Introduction

As wireless networks become the key infrastructure for the digital economy, the limitations of public WiFi networks—in terms of convenience, security, and coverage—have become increasingly apparent. The ROAM project emerged to address these issues by attempting to integrate Web3 technology, the decentralized physical infrastructure network (DePIN) concept, and the OpenRoaming standard, with the aim of constructing a global, decentralized WiFi network.

-

ROAM: Examining the Core Concepts and Vision

The ROAM project seeks to revolutionize traditional WiFi connectivity through decentralized technology. Its core vision can be summarized as follows:

– Exploring the Construction of a Decentralized WiFi Network:

ROAM aims to build a wider wireless network by leveraging a crowdsourced model where users contribute nodes. This approach strives to overcome the limitations of conventional centralized deployment models to achieve more flexible network coverage. However, this model may encounter complex technical and operational challenges during implementation and management.

– Token-Incentivized Network Participation Mechanism:

ROAM introduces a token economic model designed to reward users for connecting to the network, sharing hotspots, or deploying hardware devices through ROAM Points and the $ROAM token—embodying the “contribution equals reward” principle.

– Enhancing Roaming Experience and Network Performance:

By leveraging the OpenRoaming standard and Web3 technology, ROAM expects to provide a seamless roaming experience on a global scale while improving the security and enterprise-grade performance of public WiFi. Nonetheless, the widespread adoption of the OpenRoaming standard and the security of a decentralized network are critical factors for realizing this vision.

-

Technical Analysis: The Technology Behind ROAM

The ROAM project integrates multiple technologies, and while its technical architecture exhibits innovation, it also faces practical application challenges:

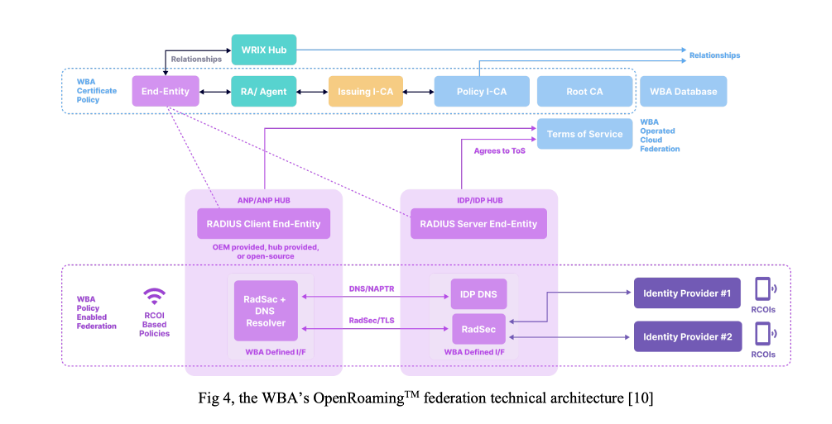

– OpenRoaming™ Technology: Standard Compatibility and Adoption Challenges

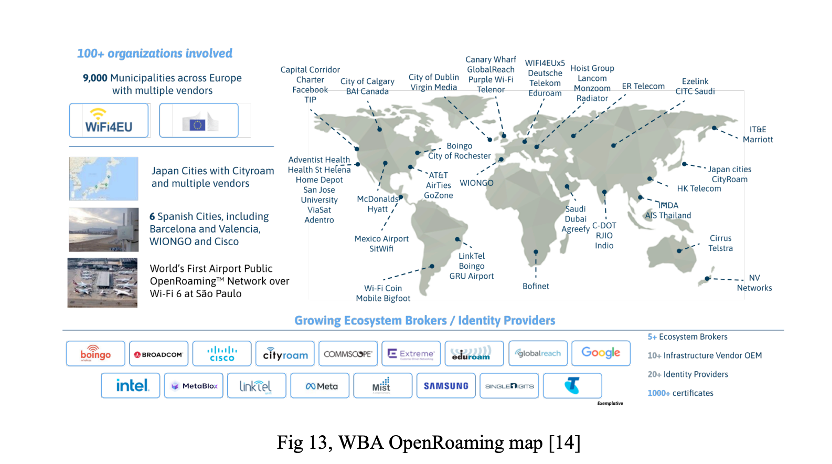

ROAM emphasizes its deep integration with OpenRoaming technology and claims to be the only Web3 identity provider (IDP) member within the Wireless Broadband Alliance (WBA). As an industry standard, OpenRoaming aims to resolve the fragmentation of WiFi roaming and enhance the user experience. In theory, ROAM can integrate public WiFi hotspots worldwide that support this standard.

