Market Review: From Policy Optimism to Price Correction

Since Trump’s election victory in 2024, Bitcoin surged from $60,000 to over $100,000 by January 2025, marking a 66% increase. This rally was fueled by Trump’s pro-crypto policies, including supporting state-level Bitcoin reserves, dismissing SEC Chair Gary Gensler, and loosening mining regulations. However, as these policies began to materialize, the market experienced a “buy the rumor, sell the news” effect.

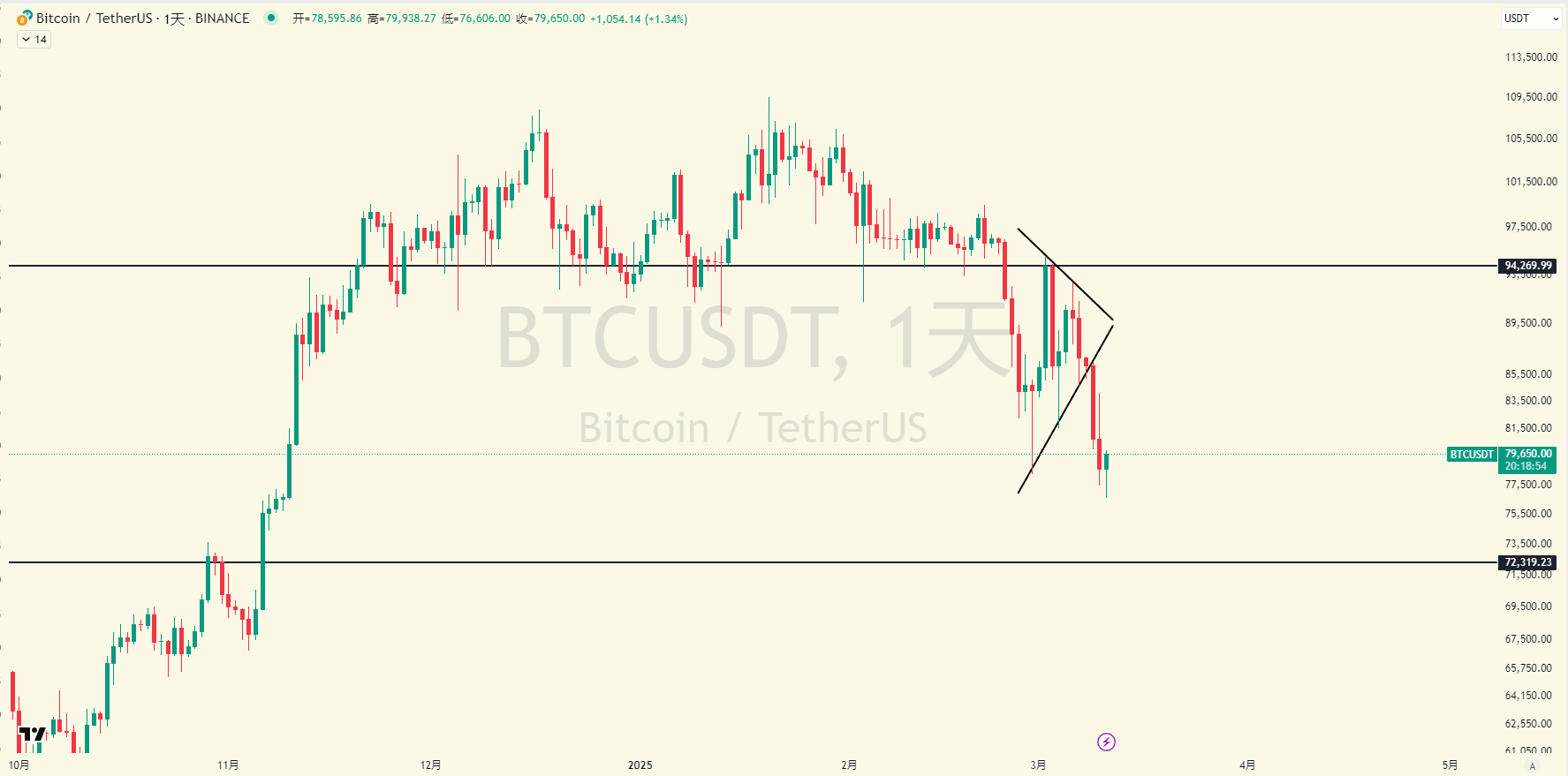

By March 2025, Bitcoin fell below $80,000, and Ethereum dropped to $1,700—more than a 30% pullback from their all-time highs. According to JuCoin data, Bitcoin hit a low of $76,000 on March 10, with over $920 million in liquidations in the derivatives market, reflecting investor concerns about policy execution.

Key Factors Driving Bitcoin’s Decline

Several factors have contributed to Bitcoin’s recent downturn:

- Unclear Crypto Reserve Strategy: Trump’s “crypto strategic reserve” plan relies only on seized assets, lacking fresh capital inflows, which weakens market confidence.

- Policy Uncertainty: Legislative changes in states like Utah, such as removing clauses on state treasury investments in Bitcoin, have added to market uncertainty.

- Macroeconomic Pressure: U.S. tariff hikes have raised fears of a trade war, while the Fed’s delayed rate cuts have pressured both the stock and crypto markets. On March 10, the S&P 500 dropped 2.7%, dragging Bitcoin below key support levels.

- Technical Patterns: Bitcoin formed a “double top” around $100,000, and breaking the $92,000 neckline triggered further selling pressure. Ethereum has also faced sell-offs, with on-chain data showing exchange ETH balances at a 12-month high.

The $72,000 Support Level: A Critical Test

Bitcoin is now approaching the $72,000 support level, which holds significance in three ways:

- Psychological Level: $72,000 was a high-volume trading zone before the 2024 halving rally, where many retail investors accumulated BTC.

- Institutional Holdings: The average cost basis for Bitcoin ETFs from BlackRock and others is around $73,000. A break below this level could trigger institutional stop-losses.

