OpenSea’s Last Stand: From NFT Giant to an All-Chain Trading Platform

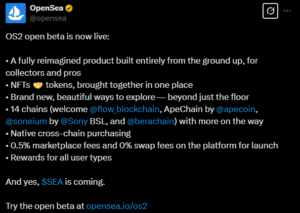

On February 13, 2025, OpenSea, the world’s largest NFT trading platform, announced the launch of its new version, OS2, in open beta and plans to issue its native token, SEA. This marks the most significant strategic upgrade in OpenSea’s seven-year history, signaling its transition from a single NFT marketplace to an “all-chain asset trading platform.”

The core innovation of OS2 lies in integrating NFT and token trading functions, allowing users to buy and sell ETH, SOL, and other cross-chain assets on the same platform. Currently, OS2 supports 14 blockchains (including Flow and ApeChain) and promises to expand to more in the future, directly addressing users’ needs for “one-stop multi-chain asset management.” However, OS2’s cross-chain transaction delays and security concerns have yet to be tested on a large scale, posing potential technical risks.

Key Timeline and Market Reactions

Following the OS2 beta launch, market reactions have been polarized. On one hand, its low-fee strategy (0.5% market fee, 0% exchange fee) attracted some Blur users back to OpenSea. On the other hand, its XP points reward system was abruptly suspended due to controversies over encouraging wash trading. As of March 2, 2025, OpenSea’s market share remains stagnant at 33%, far below Blur’s 52%.

The simultaneously announced SEA token carries high expectations. According to the whitepaper, SEA will be used for rewarding historical users, platform governance, and fee discounts. However, regulatory risks loom large—if the SEC deems it an unregistered security (similar to the XRP lawsuit), OpenSea may face business contractions.

Industry Impact and Potential Challenges

The launch of OS2 may trigger three major industry trends:

- All-chain competition: Platforms like Blur and Magic Eden may accelerate integration with more blockchains.

- Token economy as a standard: Platforms without tokens might follow SEA’s model.

- Intensified fee wars: The 0.5% fee is already close to the industry’s cost baseline.

For ordinary users, technical vulnerabilities and token speculation bubbles should be approached with caution. If OS2’s cross-chain functionality encounters issues, asset losses could occur. Additionally, SEA airdrops might repeat the pattern of Blur’s token launch in 2023, which saw a 70% crash after release.

Future Outlook: Can OpenSea Reshape the Rules?

At its core, OpenSea’s transformation is an experiment in shifting from a traditional Web2 platform to a Web3 governance model. If the SEA token successfully activates community governance (e.g., boosting liquidity through JuCoin spot trading), it could set a new industry benchmark. However, investors should closely monitor:

- SEA token launch performance: Initial circulation and exchange listings.

- OS2 user retention: Actual usage data of its cross-chain functionality.

- Blur’s countermeasures: Potential lower fees or token burns.

Regardless of success or failure, this transformation will serve as a valuable case study for the evolution of NFT trading platforms.