– Web3 and Blockchain: A Double-Edged Sword of Decentralized Identity and Token Incentives

ROAM has chosen the Solana blockchain as its underlying infrastructure, taking advantage of its high performance and low cost. The incorporation of Web3 technology brings decentralized identity (DID) and token incentive mechanisms to ROAM:

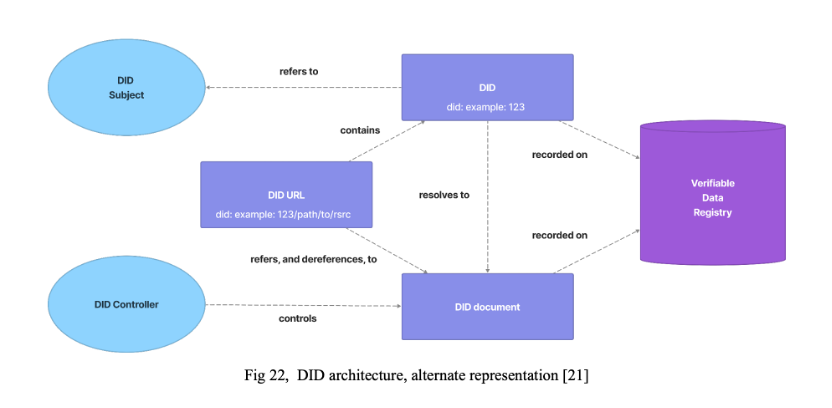

– Decentralized Identity (DID):

Users hold a DID, which theoretically enhances data privacy and security.

– $ROAM Token:

The $ROAM token is designed as the incentive core of the ecosystem, intended to drive network development via a token economic model. However, the token’s price volatility, the long-term sustainability of the economic model, and regulatory compliance are common challenges faced by DePIN projects.

– The DePIN Concept: The Gap Between Ideal and Reality

ROAM stresses its commitment to the DePIN concept by encouraging users to participate in network construction through deploying hardware devices or sharing WiFi hotspots. Although the DePIN model theoretically reduces deployment costs and promotes network expansion, practical factors such as the cost, maintenance, and deployment difficulty of hardware devices—as well as the level of user engagement—can affect the speed and effectiveness of network expansion.

– Reward Mechanism: Effectiveness of a Multi-Dimensional Incentive Design

ROAM has designed various reward mechanisms—including connection mining, sharing mining, and hardware mining—to incentivize user participation in network construction and ecosystem development. The complexity of this multi-dimensional incentive design means that its effectiveness, fairness, and long-term impact need to be validated through actual operation.

– eSIM Support: Expanding Application Scenarios Amid Market Competition

ROAM is also attempting to offer decentralized eSIM services to broaden its connectivity scenarios. While the addition of eSIM services expands ROAM’s business scope to a certain extent, it also places the project directly into the highly competitive mobile network market.

-

Product Ecosystem: Initial Construction and Future Improvement

ROAM has initially built a series of products, though the ecosystem and user base still require further development:

– Roam App: The User Gateway, with Features Yet to be Refined

Serving as the entry point for network access, the Roam App offers features such as check-ins, node additions, DID management, and eSIM data plans. Currently, the app’s functionality and user experience need improvement, and user scale and engagement are key indicators of its success.

– Roam WiFi Miner: Hardware Device, Balancing Cost and Revenue

The Roam WiFi Miner is a critical component for network construction, designed to incentivize users to participate. However, factors such as the cost of the miner devices, mining yields, maintenance expenses, and market sales directly impact users’ willingness to engage in hardware mining.

– Roam Explorer: A Data Platform Needing Greater Transparency

The Roam Explorer data platform aims to display network growth and operational data. Currently, the platform offers relatively limited information; in the future, it needs to provide more comprehensive and real-time data to enhance network transparency and build community trust.

– Roam Stickers & Roam Discovery: Attempts at Ecosystem Expansion with Uncertain Outcomes

Roam Stickers and Roam Discovery are initiatives designed to boost user interaction and expand the developer ecosystem. Whether these efforts can effectively increase user stickiness and promote ecosystem prosperity remains uncertain.

-

Operational Model: The Ideal Framework vs. Real-World Challenges

ROAM envisions a positive cycle of user participation, network expansion, reward distribution, and seamless connectivity. However, whether this ideal model can operate effectively in practice and continuously attract users and node contributions faces several challenges:

– User Engagement:

Attracting sufficient users to participate in network construction and usage is crucial to the project’s success.

– Network Expansion Speed:

The expansion of a decentralized network may be slower than that of a centralized one. Rapidly expanding network coverage to meet user demands is a challenge ROAM must address.