- Technical Outlook: If $72,000 holds, Bitcoin could rebound to $85,000–$95,000. However, breaking below it may lead to further declines toward $69,000, $63,000, or even $55,000.

On-chain data indicates that around 420,000 BTC buy orders are clustered near $72,000, suggesting some investors see this as a buying opportunity. However, if the Fed maintains high interest rates, bears could continue to dominate.

Ethereum’s Independent Risks and Market Correlation

Ethereum has been underperforming Bitcoin due to structural risks:

- SEC Scrutiny: The investigation into Ethereum’s security status remains unresolved. BlackRock’s ETH ETF saw $11 million in outflows in a single day, increasing selling pressure.

- Competitive Pressure: Solana and other blockchains, with faster transactions and lower fees, have siphoned activity from Ethereum.

- Supply Dynamics: Post-Merge, Ethereum’s supply has increased rather than decreased, undermining its “ultra-sound money” narrative.

If Bitcoin stabilizes, Ethereum may rebound to test $2,000 resistance. However, if Bitcoin breaks support, ETH could drop to the $1,500–$1,000 range. Investors can track real-time price movements via JuCoin.

Future Outlook and Investment Strategies

The market is at a crossroads between fading policy momentum and macroeconomic uncertainty. On March 15, Trump will host a White House crypto summit—potential announcements on state-level reserves or tax incentives could boost sentiment.

Technically, if Bitcoin holds above $72,000 and reclaims $78,000, it could initiate a rebound. If support fails, watch for levels at $63,000 (200-day MA) and $55,000 (institutional buy zone).

Short-term investors should monitor support levels, while mid-term traders can consider accumulating BTC if prices drop to the $55,000–$60,000 range, aligning with ETF cost bases. In the long term, RWA (Real-World Asset tokenization) and AI-driven crypto innovations may fuel the next bull cycle. Keeping a rational approach to both technical and fundamental analysis will be key to navigating risks and opportunities.