or BadgerDAO are also vying in this space; It must maintain technical and ecosystem differentiation.

Investors should monitor security audits, liquidation-mechanism enhancements, and the token unlock schedule to manage position risk.

FAQ

-

How do I mint $YU?

Connect your wallet on the Yala Dashboard, deposit BTC into the smart contract, and receive equivalent $YU. -

How do I earn $YALA rewards?

Deposit $YU into the Stability Pool and hold a debt position; rewards are distributed automatically based on pool share. -

What is the $YALA governance model?

Token holders submit proposals and vote on parameter changes; veYALA locking for vote-weight boosting will be introduced. -

Where can I use $YU?

Supported on Aave, Curve, Uniswap V3, and select CeFi BTC-collateral lending platforms. -

How do I join community activities?

Join Yala’s official Discord and Telegram for AMAs, airdrops, and testnet tasks to earn additional incentives.

Key Takeaways

-

Yala delivers a closed-loop BTC liquidity protocol via $YU minting and Stability Pool liquidations.

-

$YALA token drives incentives, governance, and security; 23.4% of supply allocated to airdrops and ecosystem incentives.

-

Backed by top institutions, integrating multi-chain DeFi applications.

-

Ongoing product improvements in cross-chain bridging, dynamic rewards, and mobile support enhance UX.

-

Key risks include liquidation stability, cross-chain security, and token unlock cadence.