– Sustainability of the Reward Mechanism:

The long-term effectiveness of the token reward mechanism in motivating users and maintaining economic balance is uncertain.

– Seamless Connectivity Experience:

The widespread adoption of the OpenRoaming standard and the interoperability of the ROAM network directly affect whether users can achieve truly seamless connectivity.

-

Potential Advantages and Risks: Opportunities and Challenges Coexist

Potential Advantages:

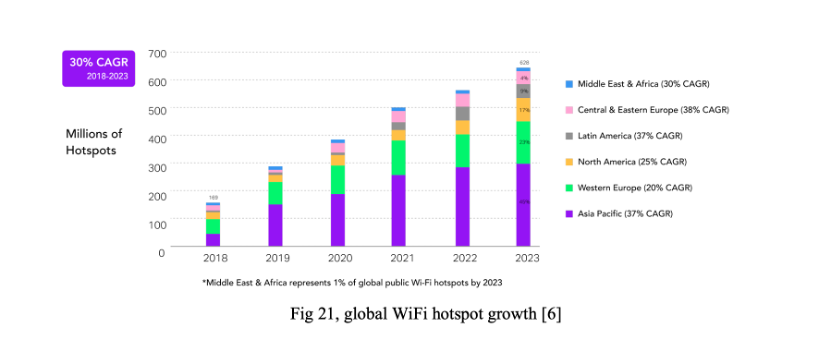

– Market Demand:

The global WiFi market is vast, and there is inherent demand among users for superior WiFi roaming services.

– Technological Innovation:

ROAM integrates multiple cutting-edge technologies, showcasing a degree of technical innovation.

– Ecosystem Layout:

ROAM has initially constructed an ecosystem framework that includes hardware, applications, a data platform, and a developer community.

– Industry Collaboration:

ROAM claims to have received support from the OpenRoaming industry standard and to be a member of the WBA alliance.

– User Incentives:

The token economic model is expected to incentivize users to participate in network construction.

Potential Risks:

– OpenRoaming Adoption Risk:

ROAM’s development relies on the adoption of the OpenRoaming standard, and uncertainties exist regarding the speed and breadth of its adoption.

– Business Model Risk:

The business model for decentralized networks is still immature, and the profitability and sustainability of ROAM’s model remain to be proven.

– Security and Trust Risks:

Public WiFi security has long been a concern for users, and ROAM will need to build user trust.

– Market Competition Risk:

ROAM faces competitive pressure from traditional WiFi services, cellular networks, and other DeWi projects.

– Regulatory Policy Risk:

DePIN projects may face uncertain regulatory policies across different countries and regions.

-

Analysis of the ROAM Token Economic Model

ROAM’s token economic model aims to drive the launch and growth of its decentralized WiFi network (DePIN) through a dual-token system and complex incentive mechanisms. This model includes two tokens—$ROAM and Roam Points—and incorporates various participation roles and mining mechanisms to balance incentives for network contributors, maintain token value, and achieve network sustainability.

Key Features of the Token Model:

– Dual-Token System:

The model uses $ROAM (a governance and value-accumulation token with a fixed supply of 1 billion) and Roam Points (a reward and day-to-day operational token with no supply cap). This design aims to separate daily operations from value accumulation, reducing the impact of token price volatility on user incentives. Roam Points can be exchanged for $ROAM through staking.

– Multi-Role Participation and Incentives:

The model designs various roles—including WiFi miners, validators, discoverers, RADIUS providers, and witnesses—with corresponding Roam Points reward mechanisms, encouraging users to participate in network construction and maintenance from multiple dimensions.

– Proof-of-Service (PoSe) and Proof-of-Validation (PoV) Mining:

PoSe incentivizes WiFi miners to provide high-quality network services, while PoV allows validators to verify miner service quality and receive rewards. This dual mechanism is intended to ensure the authenticity and quality of network services.

– Dynamic Difficulty Adjustment:

A difficulty adjustment mechanism is introduced to dynamically modify the token release rate based on network scale and $ROAM token price. When network size shrinks, the token release is reduced to ease selling pressure; when token prices fall, miner rewards are increased to maintain incentives.

– Staking Mechanism:

Both Roam Points and $ROAM can be staked. Staking Roam Points yields $ROAM, and staking $ROAM rewards network contributors such as RADIUS service providers, encouraging long-term participation and value accumulation.

– Device Certification and Licensing:

Roam mining devices are subject to certification and licensing management to prevent device fraud, ensuring equipment quality and service compliance. Device activation and manufacturer licensing both require staking tokens to raise the entry barrier and maintain network integrity.

Advantages of the Model:

– Comprehensive Incentive Mechanism:

The design considers both early-stage network construction incentives and long-term operational maintenance, aiming to attract a broad range of participants through multi-role, multi-dimensional rewards.

– Dual-Token System Reducing Volatility Risk:

With Roam Points linked to fiat and used as daily reward tokens, the impact of $ROAM price volatility on users’ daily earnings is mitigated, helping early users accumulate rewards.

– Innovative Dynamic Difficulty Adjustment:

Drawing on Bitcoin’s difficulty adjustment mechanism, ROAM’s dynamic difficulty aims to flexibly adjust token release according to actual network conditions, theoretically helping to manage changes in network scale and market fluctuations while maintaining economic balance.

– Emphasis on Service Quality Verification:

The introduction of PoSe and PoV mining mechanisms, which focus on incentivizing high-quality network service rather than merely computational power, is crucial for the practical application of a WiFi network.

– Staking Mechanism Promotes Long-Term Value Accumulation:

By encouraging users to hold $ROAM and Roam Points long-term, the staking mechanism helps reduce circulating supply, potentially enhancing token value and network stability.

Challenges:

– High Model Complexity:

The dual-token system and multiple incentive mechanisms result in a complex model that may experience unforeseen interactions, making parameter adjustments and ongoing maintenance challenging.

– Inflation Risk of Roam Points:

Since Roam Points have no supply cap, excessive reward issuance could lead to inflation, diluting user earnings and dampening participation enthusiasm. Effectively controlling the issuance and usage scenarios of Roam Points is critical.

– Uncertainty of the Difficulty Adjustment Mechanism:

Although theoretically capable of addressing market volatility, the actual effectiveness of the dynamic difficulty adjustment mechanism requires market validation. Poor parameter settings or extreme market fluctuations may not yield the desired results and could even exacerbate negative market feedback.

– Fairness and Efficiency of the Validator Mechanism:

Validators play a key role in the PoV mining process, and their fairness and efficiency directly impact the equitable distribution of mining rewards and overall network performance. Preventing collusion or cheating among validators, as well as ensuring efficient verification, remains a significant concern.

– User Understanding and Participation Barrier:

The complexity of the token model and mining mechanisms may raise the barrier for user understanding and participation—especially for newcomers to Web3—necessitating simplified user guidance and streamlined operations.

– Token Value Support:

The ultimate value of $ROAM depends on the actual application scenarios of the Roam network, user base growth, and overall ecosystem development. Limited application scenarios and slow user growth may undermine effective support for the token’s value.

ROAM’s token economic model exhibits a degree of innovation and complexity in the DePIN field, aiming to create a virtuous cycle of network launch, growth, and value capture through meticulous design. Its dual-token system, multi-role incentives, PoSe/PoV mining, and dynamic difficulty adjustment mechanisms offer theoretical advantages.

However, the model also faces potential risks and challenges such as high complexity, inflation risk, uncertain difficulty adjustment outcomes, validator mechanism issues, elevated user participation barriers, and the need for robust token value support. The long-term success of the ROAM project will depend on whether its token economic model can effectively address these challenges in practice and ultimately drive sustainable network development. Investors interested in the ROAM project need to fully understand the complexity of its token economic model and prudently assess the associated risks.

-

Project Progress and Future Outlook: TGE Approaches, Long-Term Development Under Scrutiny

As of March 4, 2025, the ROAM project is on the verge of its Token Generation Event (TGE), attracting significant market attention. Pre-deposit activities and airdrop programs are underway, a burn pool has been launched, and active efforts are being made to expand partnerships. ROAM’s future development plans include expanding the developer ecosystem, broadening application scenarios, and optimizing network performance.

Market valuation expectations for the ROAM project are relatively high, with an FDV projected between USD 600 million and USD 1.2 billion. However, these are only market expectations—the actual performance at launch and long-term value remain uncertain.

Conclusion: JuCoin Continues to Focus on Innovative Projects in the DePIN Sector with a User-Centric Approach

As an exploration in the decentralized wireless network space within the DePIN sector, the ROAM project’s innovative concepts and technical architecture are worth attention. However, DePIN projects generally involve high risk and uncertainty. JuCoin, as a digital asset trading platform, will continue to monitor innovative projects in fields like DePIN and is committed to providing users with more project information and investment options.

At the same time, JuCoin solemnly reminds investors to remain rational when considering potential projects like ROAM, to carefully assess their own risk tolerance, and to avoid blindly chasing hype—DYOR (Do Your Own Research). JuCoin strives to offer more professional and objective project analyses and risk warnings, helping users make more informed investment decisions amid the Web3 revolution.